Schedule D Creditors Holding Secured Claims Superseded Form

What is the Schedule D Creditors Holding Secured Claims Superseded

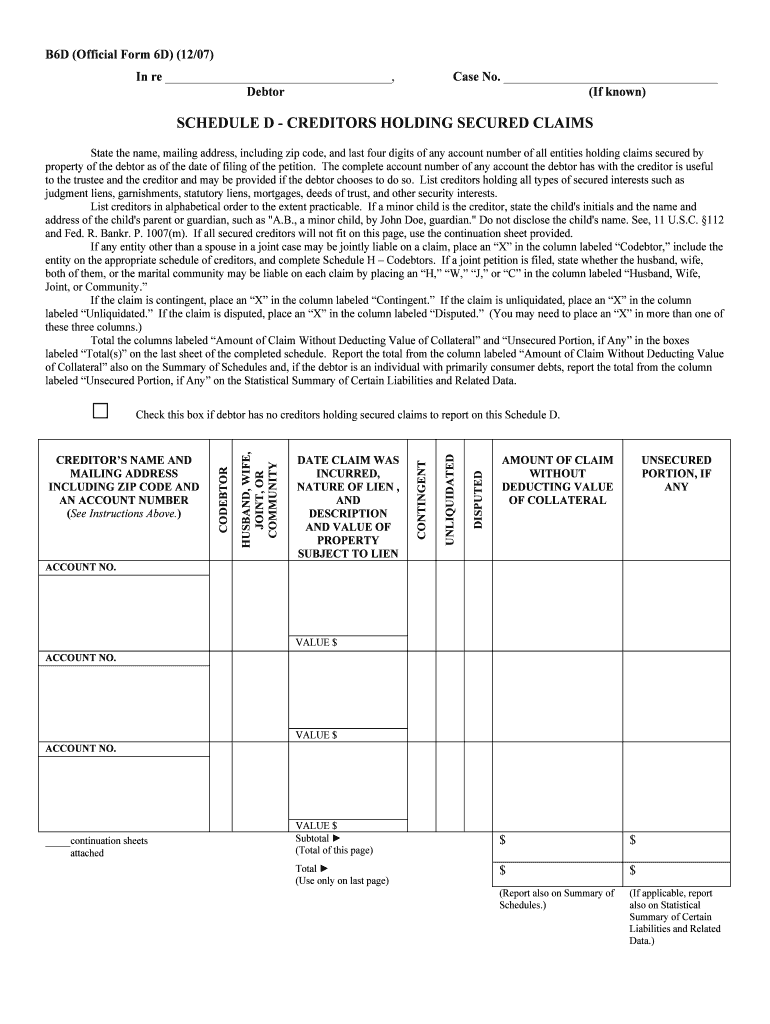

The Schedule D Creditors Holding Secured Claims Superseded form is a legal document used in bankruptcy proceedings in the United States. This form lists creditors who hold secured claims against the debtor’s assets. It is essential for accurately disclosing all secured debts to the bankruptcy court. The information provided helps determine the treatment of these claims during the bankruptcy process, ensuring that creditors are acknowledged and that the debtor's obligations are clearly outlined.

How to use the Schedule D Creditors Holding Secured Claims Superseded

Using the Schedule D Creditors Holding Secured Claims Superseded form involves several key steps. First, gather all relevant information about your secured creditors, including names, addresses, and the amounts owed. Next, accurately complete the form by entering this information in the designated sections. It is crucial to ensure that all details are correct, as inaccuracies can lead to complications in the bankruptcy process. After filling out the form, it must be submitted to the bankruptcy court along with other required documents.

Steps to complete the Schedule D Creditors Holding Secured Claims Superseded

Completing the Schedule D Creditors Holding Secured Claims Superseded form requires careful attention to detail. Follow these steps:

- Collect information about each secured creditor, including their name, address, and the total amount of the secured claim.

- Fill in the form, ensuring that all creditor information is entered accurately.

- Indicate the nature of the security interest held by each creditor, such as real estate, vehicles, or other collateral.

- Review the completed form for any errors or omissions before submission.

- File the form with the bankruptcy court as part of your bankruptcy petition.

Legal use of the Schedule D Creditors Holding Secured Claims Superseded

The Schedule D Creditors Holding Secured Claims Superseded form is legally binding once filed with the bankruptcy court. It serves to inform the court and all parties involved about the secured claims against the debtor’s assets. Accurate completion of this form is vital for compliance with bankruptcy laws, as it ensures that creditors are properly notified and that their rights are preserved during the bankruptcy process.

Required Documents

When preparing to file the Schedule D Creditors Holding Secured Claims Superseded form, several documents are typically required:

- Proof of identity, such as a government-issued ID.

- Financial statements detailing assets and liabilities.

- Documentation of secured debts, including loan agreements and security agreements.

- Any previous bankruptcy filings or related court documents.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Creditors Holding Secured Claims Superseded form are crucial to adhere to in the bankruptcy process. Generally, the form must be submitted along with the bankruptcy petition. It is important to be aware of specific deadlines set by the court, as failure to file on time can result in delays or complications in the bankruptcy case. Always check with the local bankruptcy court for precise dates and requirements.

Quick guide on how to complete schedule d creditors holding secured claims superseded

Effortlessly Prepare Schedule D Creditors Holding Secured Claims Superseded on Any Device

Digital document management has gained signNow traction among organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing users to locate the necessary forms and securely store them online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and electronically sign your documents without any hassle. Manage Schedule D Creditors Holding Secured Claims Superseded across all platforms using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

Steps to Modify and Electronically Sign Schedule D Creditors Holding Secured Claims Superseded with Ease

- Obtain Schedule D Creditors Holding Secured Claims Superseded and click on Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Highlight signNow sections of your documents or redact sensitive information using the specific tools provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to keep your modifications.

- Choose your preferred method to submit your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from your device of choice. Edit and electronically sign Schedule D Creditors Holding Secured Claims Superseded to ensure seamless communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Schedule D Creditors Holding Secured Claims Superseded?

Schedule D Creditors Holding Secured Claims Superseded refers to the list of creditors with secured claims that have been replaced or updated in bankruptcy documentation. This schedule is crucial for accurately representing the financial obligations during bankruptcy proceedings. Understanding its implications helps businesses navigate complex financial situations effectively.

-

How does airSlate SignNow help with managing Schedule D Creditors Holding Secured Claims Superseded?

airSlate SignNow simplifies the process of updating and sending documents related to Schedule D Creditors Holding Secured Claims Superseded. With our user-friendly eSigning solution, you can ensure that important documents are securely signed and transmitted, thereby streamlining your workflow and reducing errors.

-

Is airSlate SignNow cost-effective for handling legal documents like Schedule D Creditors Holding Secured Claims Superseded?

Yes, airSlate SignNow offers a cost-effective solution tailored for businesses that frequently handle legal documents, including those related to Schedule D Creditors Holding Secured Claims Superseded. Our pricing plans are designed to accommodate various business sizes and help reduce overall document management costs.

-

What features does airSlate SignNow provide for managing Schedule D Creditors Holding Secured Claims Superseded?

airSlate SignNow provides features such as reusable templates, automated workflows, and secure eSigning, which are particularly beneficial when dealing with Schedule D Creditors Holding Secured Claims Superseded. These tools enhance efficiency and accuracy, ensuring that the documentation process is streamlined and professional.

-

Can I integrate airSlate SignNow with other software for Schedule D Creditors Holding Secured Claims Superseded?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions that help manage financial or legal documentation related to Schedule D Creditors Holding Secured Claims Superseded. This allows for a more cohesive workflow and enhances the overall efficiency of your document management process.

-

What are the benefits of using airSlate SignNow for Schedule D Creditors Holding Secured Claims Superseded?

Using airSlate SignNow for Schedule D Creditors Holding Secured Claims Superseded brings multiple benefits, including faster turnaround times on document approvals and enhanced security for sensitive information. These advantages help businesses maintain compliance and trust during complex financial transactions.

-

How secure is airSlate SignNow when handling sensitive documents like Schedule D Creditors Holding Secured Claims Superseded?

airSlate SignNow prioritizes security, employing robust encryption methods and compliance with industry standards to protect sensitive documents including Schedule D Creditors Holding Secured Claims Superseded. Rest assured that your documents are safeguarded throughout the signing and storage process.

Get more for Schedule D Creditors Holding Secured Claims Superseded

- Form 1093 irs 2011

- Blank sales tax form tennessee 2014

- Minicipal business tax return classification 1c tennessee form

- Tngovrevenueformsgeneralr 2012

- 2014 municipal business tax return bus 416 2014 municipal business tax return bus 416 form

- Tennessee estate inheritance tax waiver 2008 form

- Tn fae 170 2008 form

- Tennessee department of revenue blanket certificate of resale form 2008

Find out other Schedule D Creditors Holding Secured Claims Superseded

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now