Department of Rev Ga 2011-2026

What is the Department of Revenue GA

The Department of Revenue in Georgia, often referred to as the GA Department of Revenue, is the state agency responsible for overseeing tax collection and enforcement, as well as managing various revenue-related programs. This department handles a wide range of tax types, including income tax, sales tax, and property tax. Its mission is to ensure that the state collects revenue efficiently and fairly while providing support and resources to taxpayers.

How to use the Department of Revenue GA

Utilizing the GA Department of Revenue involves accessing various online services and resources. Taxpayers can visit the official website to find forms, check the status of their tax returns, and make payments. The department also provides guidance on tax laws and filing procedures, helping individuals and businesses comply with state regulations. For those needing assistance, the department offers customer support through phone and email.

Steps to complete the Department of Revenue GA forms

Completing forms for the GA Department of Revenue requires careful attention to detail. Start by selecting the appropriate form based on your tax situation, such as the GA 525 TV for income tax. Ensure you gather all necessary documentation, including income statements and deductions. Fill out the form accurately, providing all required information. After completing the form, review it for errors before submitting it electronically or by mail. If using an eSignature, ensure it meets the legal requirements set forth by the department.

Required Documents

When filing with the GA Department of Revenue, specific documents are essential for accurate processing. Commonly required documents include:

- W-2 forms for reporting wages

- 1099 forms for reporting other income

- Receipts for deductions, such as medical expenses or charitable contributions

- Proof of residency for certain credits

Gathering these documents ahead of time can streamline the filing process and help avoid delays.

Form Submission Methods

The GA Department of Revenue offers multiple methods for submitting forms. Taxpayers can file online through the department's secure portal, which is often the fastest option. Alternatively, forms can be mailed to the appropriate address provided on the form itself. In some cases, individuals may also visit local offices for in-person submissions. Each method has its own processing times, so it’s important to choose the one that best fits your needs.

Penalties for Non-Compliance

Failing to comply with the requirements set by the GA Department of Revenue can result in penalties. Common penalties include late filing fees and interest on unpaid taxes. Additionally, taxpayers may face legal action for severe non-compliance, which could lead to wage garnishments or liens on property. Staying informed about deadlines and filing requirements is crucial to avoid these consequences.

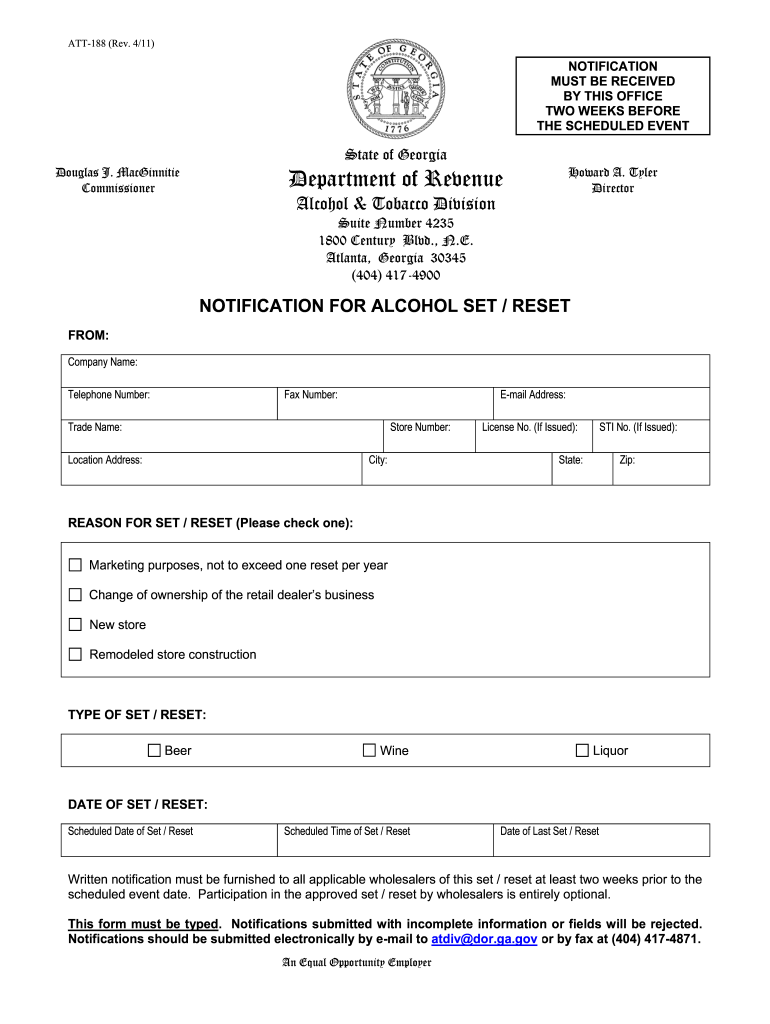

Quick guide on how to complete georgia department of revenue etax dor ga

Your assistance manual on how to prepare your Department Of Rev Ga

If you’re curious about how to finalize and submit your Department Of Rev Ga, here are some concise instructions on how to simplify tax processing.

To begin, you only need to create your airSlate SignNow profile to transform how you manage documents online. airSlate SignNow is a highly intuitive and robust document solution that enables you to modify, produce, and finalize your income tax paperwork effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to change answers when necessary. Streamline your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Department Of Rev Ga in just a few minutes:

- Create your account and start working on PDFs in moments.

- Utilize our directory to obtain any IRS tax form; browse through variants and schedules.

- Click Get form to access your Department Of Rev Ga in our editor.

- Enter the essential fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding eSignature (if necessary).

- Review your document and correct any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Take full advantage of this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that paper filing can lead to mistakes in returns and delays in reimbursements. Indeed, before e-filing your taxes, review the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

What is the total number of federal applications, documents, or forms from all the departments of government that US citizens are required by law to fill out?

I am not an American. But it would depend on the person's circumstances. How much do they earn? If you earn little then you don't need to file a tax return. How do they earn it? Self employed or employed?Do they travel? You need a passport.How long do they live? - if they die after birth then it is very little. Do they live in the USA?What entitlements do they have?Do they have dialysis? This is federally funded.Are they on medicaid/medicare?.Are they in jail or been charged with a crime?Then how do you count it? Do you count forms filled in by the parents?Then there is the census the Constitution which held every ten years.

Create this form in 5 minutes!

How to create an eSignature for the georgia department of revenue etax dor ga

How to create an eSignature for your Georgia Department Of Revenue Etax Dor Ga online

How to make an electronic signature for your Georgia Department Of Revenue Etax Dor Ga in Chrome

How to create an electronic signature for putting it on the Georgia Department Of Revenue Etax Dor Ga in Gmail

How to create an eSignature for the Georgia Department Of Revenue Etax Dor Ga right from your smartphone

How to make an eSignature for the Georgia Department Of Revenue Etax Dor Ga on iOS

How to generate an electronic signature for the Georgia Department Of Revenue Etax Dor Ga on Android

People also ask

-

What is airSlate SignNow and how does it relate to the Department Of Rev Ga?

airSlate SignNow is a powerful eSignature solution that simplifies the process of sending and signing documents online. For businesses dealing with the Department Of Rev Ga, it provides a seamless way to manage important tax documents electronically, ensuring compliance and efficiency.

-

How does airSlate SignNow support businesses in dealing with the Department Of Rev Ga?

With airSlate SignNow, businesses can easily create, send, and track documents required by the Department Of Rev Ga. The platform offers templates and automated workflows that streamline the submission process, making it easier to meet deadlines and requirements.

-

What are the pricing options for airSlate SignNow when working with the Department Of Rev Ga?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, including those interacting with the Department Of Rev Ga. Plans start at a competitive rate, providing businesses with access to essential features like unlimited document signing and secure storage.

-

What features does airSlate SignNow offer for documents related to the Department Of Rev Ga?

Key features of airSlate SignNow include customizable templates, in-person signing, and advanced security measures tailored for documents linked to the Department Of Rev Ga. These features ensure that your sensitive information remains protected while allowing for efficient document management.

-

Can airSlate SignNow integrate with other tools to assist with Department Of Rev Ga submissions?

Yes, airSlate SignNow seamlessly integrates with various applications and tools, enhancing your workflow when dealing with the Department Of Rev Ga. Integrations with platforms like Google Drive and Salesforce ensure that all your documents are easily accessible and manageable.

-

What benefits does airSlate SignNow provide for businesses interacting with the Department Of Rev Ga?

Using airSlate SignNow allows businesses to save time and reduce paperwork when engaging with the Department Of Rev Ga. The platform's automation features minimize manual tasks, leading to greater accuracy and faster processing of essential documents.

-

How can airSlate SignNow help ensure compliance with the Department Of Rev Ga requirements?

airSlate SignNow helps ensure compliance with the Department Of Rev Ga by providing legally binding eSignatures and audit trails for all transactions. This transparency is crucial for businesses that must adhere to strict regulatory standards while submitting documents.

Get more for Department Of Rev Ga

- County hereinafter referred to as grantors and form

- Control number ks 020 78 form

- State of nebraska warranty deed to child reserving life form

- Two trustees to husband and wife form

- Kansas quitclaim deed mineral rights us legal forms

- Lien statement subcontractorsupplier corporation form

- Golden gait riding stables form

- A limited liability company existing under and by virtue of the laws of the form

Find out other Department Of Rev Ga

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure