Instructions for Form 4797 Internal Revenue Service

What is the Instructions For Form 4797 Internal Revenue Service

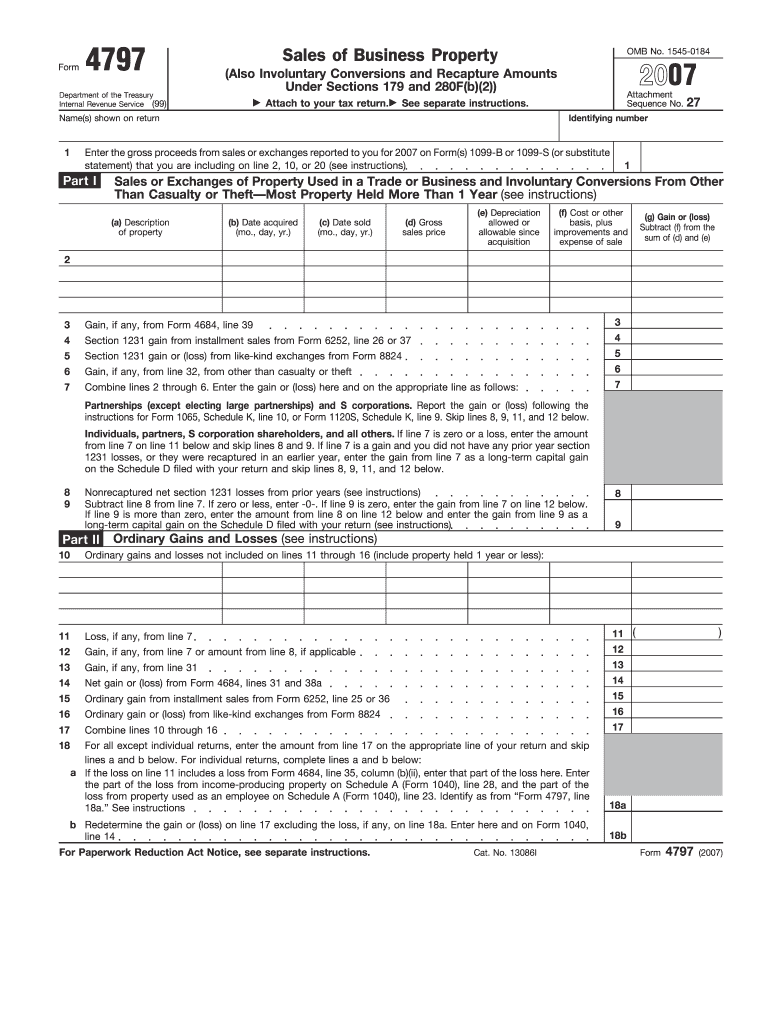

The Instructions For Form 4797, issued by the Internal Revenue Service (IRS), provide guidance on reporting the sale or exchange of business property. This form is essential for taxpayers who have disposed of assets used in a trade or business, including real estate and depreciable property. The instructions detail how to calculate gains or losses from these transactions, ensuring compliance with tax regulations. Understanding these instructions is crucial for accurate tax reporting and minimizing potential penalties.

Steps to complete the Instructions For Form 4797 Internal Revenue Service

Completing the Instructions For Form 4797 involves several key steps. First, gather all necessary documentation related to the property being sold or exchanged, including purchase price, sale price, and any depreciation taken. Next, follow the instructions to determine the adjusted basis of the property, which is essential for calculating gain or loss. Fill out the form by entering the relevant information, such as the type of property and the date of acquisition and sale. Finally, review the completed form for accuracy before submitting it to the IRS.

Legal use of the Instructions For Form 4797 Internal Revenue Service

The legal use of the Instructions For Form 4797 is governed by IRS regulations, which dictate how taxpayers must report the sale of business property. Adhering to these instructions ensures that transactions are reported correctly, which is vital for compliance with federal tax laws. Failure to follow the instructions can lead to misreporting, resulting in penalties or audits. Therefore, understanding and correctly applying the instructions is essential for legal compliance and protecting taxpayer rights.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Form 4797 align with the annual tax return deadlines. Typically, the form must be submitted by April fifteenth of the following year for individual taxpayers. However, if additional time is needed, taxpayers may file for an extension, which grants an additional six months to submit their tax returns. It is important to be aware of these deadlines to avoid late fees and ensure timely compliance with IRS requirements.

Required Documents

When completing the Instructions For Form 4797, several documents are essential. Taxpayers should gather records of the purchase and sale of the property, including closing statements, invoices, and receipts. Additionally, documentation of any depreciation claimed on the property is necessary to accurately calculate the adjusted basis. Keeping organized records will facilitate the completion of the form and support the information provided in case of an audit.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Instructions For Form 4797 through various methods. The form can be filed electronically using IRS-approved e-filing software, which often simplifies the process and provides immediate confirmation of receipt. Alternatively, taxpayers may choose to mail the completed form to the appropriate IRS address based on their location and the type of return being filed. In-person submission is generally not an option for this form, as the IRS primarily processes forms through electronic and mail channels.

Quick guide on how to complete instructions for form 4797 2018internal revenue service

Complete Instructions For Form 4797 Internal Revenue Service effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally-friendly alternative to traditional printed and signed forms, as you can access the necessary template and securely store it online. airSlate SignNow equips you with all the resources required to create, update, and electronically sign your documents quickly and efficiently. Manage Instructions For Form 4797 Internal Revenue Service on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The simplest way to modify and electronically sign Instructions For Form 4797 Internal Revenue Service with ease

- Obtain Instructions For Form 4797 Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional wet signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Instructions For Form 4797 Internal Revenue Service and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the Instructions For Form 4797 Internal Revenue Service?

The Instructions For Form 4797 Internal Revenue Service provide detailed guidance on how to report the sale or exchange of business property. It explains the procedures to follow and what information is required to ensure compliance with tax regulations when selling assets.

-

How can airSlate SignNow help with completing the Instructions For Form 4797 Internal Revenue Service?

airSlate SignNow simplifies the process of filling out the Instructions For Form 4797 Internal Revenue Service by allowing users to eSign and share documents electronically. Our intuitive platform ensures that you can easily gather necessary signatures and share forms in a secure environment.

-

Is there a cost associated with using airSlate SignNow for eSigning documents related to the Instructions For Form 4797 Internal Revenue Service?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. We provide a cost-effective solution to manage documents, ensuring you can comply with the Instructions For Form 4797 Internal Revenue Service without overspending.

-

What features does airSlate SignNow offer for handling the Instructions For Form 4797 Internal Revenue Service?

airSlate SignNow includes features such as easy document editing, customizable templates, and automated workflows. These tools help streamline the process of completing the Instructions For Form 4797 Internal Revenue Service, making it more efficient for businesses.

-

Are there any integrations available with airSlate SignNow for filing the Instructions For Form 4797 Internal Revenue Service?

Yes, airSlate SignNow integrates seamlessly with various applications, including accounting and document management software. This allows users to effortlessly import data and enhance their experience while working with the Instructions For Form 4797 Internal Revenue Service.

-

Can airSlate SignNow ensure compliance with the Instructions For Form 4797 Internal Revenue Service?

Absolutely! airSlate SignNow takes data security and compliance seriously, ensuring that all documents meet the requirements set forth in the Instructions For Form 4797 Internal Revenue Service. You can rely on our platform to keep your tax-related documents secure and compliant.

-

How quickly can I complete the Instructions For Form 4797 Internal Revenue Service using airSlate SignNow?

With airSlate SignNow, you can complete the Instructions For Form 4797 Internal Revenue Service in a matter of minutes. Our user-friendly interface simplifies the process, allowing for quick document preparation and eSigning.

Get more for Instructions For Form 4797 Internal Revenue Service

Find out other Instructions For Form 4797 Internal Revenue Service

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement