Missouri Sales Tax Form 2760

What is the Missouri Sales Tax Form 2760

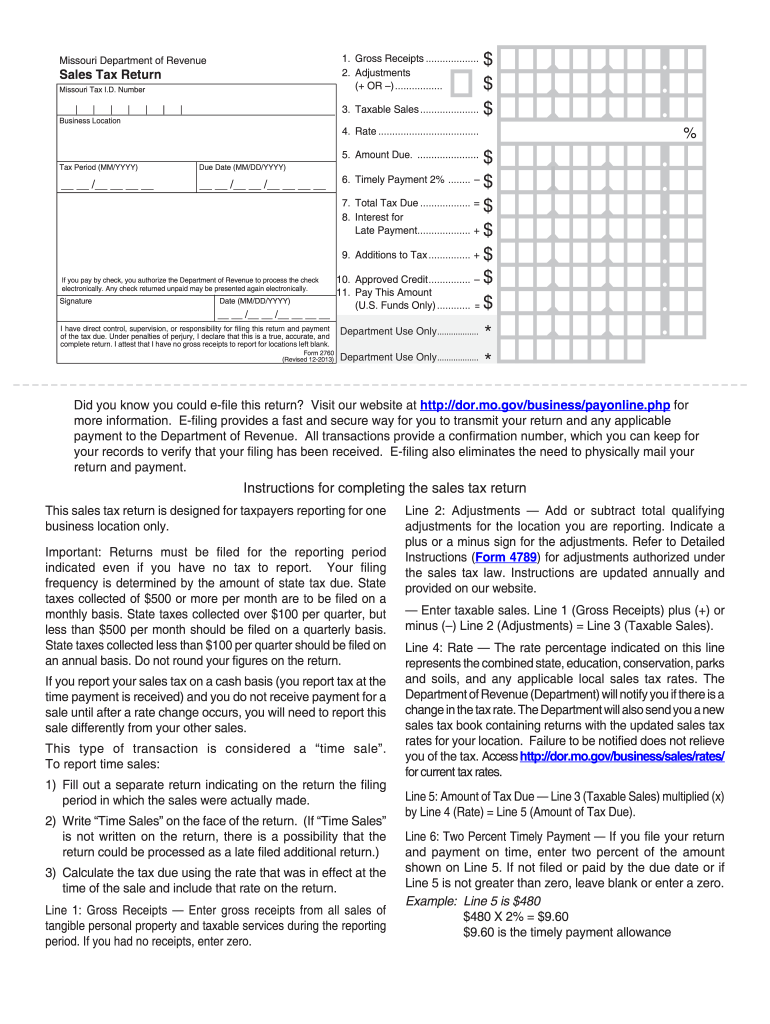

The Missouri Sales Tax Form 2760 is a specific document used by businesses in Missouri to report and remit sales tax collected on taxable sales. This form is essential for ensuring compliance with state tax regulations. It enables businesses to accurately calculate the amount of sales tax owed to the Missouri Department of Revenue (DOR). The form captures various details, including the total sales, exempt sales, and the tax rate applied. Understanding this form is crucial for businesses to avoid penalties and ensure proper tax reporting.

How to use the Missouri Sales Tax Form 2760

Using the Missouri Sales Tax Form 2760 involves several straightforward steps. First, businesses need to gather all relevant sales data, including total sales and exempt sales. Next, the form should be filled out with accurate figures, ensuring that the correct tax rates are applied. Once completed, the form can be submitted either online or by mail. It is important to retain a copy for your records. Regularly using this form helps maintain compliance with state tax laws and simplifies the filing process.

Steps to complete the Missouri Sales Tax Form 2760

Completing the Missouri Sales Tax Form 2760 requires careful attention to detail. Follow these steps:

- Gather all sales records for the reporting period.

- Calculate total sales and any exempt sales.

- Enter the total sales amount in the designated field.

- Calculate the sales tax based on the applicable rate.

- Complete any additional required sections, such as exemptions.

- Review the form for accuracy before submission.

By following these steps, businesses can ensure that their sales tax reporting is accurate and compliant with Missouri regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Missouri Sales Tax Form 2760 vary based on the business's reporting frequency. Most businesses are required to file monthly, quarterly, or annually. It is crucial to be aware of these deadlines to avoid late fees and penalties. Monthly filers typically need to submit their forms by the 20th of the following month, while quarterly and annual filers have different deadlines. Keeping a calendar of these important dates helps ensure timely compliance with state tax obligations.

Legal use of the Missouri Sales Tax Form 2760

The Missouri Sales Tax Form 2760 is legally binding when completed and submitted according to state regulations. To ensure its legal standing, businesses must provide accurate information and comply with all relevant tax laws. The form must be signed by an authorized representative of the business, which affirms the accuracy of the information provided. Understanding the legal implications of this form helps businesses avoid potential disputes or penalties with the Missouri Department of Revenue.

Key elements of the Missouri Sales Tax Form 2760

Several key elements are essential for completing the Missouri Sales Tax Form 2760 effectively. These include:

- Business Information: Name, address, and tax identification number.

- Sales Data: Total sales, exempt sales, and taxable sales.

- Tax Calculation: The total sales tax due based on the applicable rate.

- Signature: Required from an authorized representative to validate the form.

Focusing on these elements ensures that the form is filled out correctly and meets all legal requirements.

Quick guide on how to complete missouri dept of revenue form 2760

Easily Prepare Missouri Sales Tax Form 2760 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Missouri Sales Tax Form 2760 on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Modify and eSign Missouri Sales Tax Form 2760 Effortlessly

- Find Missouri Sales Tax Form 2760 and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign function, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to distribute your form, via email, text message (SMS), an invite link, or download it to your computer.

No more concerns about lost or misfiled documents, frustrating form searches, or errors requiring the reprinting of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Missouri Sales Tax Form 2760 and ensure excellent communication at every stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Need to fill out Form 10C and Form 19. Where can I get a 1 rupee revenue stamp in Bangalore?

I believe you are trying to withdraw PF. If that is correct, then I think its not a mandatory thing as I was able to submit these forms to my ex-employer without the stamp. I did receive the PF!

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

Create this form in 5 minutes!

How to create an eSignature for the missouri dept of revenue form 2760

How to generate an eSignature for your Missouri Dept Of Revenue Form 2760 in the online mode

How to make an eSignature for the Missouri Dept Of Revenue Form 2760 in Chrome

How to make an electronic signature for putting it on the Missouri Dept Of Revenue Form 2760 in Gmail

How to make an electronic signature for the Missouri Dept Of Revenue Form 2760 right from your mobile device

How to generate an eSignature for the Missouri Dept Of Revenue Form 2760 on iOS

How to create an eSignature for the Missouri Dept Of Revenue Form 2760 on Android

People also ask

-

What is the Missouri sales tax form and why is it important?

The Missouri sales tax form is a crucial document used for reporting sales and calculating sales tax owed to the state. It ensures compliance with state tax regulations and helps businesses avoid penalties. Properly completing this form is essential for any business that sells taxable goods or services in Missouri.

-

How can airSlate SignNow help me with the Missouri sales tax form?

AirSlate SignNow simplifies the process of preparing and submitting your Missouri sales tax form. With our intuitive eSigning solution, you can quickly fill out, sign, and send your forms without the hassle of printing or physical signatures. This saves time and reduces the risk of errors in your submissions.

-

Is there a cost associated with using airSlate SignNow for the Missouri sales tax form?

AirSlate SignNow offers various pricing plans to fit different business needs. While there's a nominal fee for using the service, the efficiency and time-saving features often lead to greater cost-effectiveness in managing your Missouri sales tax form process. Check our pricing page for detailed information.

-

Can I integrate airSlate SignNow with my accounting software for the Missouri sales tax form?

Yes, airSlate SignNow offers seamless integrations with popular accounting software. This allows you to effortlessly import data needed for your Missouri sales tax form, minimizing manual entry and ensuring accuracy. Enjoy the convenience of connecting your business tools for streamlined operations.

-

What features does airSlate SignNow provide for handling tax forms?

AirSlate SignNow provides features like customizable templates, bulk sending options, and secure cloud storage, specifically tailored for handling tax forms like the Missouri sales tax form. These tools help you manage your documents efficiently while ensuring a professional workflow, making tax submission less stressful.

-

How does airSlate SignNow ensure the security of my Missouri sales tax form?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption protocols and complies with industry standards to safeguard your sensitive information, including your Missouri sales tax form. You can trust that your documents are protected throughout the signing and storage process.

-

What are the benefits of using airSlate SignNow for eSigning the Missouri sales tax form?

Using airSlate SignNow for eSigning your Missouri sales tax form offers numerous benefits, including faster turnaround times and reduced paperwork. With our user-friendly interface, you can complete forms anytime, anywhere, which enhances your efficiency and helps you meet tax deadlines effortlessly.

Get more for Missouri Sales Tax Form 2760

- I state for an affidavit under form

- Sp cv form

- Housing court summary process answer form massgov

- The undersigned parties agree that a member of the housing specialist department form

- Pursuant to the provisions of mass form

- Jury waiver form massgov

- Court forms for supplementary processmassgov

- The directors corporations canada form

Find out other Missouri Sales Tax Form 2760

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document