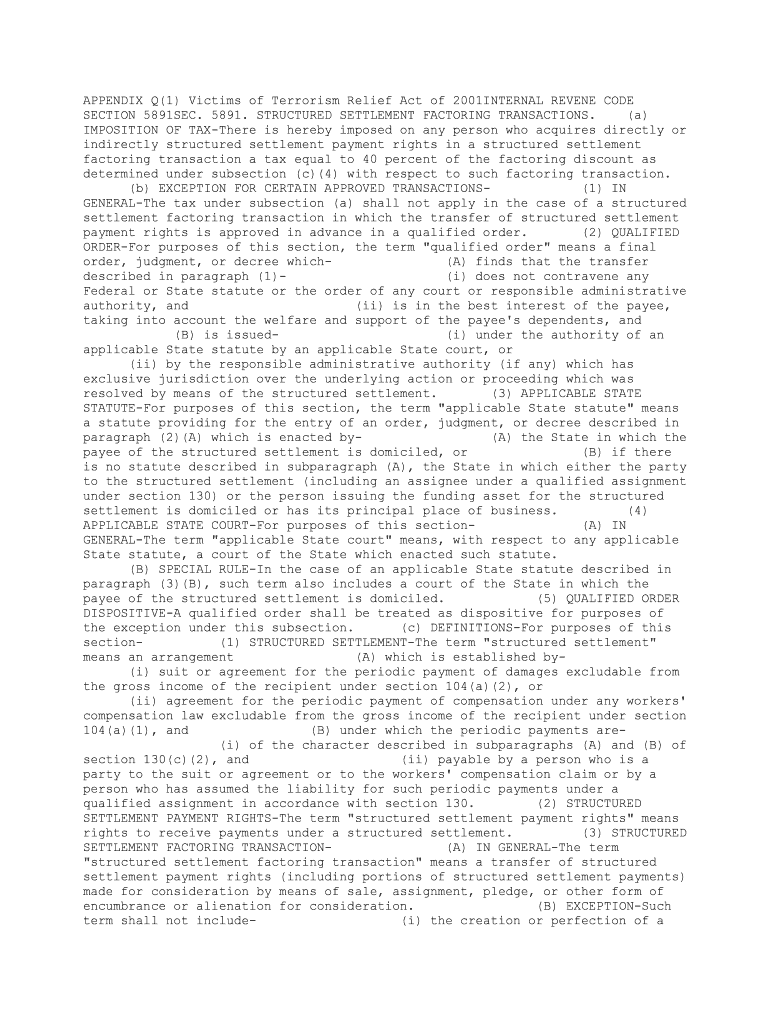

APPENDIX Q1 Victims of Terrorism Relief Act of 2001INTERNAL REVENE CODE Form

What is the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 Internal Revenue Code

The APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 Internal Revenue Code is a legislative measure designed to provide tax relief to individuals and businesses affected by acts of terrorism. This act offers specific provisions that allow for deductions, credits, and other tax benefits aimed at alleviating the financial burden on victims. The legislation recognizes the unique challenges faced by those impacted by terrorism, ensuring that they receive appropriate support during their recovery process.

Steps to Complete the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 Internal Revenue Code

Completing the APPENDIX Q1 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including personal identification and any relevant financial records. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is crucial to review the form for any errors or omissions before submission. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the requirements set forth by the IRS.

Legal Use of the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 Internal Revenue Code

The legal use of the APPENDIX Q1 form is governed by federal tax laws that outline eligibility criteria and compliance requirements. To ensure that the form is used legally, individuals must meet specific conditions, such as being directly affected by a terrorist act. Additionally, the form must be completed in accordance with IRS guidelines, and all claims made must be substantiated with appropriate documentation. Understanding these legal parameters is essential for ensuring that the benefits of the act are fully realized.

Eligibility Criteria for the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 Internal Revenue Code

Eligibility for the APPENDIX Q1 form is primarily determined by the individual's or business's connection to a terrorist act. To qualify, applicants must demonstrate that they have suffered financial loss due to terrorism. This includes direct victims, as well as businesses that experienced economic downturns as a result of terrorist activities. It is important to review the specific eligibility criteria outlined by the IRS to ensure compliance and maximize potential benefits.

