Loan Agreement the Borrower Identified on the Signature Form

What is the Loan Agreement The Borrower Identified On The Signature

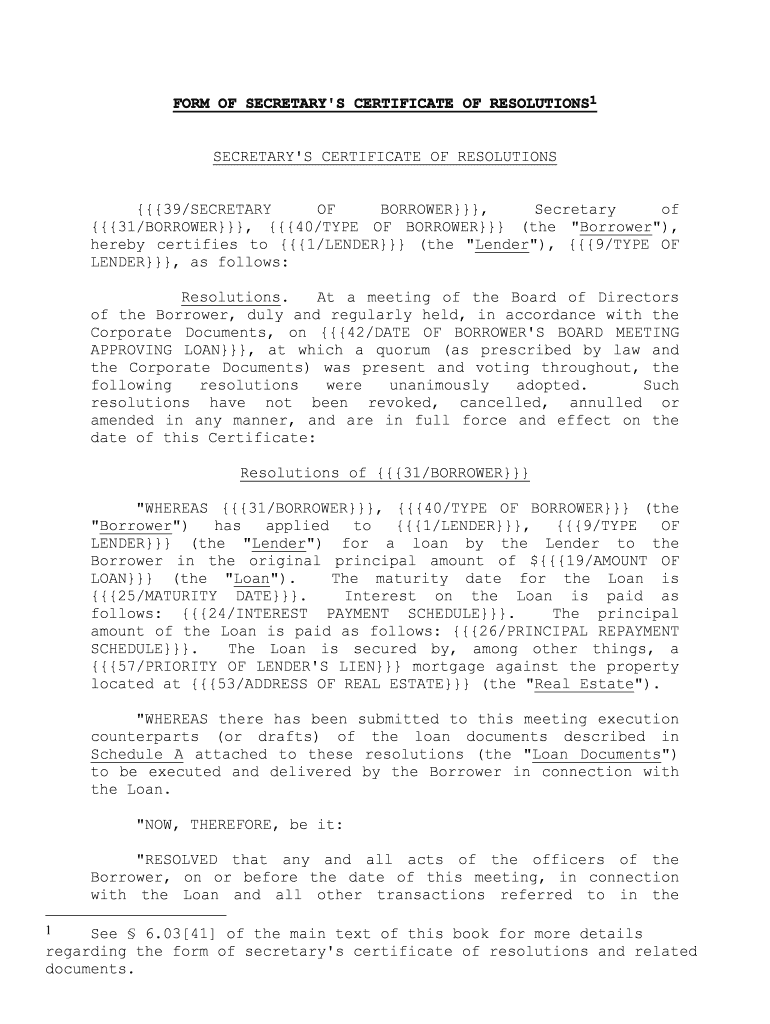

The loan agreement the borrower identified on the signature is a legal document that outlines the terms and conditions under which a borrower receives funds from a lender. This agreement specifies the amount borrowed, interest rates, repayment schedules, and other essential terms. It serves as a binding contract between the parties involved, ensuring that both the lender and borrower understand their rights and obligations. The identification of the borrower on the signature line is crucial, as it confirms the individual or entity responsible for the repayment of the loan.

How to Use the Loan Agreement The Borrower Identified On The Signature

To effectively use the loan agreement the borrower identified on the signature, both parties should carefully review the document and ensure that all terms are clearly understood. The borrower must provide accurate personal information, including their full name and contact details. Once the agreement is filled out, both the borrower and lender should sign the document electronically or in person, depending on their preference. Utilizing a secure platform for electronic signatures can enhance the validity and security of the agreement.

Key Elements of the Loan Agreement The Borrower Identified On The Signature

Several key elements are essential in the loan agreement the borrower identified on the signature. These include:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The percentage charged on the borrowed amount.

- Repayment Terms: The schedule for repayment, including due dates and amounts.

- Default Clauses: Conditions under which the borrower may be considered in default.

- Signatures: The signatures of both the borrower and lender, confirming their agreement to the terms.

Steps to Complete the Loan Agreement The Borrower Identified On The Signature

Completing the loan agreement the borrower identified on the signature involves several straightforward steps:

- Gather necessary information, including personal identification and financial details.

- Fill out the loan agreement form accurately, ensuring all required fields are completed.

- Review the terms of the agreement with the lender to clarify any uncertainties.

- Sign the document electronically or in person, ensuring that the borrower’s identification is clearly indicated.

- Keep a copy of the signed agreement for personal records and future reference.

Legal Use of the Loan Agreement The Borrower Identified On The Signature

The loan agreement the borrower identified on the signature is legally binding when executed properly. For it to be enforceable, it must meet specific legal requirements, including the presence of clear terms, mutual consent, and the capacity of the parties involved. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, allowing for the legal use of digital agreements as long as they comply with these regulations. This ensures that both parties are protected under the law.

State-Specific Rules for the Loan Agreement The Borrower Identified On The Signature

It is essential to be aware that state-specific rules may apply to the loan agreement the borrower identified on the signature. Different states may have varying regulations regarding interest rates, disclosure requirements, and enforcement of loan agreements. Borrowers and lenders should familiarize themselves with their state laws to ensure compliance and avoid potential legal issues. Consulting with a legal professional can provide clarity on any state-specific requirements that may impact the agreement.

Quick guide on how to complete loan agreement the borrower identified on the signature

Prepare Loan Agreement The Borrower Identified On The Signature seamlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Loan Agreement The Borrower Identified On The Signature on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to adjust and electronically sign Loan Agreement The Borrower Identified On The Signature with ease

- Obtain Loan Agreement The Borrower Identified On The Signature and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools specifically designed for that function by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunts, or mistakes that necessitate printing new document copies. airSlate SignNow meets your requirements in document management within a few clicks from any device you select. Edit and electronically sign Loan Agreement The Borrower Identified On The Signature to guarantee excellent communication throughout any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Loan Agreement The Borrower Identified On The Signature?

A Loan Agreement The Borrower Identified On The Signature is a legally binding document that outlines the terms of a loan between the lender and the borrower. This agreement specifies the amount borrowed, interest rates, repayment terms, and other essential conditions. It ensures clarity and protection for both parties involved in the loan.

-

How does airSlate SignNow facilitate the creation of a Loan Agreement The Borrower Identified On The Signature?

airSlate SignNow provides easy-to-use templates that enable users to craft a Loan Agreement The Borrower Identified On The Signature quickly. With our document editor, you can customize the agreement to include specific loan terms and borrower details. This streamlines the process and saves you time.

-

What are the pricing options for using airSlate SignNow for loan agreements?

airSlate SignNow offers various pricing plans to suit different needs, including a free trial for new users. Our plans provide flexibility based on the volume of agreements or specific features required for creating a Loan Agreement The Borrower Identified On The Signature. Review our pricing page for more detailed information.

-

Can I integrate airSlate SignNow with other applications for managing loan agreements?

Yes, airSlate SignNow seamlessly integrates with numerous applications, enhancing your workflow when creating a Loan Agreement The Borrower Identified On The Signature. Whether you use CRM software or cloud storage, our integrations help ensure all your documents are efficiently managed and accessible. Check our integrations page for a complete list.

-

What security measures does airSlate SignNow implement for loan agreements?

Security is a top priority at airSlate SignNow. All Loan Agreements The Borrower Identified On The Signature and associated data are encrypted to protect sensitive information. Additionally, we comply with industry standards and regulations to maintain your data's confidentiality and security.

-

Is it easy to eSign a Loan Agreement The Borrower Identified On The Signature with airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to eSign a Loan Agreement The Borrower Identified On The Signature. With a user-friendly interface, signers can securely sign documents from any device, ensuring a quick, hassle-free signing process.

-

What are the key benefits of using airSlate SignNow for loan agreements?

Using airSlate SignNow for a Loan Agreement The Borrower Identified On The Signature provides numerous benefits, including time savings, improved accuracy, and seamless collaboration. Our platform allows for quick revisions and sharing, ensuring that all parties can review and finalize agreements efficiently.

Get more for Loan Agreement The Borrower Identified On The Signature

- Orange county public schools field trip information form school year ocps

- Certificate of appropriateness application san francisco form

- Planning application forms templates for local planning

- Pricing revenues and participation under washington state form

- Bcii 8016 form

- Dsa 810 form

- Egusd transportation form

- Konin todoke form

Find out other Loan Agreement The Borrower Identified On The Signature

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors