First Amended and Restated Loan Agreementlegal Definition Form

What is the First Amended And Restated Loan Agreement legal definition

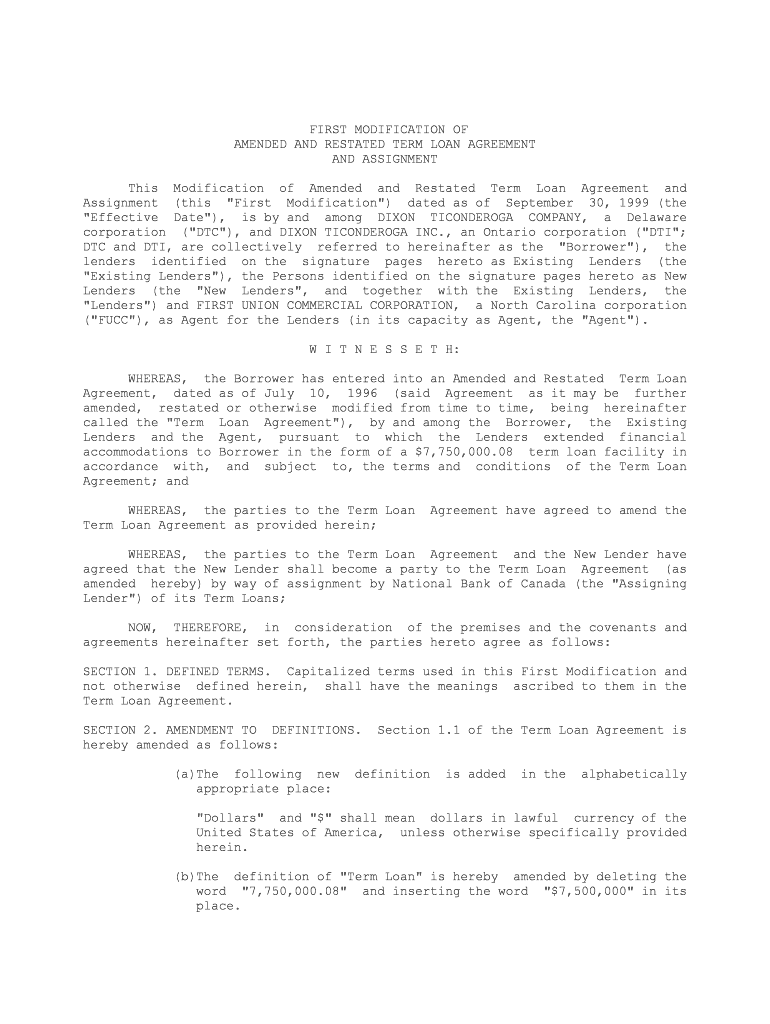

The First Amended And Restated Loan Agreement is a legal document that modifies and consolidates the terms of a previous loan agreement. This type of agreement typically includes updated terms regarding interest rates, repayment schedules, and covenants. It serves to clarify the obligations of both the borrower and the lender, ensuring that all parties are aware of the current terms governing the loan. This document is crucial in maintaining transparency and legal compliance in financial transactions.

Key elements of the First Amended And Restated Loan Agreement legal definition

Several key elements define the First Amended And Restated Loan Agreement. These include:

- Parties Involved: Identification of the borrower and lender, including their legal names and addresses.

- Loan Amount: The total amount of money being borrowed, which may be subject to changes in the amended version.

- Interest Rate: The rate at which interest will accrue on the loan, which may differ from the original agreement.

- Repayment Terms: Detailed descriptions of how and when the loan will be repaid, including any grace periods or penalties for late payments.

- Covenants: Specific obligations or restrictions placed on the borrower to protect the lender's interests.

Steps to complete the First Amended And Restated Loan Agreement legal definition

Completing the First Amended And Restated Loan Agreement involves several important steps:

- Review the Original Agreement: Examine the previous loan agreement to understand the existing terms.

- Negotiate New Terms: Discuss and agree on any changes to the loan terms with the lender.

- Draft the Amended Agreement: Prepare the new document, incorporating all agreed-upon changes.

- Obtain Signatures: Ensure that all parties sign the document, preferably using a secure digital signature platform for legal compliance.

- Distribute Copies: Provide copies of the signed agreement to all parties for their records.