IRS Guidelines for the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 Internal Revenue Code

The IRS provides comprehensive guidelines for the completion and submission of the APPENDIX Q1 form. These guidelines include instructions on the necessary documentation, deadlines for submission, and specific tax benefits available under the act. Familiarizing oneself with these guidelines is crucial for ensuring that the form is filled out correctly and submitted in a timely manner. Adhering to IRS instructions helps prevent delays and potential issues with tax compliance.

Form Submission Methods for the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 Internal Revenue Code

The APPENDIX Q1 form can be submitted through various methods, including electronic submission and traditional mail. Electronic submission is often preferred for its speed and efficiency, allowing for quicker processing times. Alternatively, individuals may choose to print the form and submit it by mail. Regardless of the method chosen, it is essential to follow IRS guidelines for submission to ensure that the form is received and processed without issues.

Quick guide on how to complete appendix q1 victims of terrorism relief act of 2001internal revene code

Handle APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001INTERNAL REVENE CODE effortlessly on any gadget

Web-based document management has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly option to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the functionalities required to create, edit, and eSign your documents swiftly without any delays. Manage APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001INTERNAL REVENE CODE on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The simplest way to edit and eSign APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001INTERNAL REVENE CODE with ease

- Locate APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001INTERNAL REVENE CODE and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001INTERNAL REVENE CODE and maintain excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 INTERNAL REVENUE CODE?

The APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 INTERNAL REVENUE CODE is legislation that provides tax relief for individuals affected by acts of terrorism. This act includes various provisions benefiting victims, allowing them to access financial support in challenging times. Understanding this code can be crucial for affected individuals seeking relief.

-

How does airSlate SignNow assist with documents related to the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 INTERNAL REVENUE CODE?

airSlate SignNow offers a secure platform for sending and eSigning documents related to the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 INTERNAL REVENUE CODE. Users can quickly manage important paperwork, ensuring compliance with this legal framework. The ease of use makes it ideal for individuals seeking to navigate the complexities of this act.

-

What are the pricing options for airSlate SignNow when dealing with the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 INTERNAL REVENUE CODE?

airSlate SignNow provides various pricing plans that accommodate different needs when dealing with the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 INTERNAL REVENUE CODE. These plans are designed to be cost-effective, ensuring that users can access essential eSigning services without breaking the bank. Check out our pricing page for more details on the options available.

-

What features does airSlate SignNow offer for managing documents related to the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 INTERNAL REVENUE CODE?

With airSlate SignNow, users can enjoy a wide range of features for managing documents related to the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 INTERNAL REVENUE CODE. These include customizable templates, audit trails, and seamless integration with other platforms. This ensures that all your documentation processes are streamlined and compliant.

-

Can airSlate SignNow integrate with other software related to the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 INTERNAL REVENUE CODE?

Yes, airSlate SignNow can integrate with various software solutions that facilitate document management concerning the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 INTERNAL REVENUE CODE. Our platform is designed to work with popular tools like CRM and project management software, making it easier to manage your workflow. This integration enhances efficiency for users navigating this complex landscape.

-

What benefits does using airSlate SignNow provide for victims of terrorism under the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 INTERNAL REVENUE CODE?

Using airSlate SignNow provides signNow benefits for victims under the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 INTERNAL REVENUE CODE. Our platform ensures that documentation is handled securely and efficiently, allowing quick access to necessary forms. This can greatly ease the administrative burden on victims seeking assistance through the act.

-

Is airSlate SignNow compliant with legal standards related to the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 INTERNAL REVENUE CODE?

Absolutely, airSlate SignNow is compliant with the necessary legal standards associated with the APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001 INTERNAL REVENUE CODE. We ensure that our platform meets all regulatory requirements for eSignature and document management. This compliance guarantees that your documents are legally binding.

Get more for APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001INTERNAL REVENE CODE

Find out other APPENDIX Q1 Victims Of Terrorism Relief Act Of 2001INTERNAL REVENE CODE

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF