Like Kind Exchanges Purpose of Form Internal Revenue Service

What is the Like Kind Exchanges Purpose Of Form Internal Revenue Service

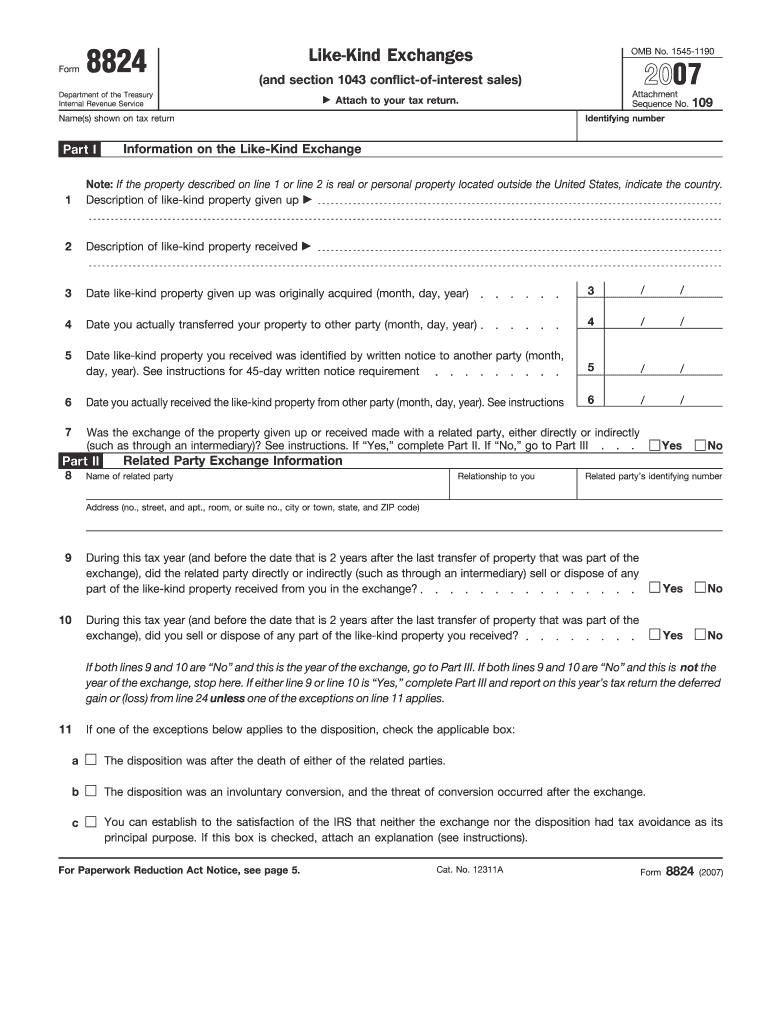

The Like Kind Exchanges Purpose of Form Internal Revenue Service is designed to facilitate tax-deferred exchanges of similar types of property. This form allows taxpayers to defer capital gains taxes when they exchange one investment property for another, provided both properties meet specific criteria set by the IRS. The main purpose of this form is to document the exchange and ensure compliance with IRS regulations, ultimately helping taxpayers manage their tax liabilities effectively.

How to use the Like Kind Exchanges Purpose Of Form Internal Revenue Service

Using the Like Kind Exchanges Purpose of Form Internal Revenue Service involves several steps. First, you must determine if your property qualifies as like-kind under IRS guidelines. Next, complete the form accurately, providing all required information about the properties involved in the exchange. After filling out the form, you should retain it for your records and submit it with your tax return for the year in which the exchange occurred. This ensures that the IRS has the necessary documentation to process your tax deferral correctly.

Steps to complete the Like Kind Exchanges Purpose Of Form Internal Revenue Service

Completing the Like Kind Exchanges Purpose of Form Internal Revenue Service requires careful attention to detail. Follow these steps:

- Identify the properties involved in the exchange, ensuring they meet the like-kind criteria.

- Gather necessary documentation, including purchase prices and dates of acquisition.

- Fill out the form, providing accurate information about both the relinquished and acquired properties.

- Review the completed form for accuracy and completeness.

- Keep a copy for your records and submit it with your tax return.

Legal use of the Like Kind Exchanges Purpose Of Form Internal Revenue Service

The legal use of the Like Kind Exchanges Purpose of Form Internal Revenue Service hinges on compliance with IRS regulations. To qualify for tax deferral, the properties exchanged must be of a similar nature or character, and the exchange must meet specific timelines and requirements. Proper documentation through this form ensures that taxpayers can substantiate their claims in case of an audit, protecting them from potential penalties or tax liabilities.

Key elements of the Like Kind Exchanges Purpose Of Form Internal Revenue Service

Key elements of the Like Kind Exchanges Purpose of Form Internal Revenue Service include:

- Identification of the relinquished and acquired properties.

- Details regarding the transaction dates.

- Statements confirming the like-kind nature of the properties.

- Signatures of all parties involved in the exchange.

Filing Deadlines / Important Dates

Filing deadlines for the Like Kind Exchanges Purpose of Form Internal Revenue Service are crucial for compliance. Typically, the form must be submitted with your tax return for the year in which the exchange occurs. Taxpayers should also be aware of any specific deadlines related to the identification and acquisition of replacement properties, which generally must occur within 45 days and 180 days, respectively, following the sale of the relinquished property.

Quick guide on how to complete like kind exchanges purpose of form internal revenue service

Complete Like Kind Exchanges Purpose Of Form Internal Revenue Service effortlessly on any device

Web-based document management has gained traction among companies and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Handle Like Kind Exchanges Purpose Of Form Internal Revenue Service on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to alter and eSign Like Kind Exchanges Purpose Of Form Internal Revenue Service with ease

- Locate Like Kind Exchanges Purpose Of Form Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for this task.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Verify all the information and click on the Done button to save your changes.

- Select how you want to send your form—via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Like Kind Exchanges Purpose Of Form Internal Revenue Service and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Like Kind Exchanges Purpose Of Form Internal Revenue Service?

The Like Kind Exchanges Purpose Of Form Internal Revenue Service is designed to facilitate tax-deferred exchanges of like-kind properties. This form helps taxpayers report the exchange and understand the implications of such transactions. By utilizing this form correctly, individuals can defer capital gains taxes, making it a valuable tool for real estate and investment property exchanges.

-

How can airSlate SignNow assist with the Like Kind Exchanges Purpose Of Form Internal Revenue Service?

airSlate SignNow provides a streamlined platform for eSigning and sending documents, including those related to the Like Kind Exchanges Purpose Of Form Internal Revenue Service. Our easy-to-use solution allows users to quickly prepare and execute necessary paperwork, ensuring compliance and promoting efficiency in handling complex tax-related transactions. This simplifies the process for clients needing to complete their exchanges seamlessly.

-

Are there any costs involved when using airSlate SignNow for forms related to the Like Kind Exchanges Purpose Of Form Internal Revenue Service?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features that support the handling of forms related to the Like Kind Exchanges Purpose Of Form Internal Revenue Service. Users can choose a plan that fits their volume of transactions and specific requirements, ensuring a cost-effective solution.

-

What features does airSlate SignNow provide to help with the Like Kind Exchanges Purpose Of Form Internal Revenue Service?

airSlate SignNow offers features like document templates, status tracking, and secure cloud storage to assist users with the Like Kind Exchanges Purpose Of Form Internal Revenue Service. These tools enhance user experience by enabling efficient preparation, signing, and management of important documents. Additionally, our platform supports various formats, making it easy to customize and utilize forms as needed.

-

Can airSlate SignNow integrate with accounting software for managing the Like Kind Exchanges Purpose Of Form Internal Revenue Service?

Yes, airSlate SignNow supports integrations with popular accounting software, which can be beneficial for managing the Like Kind Exchanges Purpose Of Form Internal Revenue Service. By integrating with your existing systems, you can streamline your document workflows and ensure all financial records are accurate and accessible. This integration helps maintain compliance and provides an organized approach to tax-related matters.

-

What are the benefits of using airSlate SignNow for processing the Like Kind Exchanges Purpose Of Form Internal Revenue Service?

Using airSlate SignNow for processing the Like Kind Exchanges Purpose Of Form Internal Revenue Service offers numerous benefits, including increased efficiency, cost savings, and improved compliance. Our platform reduces the time and effort needed for document execution, allowing clients to focus on their investments. Additionally, with robust security measures in place, your sensitive tax information remains protected.

-

How do I get started with airSlate SignNow for the Like Kind Exchanges Purpose Of Form Internal Revenue Service?

Getting started with airSlate SignNow is simple! You can sign up for a free trial on our website to explore the features designed to assist with the Like Kind Exchanges Purpose Of Form Internal Revenue Service. After signing up, you will gain access to our platform, allowing you to create, send, and manage your documents efficiently.

Get more for Like Kind Exchanges Purpose Of Form Internal Revenue Service

Find out other Like Kind Exchanges Purpose Of Form Internal Revenue Service

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document