Legal use of the First Amended And Restated Loan Agreement legal definition

The legal use of the First Amended And Restated Loan Agreement is significant in financial transactions. This document not only serves to update the terms of the loan but also provides a clear legal framework that can be enforced in court if necessary. It is essential for both parties to retain copies of the agreement, as it may be required for audits, legal disputes, or future financial dealings. The agreement must comply with applicable laws and regulations to ensure its enforceability.

How to use the First Amended And Restated Loan Agreement legal definition

Using the First Amended And Restated Loan Agreement effectively involves understanding its purpose and implications. This document should be utilized whenever there are changes to the original loan terms. It is important to communicate these changes clearly to all parties involved and to ensure that the agreement reflects the current understanding. Utilizing digital platforms for signing can enhance security and streamline the process, making it easier to manage documentation.

State-specific rules for the First Amended And Restated Loan Agreement legal definition

State-specific rules may affect the First Amended And Restated Loan Agreement. Different states have varying laws regarding loan agreements, including interest rate limits, disclosure requirements, and enforcement procedures. It is crucial to consult legal counsel or financial advisors familiar with local regulations to ensure compliance. Understanding these nuances can help avoid potential legal issues and ensure that the agreement is valid and enforceable in the relevant jurisdiction.

Quick guide on how to complete first amended and restated loan agreementlegal definition

Easily prepare First Amended And Restated Loan Agreementlegal Definition on any device

The management of documents online has become increasingly popular among businesses and individuals. It serves as a great eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle First Amended And Restated Loan Agreementlegal Definition on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign First Amended And Restated Loan Agreementlegal Definition effortlessly

- Locate First Amended And Restated Loan Agreementlegal Definition and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal standing as a conventional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign First Amended And Restated Loan Agreementlegal Definition and ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a First Amended And Restated Loan Agreement legal definition?

A First Amended And Restated Loan Agreement is a legal document that modifies and consolidates prior loan agreements into a single, comprehensive agreement. This updated version typically clarifies terms, conditions, and obligations, ensuring all parties clearly understand their roles. Understanding the First Amended And Restated Loan Agreement legal definition is essential for all businesses engaging in financial transactions.

-

How does airSlate SignNow support the creation of a First Amended And Restated Loan Agreement?

AirSlate SignNow provides customizable templates that simplify the process of drafting a First Amended And Restated Loan Agreement. Users can easily input necessary details and adjust terms according to their specific needs. By leveraging this tool, businesses can ensure their agreements are not only compliant but also tailored to their requirements.

-

What are the primary benefits of using airSlate SignNow for loan agreements?

The benefits of using airSlate SignNow for loan agreements, including a First Amended And Restated Loan Agreement, include enhanced efficiency and security. The platform allows for quick electronic signatures, reducing the time spent on paperwork. Additionally, the automated workflow minimizes errors and ensures documents are stored securely.

-

Is airSlate SignNow cost-effective for small businesses needing loan agreements?

Yes, airSlate SignNow is a highly cost-effective solution for small businesses needing to manage their loan agreements, including a First Amended And Restated Loan Agreement. With various pricing plans available, businesses can choose the option that best fits their budget. This affordability allows small businesses to access essential e-signature features without breaking the bank.

-

Can airSlate SignNow integrate with other software for managing loans?

Absolutely! airSlate SignNow seamlessly integrates with various software applications used for managing loans, such as CRM systems and accounting software. This integration allows businesses to streamline their processes when creating and managing a First Amended And Restated Loan Agreement, ensuring all data is in sync and easily accessible.

-

What specific features does airSlate SignNow offer for legal documents?

AirSlate SignNow offers a range of features specifically designed for legal documents, including e-signatures, customizable templates, and document tracking. For a First Amended And Restated Loan Agreement, these features ensure that all parties can sign with ease, making the document legally binding and decreasing turnaround time signNowly.

-

How secure is airSlate SignNow for handling sensitive loan agreements?

Security is a top priority for airSlate SignNow when handling sensitive documents like a First Amended And Restated Loan Agreement. The platform employs advanced encryption methods to protect data, as well as features like multi-factor authentication. This ensures that all transactions remain secure and private.

Get more for First Amended And Restated Loan Agreementlegal Definition

- Pa02 form 2012

- Vehicle registration transfer application qld form

- Casa form 1365 2013

- Acfi claim for appraisal form medicare australia medicareaustralia gov

- Form 388 certificate of airworthiness checklist 07 airworthiness directive aircraft casa gov

- 59c form

- Checklist format for certificates 2014

- Form 388certificate of airworthinesschecklist 07 airworthiness directiveaircraft

Find out other First Amended And Restated Loan Agreementlegal Definition

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself