Mo State Audiror 2013-2026

Understanding the Missouri State Auditor

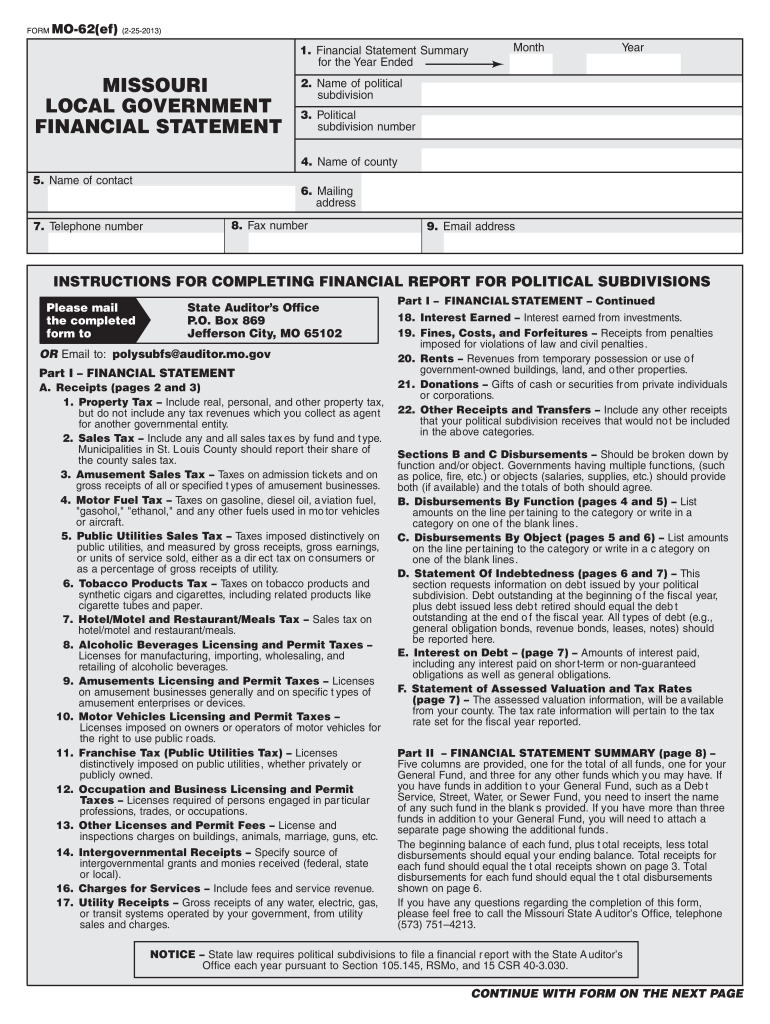

The Missouri State Auditor is a key figure in ensuring transparency and accountability in the state's financial operations. This office is responsible for conducting audits of state agencies, local governments, and various public entities. The auditor's role includes evaluating financial statements, compliance with laws, and the effectiveness of programs. By providing independent assessments, the Missouri State Auditor helps safeguard public funds and promotes responsible fiscal management.

How to Utilize the Missouri State Auditor's Resources

To effectively use the resources provided by the Missouri State Auditor, individuals and organizations can access various reports and audit findings available on the official website. These documents offer insights into the financial health and operational efficiency of public entities. For specific inquiries or to request additional information, stakeholders can reach out directly to the auditor's office through established communication channels. Engaging with the auditor's findings can aid in understanding local government financial practices and identifying areas for improvement.

Steps to Complete the Missouri State Auditor's Requirements

Completing the requirements set forth by the Missouri State Auditor involves several key steps. First, ensure that all necessary documentation is prepared, including financial statements and compliance records. Next, submit these documents according to the guidelines provided by the auditor's office, which may include online submissions or physical mail. It is important to adhere to any specified deadlines to avoid penalties. After submission, be prepared for follow-up questions or requests for additional information from the auditor's team.

Legal Use of the Missouri State Auditor's Findings

The findings from the Missouri State Auditor carry significant legal weight and can be used in various contexts. These reports can serve as evidence in legal proceedings, support claims for funding, or inform policy decisions. It is essential for entities to understand the implications of the auditor's findings and to utilize them in compliance with relevant laws and regulations. Proper use of these findings can enhance credibility and foster trust among stakeholders.

Key Elements of the Missouri State Auditor's Reports

The reports issued by the Missouri State Auditor typically include several key elements. These elements often encompass an executive summary, detailed findings, recommendations for improvement, and management responses. Each report aims to provide a comprehensive overview of the audited entity's financial practices and operational effectiveness. Understanding these components can help users navigate the reports and apply the insights effectively.

Filing Deadlines and Important Dates Related to the Missouri State Auditor

Filing deadlines for submissions to the Missouri State Auditor are crucial for compliance. These deadlines vary by the type of entity being audited and the specific requirements set forth by the auditor's office. It is advisable to stay informed about these dates to ensure timely submissions and avoid potential penalties. Regularly checking the auditor's website or subscribing to updates can help keep stakeholders aware of any changes in deadlines.

Form Submission Methods for the Missouri Sales Tax Form 2760

The Missouri Sales Tax Form 2760 can be submitted through various methods to accommodate different preferences. Individuals can choose to file the form online, which often provides a quicker processing time. Alternatively, the form can be submitted via mail or in person at designated locations. Each submission method has its own guidelines and requirements, so it is important to follow the instructions provided for the chosen method to ensure successful processing.

Quick guide on how to complete missouri local government financial statement state auditor auditor mo

Effortlessly Prepare Mo State Audiror on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to swiftly create, modify, and electronically sign your documents without any hold-ups. Manage Mo State Audiror on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Mo State Audiror with Ease

- Find Mo State Audiror and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to finalize your changes.

- Decide how you wish to send your form: via email, text (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Mo State Audiror to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

When is it mandatory to fill out a personal financial statement for one's bank? The form states no deadline about when it must be returned.

The only time I know that financial statements are asked for is when one applies for a business or personal loan, or applying for a mortgage. Each bank or credit union can have their own document requirements, however for each transaction. It really is at their discretion.

-

If you work for yourself doing government contracts and American Express asks for you to show them a current pay stub, how would you provide that? Is there a form that has an earnings statement that you can fill out yourself?

It seems to me you should just ask American Express if they have form you can fill out. It seems odd they would want to see an earnings statement, but if you need to show some sort of proof of income, typically in the absence of a pay stub, your most recently-filed tax return should suffice.I'd really ask them first before automatically sending them your tax returns though.

Create this form in 5 minutes!

How to create an eSignature for the missouri local government financial statement state auditor auditor mo

How to make an electronic signature for your Missouri Local Government Financial Statement State Auditor Auditor Mo in the online mode

How to make an eSignature for your Missouri Local Government Financial Statement State Auditor Auditor Mo in Chrome

How to create an eSignature for putting it on the Missouri Local Government Financial Statement State Auditor Auditor Mo in Gmail

How to make an eSignature for the Missouri Local Government Financial Statement State Auditor Auditor Mo straight from your smartphone

How to create an eSignature for the Missouri Local Government Financial Statement State Auditor Auditor Mo on iOS devices

How to create an electronic signature for the Missouri Local Government Financial Statement State Auditor Auditor Mo on Android OS

People also ask

-

What is the Missouri sales tax form 2760?

The Missouri sales tax form 2760 is used by businesses to report sales tax obligations and exemptions. This form helps ensure that companies comply with state tax regulations while simplifying the overall tax reporting process.

-

How can airSlate SignNow assist with the Missouri sales tax form 2760?

airSlate SignNow offers an easy-to-use platform for sending and eSigning the Missouri sales tax form 2760. Our solution streamlines the document management process, allowing users to complete and submit this tax form efficiently.

-

Is there a cost associated with using airSlate SignNow for the Missouri sales tax form 2760?

Yes, airSlate SignNow provides various pricing plans to suit different business needs when using the Missouri sales tax form 2760. We offer flexible pricing options that cater to both small and large organizations, making document management cost-effective.

-

Can airSlate SignNow handle multiple revisions of the Missouri sales tax form 2760?

Absolutely! airSlate SignNow allows users to easily make revisions to the Missouri sales tax form 2760. Our platform keeps track of changes and enables seamless collaboration among team members, ensuring that everyone is on the same page.

-

What features does airSlate SignNow offer for processing the Missouri sales tax form 2760?

airSlate SignNow provides features like customizable templates, real-time tracking, and secure storage for the Missouri sales tax form 2760. These features enhance efficiency and ensure that all documents are accessible and organized.

-

Can I integrate airSlate SignNow with other software for handling the Missouri sales tax form 2760?

Yes, airSlate SignNow has numerous integrations with popular software tools that can help streamline the process of managing the Missouri sales tax form 2760. This makes it easier for businesses to utilize their existing systems while ensuring compliance.

-

How does airSlate SignNow improve the accuracy of the Missouri sales tax form 2760?

airSlate SignNow enhances the accuracy of completing the Missouri sales tax form 2760 through automated error-checking and validation features. By reducing the potential for human error, businesses can ensure they file their tax forms correctly and on time.

Get more for Mo State Audiror

- For complaint form

- Treating physicians recommendation form recommendation to forgo or discontinue life sustaining medical treatment

- Hospital ethics committee recommendation form

- Affidavit of indigency and request for waiver substitution or form

- Supplement to affidavit of indigency massachusetts family law form

- Determination regarding fees and costs form

- F agent has informed the seller of the seller obligations under 42 u

- Massachusetts eye and ear infirmary application for form

Find out other Mo State Audiror

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien