A Guide to Bank Statements for Your MortgageRocket Form

What is the A Guide To Bank Statements For Your MortgageRocket

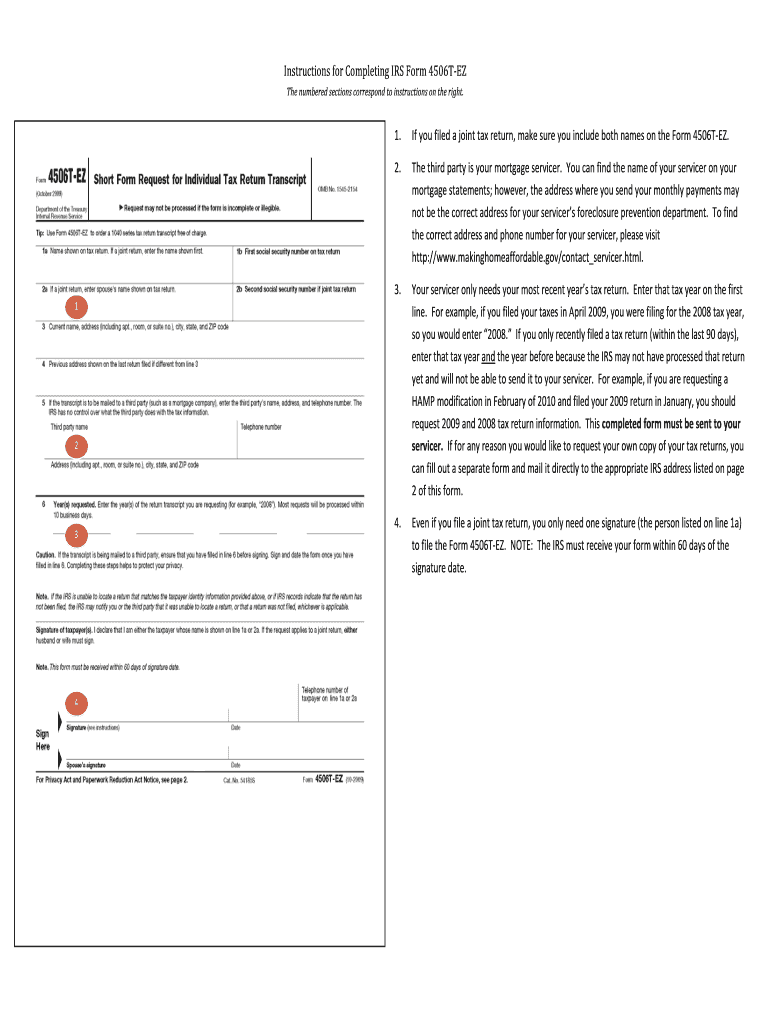

The A Guide To Bank Statements For Your MortgageRocket is a crucial document used by lenders to assess a borrower's financial stability and creditworthiness. This guide outlines the necessary information and format required for bank statements when applying for a mortgage. It typically includes details such as account balances, transaction history, and the account holder's name. Providing accurate and complete bank statements is essential for a smooth mortgage application process.

How to obtain the A Guide To Bank Statements For Your MortgageRocket

To obtain the A Guide To Bank Statements For Your MortgageRocket, borrowers can request their bank statements directly from their financial institutions. Most banks offer online banking services, allowing customers to download their statements in PDF format. Alternatively, customers can visit their bank branch or contact customer service for assistance. It is important to ensure that the statements cover the required time frame, usually the last two to three months, to meet lender requirements.

Steps to complete the A Guide To Bank Statements For Your MortgageRocket

Completing the A Guide To Bank Statements For Your MortgageRocket involves several important steps. First, gather all relevant bank statements for the required period. Next, review the statements to ensure that all information is accurate and complete. If any discrepancies are found, contact the bank for corrections. Once verified, the statements can be compiled and submitted as part of the mortgage application package. It is advisable to keep copies of all submitted documents for personal records.

Key elements of the A Guide To Bank Statements For Your MortgageRocket

The key elements of the A Guide To Bank Statements For Your MortgageRocket include the account holder's name and address, the bank's name and contact information, account numbers, balances, and transaction details. Lenders look for consistent income deposits, regular expenses, and overall financial health reflected in the statements. Any large or unusual transactions may require further explanation, so it is beneficial to be prepared to provide additional context if needed.

Legal use of the A Guide To Bank Statements For Your MortgageRocket

The legal use of the A Guide To Bank Statements For Your MortgageRocket is governed by various regulations that ensure the authenticity and accuracy of the documents submitted. Lenders must comply with federal and state laws regarding consumer protection and privacy. When submitting bank statements electronically, it is important to use secure methods to protect sensitive information. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act ensures that electronic submissions are legally recognized.

Examples of using the A Guide To Bank Statements For Your MortgageRocket

Examples of using the A Guide To Bank Statements For Your MortgageRocket include scenarios where borrowers are applying for a home purchase or refinancing an existing mortgage. In both cases, lenders require bank statements to verify income and assess the borrower's ability to repay the loan. For instance, a self-employed individual may need to provide additional documentation alongside their bank statements to demonstrate consistent income. Similarly, first-time homebuyers may need to show savings patterns that indicate financial responsibility.

Form Submission Methods (Online / Mail / In-Person)

Form submission methods for the A Guide To Bank Statements For Your MortgageRocket can vary based on lender preferences. Most lenders offer online submission options through secure portals, allowing borrowers to upload their bank statements directly. Alternatively, borrowers can submit physical copies by mail or deliver them in person to their lender's office. It is essential to follow the lender's specific instructions regarding submission methods to ensure timely processing of the mortgage application.

Quick guide on how to complete a guide to bank statements for your mortgagerocket

Manage A Guide To Bank Statements For Your MortgageRocket effortlessly on any device

Digital document administration has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow offers you all the resources you require to create, edit, and electronically sign your documents quickly and without hesitation. Handle A Guide To Bank Statements For Your MortgageRocket on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign A Guide To Bank Statements For Your MortgageRocket with ease

- Obtain A Guide To Bank Statements For Your MortgageRocket and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your updates.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign A Guide To Bank Statements For Your MortgageRocket and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is A Guide To Bank Statements For Your MortgageRocket?

A Guide To Bank Statements For Your MortgageRocket provides essential information on how to effectively use bank statements to secure your mortgage. This guide helps you understand what documents you need and how to present them to lenders, ensuring a smoother application process.

-

How can A Guide To Bank Statements For Your MortgageRocket benefit me?

Utilizing A Guide To Bank Statements For Your MortgageRocket can signNowly streamline the mortgage application process. It equips you with the necessary knowledge to prepare and organize your finances, allowing for a quicker approval time and reducing potential delays.

-

Are there costs associated with accessing A Guide To Bank Statements For Your MortgageRocket?

A Guide To Bank Statements For Your MortgageRocket is part of our cost-effective solution offered by airSlate SignNow. There are no hidden fees for accessing this guide, ensuring you get valuable insights without breaking the bank.

-

What features are included in A Guide To Bank Statements For Your MortgageRocket?

A Guide To Bank Statements For Your MortgageRocket includes step-by-step instructions, tips on gathering your financial documents, and expert advice on presenting them to lenders. These features are designed to simplify your mortgage application process and enhance your chances for approval.

-

Can I integrate A Guide To Bank Statements For Your MortgageRocket with other financial tools?

Yes, A Guide To Bank Statements For Your MortgageRocket can easily integrate with various financial tools and platforms. This compatibility allows you to manage your documents and funding sources efficiently, making the entire mortgage application process more seamless.

-

What types of bank statements should I prepare according to A Guide To Bank Statements For Your MortgageRocket?

A Guide To Bank Statements For Your MortgageRocket recommends preparing at least two months of personal bank statements, including checking, savings, and any other relevant accounts. Additionally, make sure the statements are complete, showing all transactions for transparency.

-

How does A Guide To Bank Statements For Your MortgageRocket simplify the mortgage application process?

A Guide To Bank Statements For Your MortgageRocket simplifies the mortgage application process by clarifying the exact documentation required for approval. By following the guide, applicants can precisely compile their financial history, which helps lenders assess eligibility more efficiently.

Get more for A Guide To Bank Statements For Your MortgageRocket

- Suretyship agreement for bupcmb return service agreement rsa upcm form

- Bdo application form sample

- Small claims forms download philippines 2019

- Sss loan payment form

- Cs form 100

- Contract name repairrehabilitation of multi purpose building including ground improvement form

- Obligation slip form

- Annex f 7 commission on elections form

Find out other A Guide To Bank Statements For Your MortgageRocket

- How Can I Integrate eSign in 1Password

- Can I Integrate eSign in 1Password

- How To Implement Sign in Word

- Can I Integrate eSign in WebMerge

- How Do I Implement Sign in Word

- Help Me With Implement Sign in Word

- How To Integrate eSign in MacApp

- How To Integrate eSign in eSignPay

- How Do I Implement Sign in PaperWise

- Help Me With Integrate eSign in eSignPay

- Can I Implement Sign in Zapier

- How To Integrate eSign in Grooper

- How To Integrate eSign in Android

- How To Use eSign in ERP

- Can I Integrate eSign in Grooper

- How To Use eSign in CMS

- How Do I Use eSign in CMS

- How To Use eSign in CRM

- Help Me With Use eSign in ERP

- Help Me With Use eSign in CRM