Federal Standard Form SF 254 Procurement Services Home

Understanding the Federal Standard Form SF 254

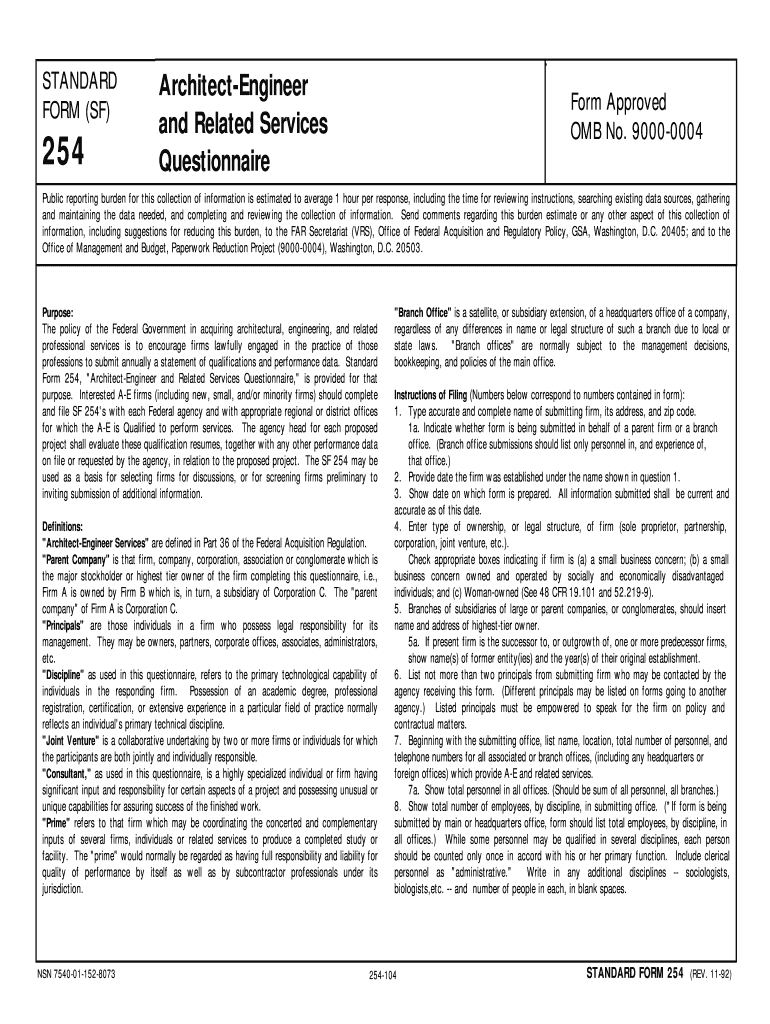

The Federal Standard Form SF 254 is a crucial document used by businesses to provide information about their qualifications for federal contracts. This form is primarily utilized by architectural and engineering firms, allowing them to showcase their capabilities and experience. The SF 254 serves as a means for federal agencies to assess potential contractors based on their expertise, past performance, and resources. It is essential for firms seeking to engage in procurement services with the government, as it helps streamline the selection process.

Steps to Complete the Federal Standard Form SF 254

Completing the SF 254 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information about your organization, including its history, staff qualifications, and relevant project experience. Next, fill out the form by providing detailed responses to each section, ensuring that all information is current and reflects your firm’s capabilities. Pay special attention to the sections that require specifics about past projects and client references, as these are critical for evaluation. Finally, review the completed form for any errors or omissions before submission.

Legal Use of the Federal Standard Form SF 254

The legal validity of the SF 254 is supported by compliance with federal regulations regarding procurement processes. When filled out correctly and submitted through the appropriate channels, the SF 254 is considered a legally binding document. It is important to ensure that all statements made in the form are truthful and accurate, as any discrepancies could lead to legal repercussions or disqualification from federal contracts. Utilizing a reliable eSignature solution can enhance the form's legal standing by providing a secure method for signing and submitting the document.

Key Elements of the Federal Standard Form SF 254

The SF 254 consists of several key elements that must be addressed thoroughly. These include the firm’s name and address, a description of the services provided, and a list of relevant projects completed in the past. Additionally, it requires information about the firm's staff, including their qualifications and roles in previous projects. Each section is designed to give federal agencies a comprehensive view of the firm’s capabilities and experience, which is essential for making informed decisions during the procurement process.

How to Obtain the Federal Standard Form SF 254

The SF 254 can be obtained from various government websites, including the General Services Administration (GSA) website. It is typically available in a downloadable format, allowing firms to fill it out electronically or print it for manual completion. Additionally, many organizations provide templates that can help streamline the process of filling out the form. Ensuring you have the most current version of the SF 254 is important, as updates may occur that could affect the information required.

Examples of Using the Federal Standard Form SF 254

Examples of using the SF 254 include submitting the form as part of a proposal for a federal construction project or as a qualification statement for engineering services. Firms may also use the SF 254 when responding to requests for qualifications (RFQs) from various government agencies. Each submission of the form should be tailored to highlight the specific qualifications and experiences relevant to the project at hand, thereby increasing the chances of being selected for the contract.

Quick guide on how to complete federal standard form sf 254 procurement services home

Complete Federal Standard Form SF 254 Procurement Services Home seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents promptly without any holdups. Manage Federal Standard Form SF 254 Procurement Services Home on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Federal Standard Form SF 254 Procurement Services Home without hassle

- Find Federal Standard Form SF 254 Procurement Services Home and then hit Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then press the Done button to save your amendments.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Federal Standard Form SF 254 Procurement Services Home and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I write qualification details in order to fill out the AIIMS application form if a student is appearing in 12th standard?

There must be provision in the form for those who are taking 12 th board exam this year , so go through the form properly before filling it .

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

-

How likely are you to win a car from filling out a form at a mall? Who drives the new car home? What are your chances to win another car again?

I am going to get pretty literal here. Please forgive meHow likely are you to win a car from filling out a form at a mall? In the US, at least, this is usually spelled out somewhere on the form or on a website listed on the form. If it is not, you could ask (and may or may not get a truthful answer). If none of this works, you could probably be able to guess using a few factors: * How many people take the time to stop and enter (what percentage of passers-by, multiplied by amount of typical or expected foot-traffic)?* Are multiple entries allowed? * How long will entries be accepted before the drawing? As a rule of thumb, if the odds aren’t stated (and usually, even if they are) the odds are probably staggering. If you multiply the amount of time it takes to fill out the form by the amount of forms you would have to fill-out before you had an even 1% chance of winning the car, you would likely do better using that time to get a second job. Oh, and lastly, realize that the reason they are enticing you with the chance to win a car is that they are collecting your personal information on the form. It usually is quite a cheap way to generate a LOT of personal data, add you to mailing/dialing lists, etc. They folks running the drawing often gather another great bit of psychology about you: person who fills out form likes to enter “something for nothing” type contests (the drawing itself). This can be valuable to advertisers.Who drives the new car home? By definition of “home” the owner (presumably the winner) would drive the car “home”. If the car is driven to your house by an employee of the company running the lottery, they would just be driving the car to the winners residence…not their “home”.Frankly, I am not sure of what is meant by this question. I would assume that any winner of the drawing would either pick up the vehicle and drive it themselves away from the drawing or other site where the prize was moved to, possibly prepped for delivery tot he winner, or someone would deliver it to the winner’s home by driving it or trucking it there.What are your chances to win another car again? Your chances of winning the next drawing you entered would be EXACTLY the same as they would be had you lost the previous one, as specified in item number one. The odds of winning/losing do not change based on previous outcome. Think about it this way: If I just flipped a coin and it landed on “heads” 50 times in a row, what are the chances that it will be “heads” on the 51st attempt? EXACTLY (assuming there is nothing about the coin or flip that favors one side over the other) 1 in 2 or 50%, just as it was the first flip, just as it will be on the 51st millionth.Now the probability of winning 2 drawings, each with 1 million entries is staggeringly small. But they are two separate events, each governed independently by their own set of probabilities. Landing on heads 51 times in a row or winning 2 cars in consecutive drawings would be matters of remarkable coincidence: respectively 50 1 in 2 or 2 one in a million events happening to share the same outcome.Good luck

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the federal standard form sf 254 procurement services home

How to create an electronic signature for your Federal Standard Form Sf 254 Procurement Services Home online

How to make an eSignature for the Federal Standard Form Sf 254 Procurement Services Home in Chrome

How to create an electronic signature for putting it on the Federal Standard Form Sf 254 Procurement Services Home in Gmail

How to create an eSignature for the Federal Standard Form Sf 254 Procurement Services Home straight from your smart phone

How to make an electronic signature for the Federal Standard Form Sf 254 Procurement Services Home on iOS

How to make an electronic signature for the Federal Standard Form Sf 254 Procurement Services Home on Android OS

People also ask

-

What is the sf 254 form and how can airSlate SignNow help?

The sf 254 form is a standard form used by businesses to demonstrate their competence and qualifications for federal contracting. With airSlate SignNow, you can easily upload, sign, and send your sf 254 documents securely, streamlining the submission process.

-

How much does it cost to use airSlate SignNow for managing sf 254 forms?

airSlate SignNow offers various pricing plans that accommodate different business needs, ensuring that managing sf 254 forms remains cost-effective. The plans are flexible, allowing businesses to choose a package that fits their budget while providing robust features.

-

What features does airSlate SignNow offer for handling sf 254 documents?

airSlate SignNow provides features like document templates, PDF editing, and electronic signatures, which simplify the process of handling sf 254 documents. These tools help ensure that your forms are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for sf 254 management?

Yes, airSlate SignNow supports integrations with various software tools, making it easier to manage your sf 254 forms alongside your existing systems. This integration capability enhances workflow efficiency and allows for seamless data transfers.

-

What are the benefits of using airSlate SignNow for sf 254 submissions?

Using airSlate SignNow for sf 254 submissions offers numerous benefits, including increased efficiency and reduced paper waste. The platform allows for fast electronic signatures and secure document storage, which can signNowly streamline the submission process.

-

Is airSlate SignNow compliant with federal regulations for sf 254 forms?

Absolutely! airSlate SignNow is designed to comply with federal regulations, ensuring that your sf 254 forms meet all necessary legal requirements. This compliance provides peace of mind as you handle sensitive documents.

-

How does airSlate SignNow ensure the security of my sf 254 documents?

airSlate SignNow employs robust security measures, including encryption and secure access controls, to safeguard your sf 254 documents from unauthorized access. This focus on security ensures that your sensitive information remains protected throughout the signing process.

Get more for Federal Standard Form SF 254 Procurement Services Home

- Doing discovery in family law casesinterrogatories and form

- Default judgment motion in minnesota template forms

- Manual for clerks of the iowa district courtspdf form

- Motion to change venue disclosure minnesota judicial branch form

- Order to amend form

- Judgement and decree form

- Judgment and decree form

- Dakota county district court minnesota judicial branch form

Find out other Federal Standard Form SF 254 Procurement Services Home

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free