M&A Transaction Term Sheet Guideline Form

What is the M&A Transaction Term Sheet Guideline

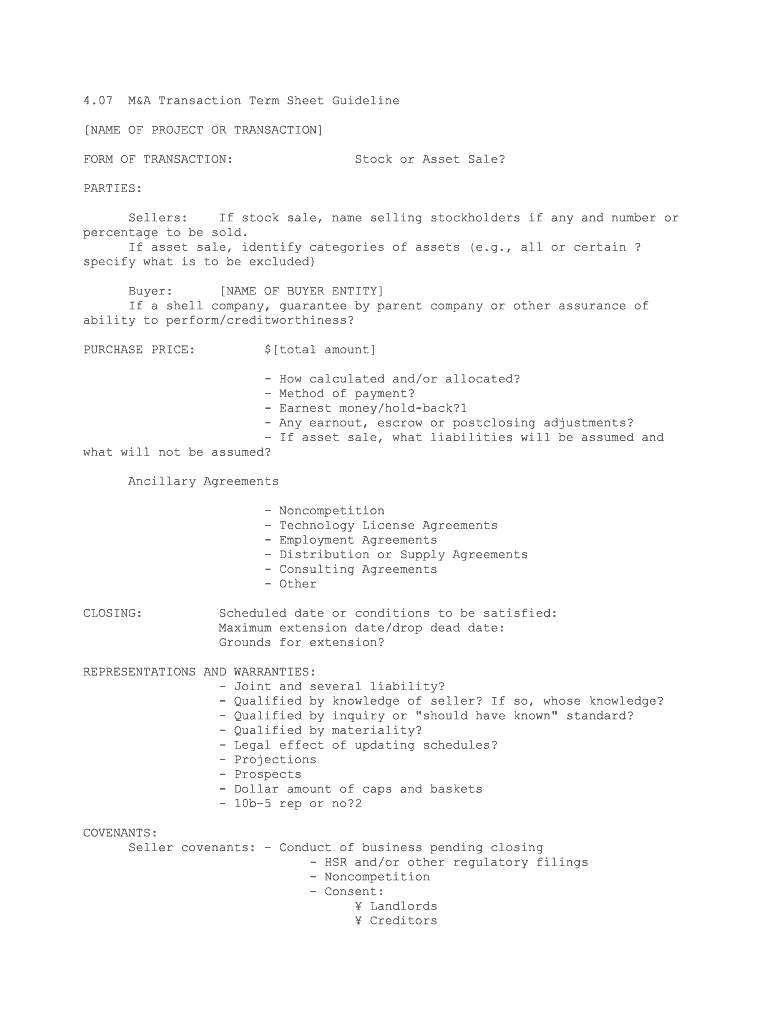

The M&A Transaction Term Sheet Guideline serves as a foundational document in the merger and acquisition process. It outlines the essential terms and conditions agreed upon by the parties involved before finalizing a deal. This guideline typically includes details such as the purchase price, payment structure, and key milestones. By providing a clear framework, it helps ensure that all parties have a mutual understanding of the transaction's basic elements, which can prevent misunderstandings and disputes later in the process.

Key elements of the M&A Transaction Term Sheet Guideline

Understanding the key elements of the M&A Transaction Term Sheet Guideline is crucial for effective communication between parties. Important components often include:

- Transaction Structure: Defines whether the deal is an asset purchase or a stock purchase.

- Purchase Price: Specifies the total cost of the transaction and any adjustments that may apply.

- Closing Conditions: Outlines the requirements that must be met before the transaction can be finalized.

- Confidentiality Provisions: Ensures that sensitive information shared during negotiations remains protected.

- Exclusivity Period: Indicates a timeframe during which the seller agrees not to negotiate with other potential buyers.

Steps to complete the M&A Transaction Term Sheet Guideline

Completing the M&A Transaction Term Sheet Guideline involves several key steps to ensure accuracy and clarity:

- Gather Information: Collect all necessary data regarding the transaction, including financial details and legal considerations.

- Draft the Term Sheet: Create a draft that includes all agreed-upon terms, ensuring clarity and precision in language.

- Review with Stakeholders: Share the draft with all parties involved for feedback and necessary adjustments.

- Finalize the Document: Make any final edits and ensure all parties sign the term sheet to indicate agreement.

- Store Securely: Keep the finalized term sheet in a secure location for future reference and compliance.

Legal use of the M&A Transaction Term Sheet Guideline

The legal validity of the M&A Transaction Term Sheet Guideline is crucial for its enforceability. While the term sheet itself may not be a binding contract, it sets the stage for the definitive agreements that follow. To ensure legal compliance, it is important to:

- Clearly state the intent of the parties involved.

- Include any necessary legal disclaimers or conditions.

- Ensure that all parties have the authority to enter into the agreement.

How to use the M&A Transaction Term Sheet Guideline

Using the M&A Transaction Term Sheet Guideline effectively involves several practical considerations. Start by familiarizing yourself with the document's structure and key terms. During negotiations, refer to the term sheet to clarify points of agreement and identify areas that may need further discussion. It serves as a roadmap throughout the M&A process, helping to keep all parties aligned and focused on the agreed-upon terms.

Examples of using the M&A Transaction Term Sheet Guideline

Real-world examples can illustrate how the M&A Transaction Term Sheet Guideline functions in practice. For instance, in a recent acquisition, a technology firm used the term sheet to outline the purchase price and payment schedule, which facilitated smoother negotiations. Another example involved a healthcare company that included specific confidentiality provisions in the term sheet to protect sensitive patient data during the acquisition process. These examples highlight the guideline's role in promoting clarity and security in M&A transactions.

Quick guide on how to complete mampa transaction term sheet guideline

Effortlessly Prepare M&A Transaction Term Sheet Guideline on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly option to conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage M&A Transaction Term Sheet Guideline on any device using the airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

Edit and eSign M&A Transaction Term Sheet Guideline with Ease

- Find M&A Transaction Term Sheet Guideline and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow efficiently addresses your document management needs in just a few clicks from any device you choose. Modify and eSign M&A Transaction Term Sheet Guideline and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an M&A Transaction Term Sheet Guideline?

An M&A Transaction Term Sheet Guideline outlines key terms and conditions for mergers and acquisitions. It serves as a preliminary agreement that helps facilitate discussions between parties involved. Utilizing an effective guideline can ease the negotiation process and ensure all critical points are covered.

-

How does airSlate SignNow support M&A Transaction Term Sheet Guideline creation?

airSlate SignNow provides user-friendly tools to create and customize M&A Transaction Term Sheet Guidelines. With easy-to-use templates and document collaboration features, businesses can quickly draft precise term sheets. This streamlines the documentation process and enhances efficiency.

-

What are the pricing options for using airSlate SignNow for M&A Transaction Term Sheets?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Pricing is based on the number of users and features required for document management, including M&A Transaction Term Sheet Guidelines. A free trial is available to explore capabilities before committing.

-

What features does airSlate SignNow offer for managing M&A Transaction Term Sheets?

Key features of airSlate SignNow include document editing, eSigning, and real-time collaboration. These features allow teams to efficiently manage M&A Transaction Term Sheet Guidelines while reducing delays. Additionally, document tracking and notifications help keep everyone informed about document status.

-

Can airSlate SignNow integrate with other tools for M&A transactions?

Yes, airSlate SignNow integrates seamlessly with various business tools, enhancing its utility for M&A transactions. Common integrations include CRM systems and productivity software, which can improve the workflow around M&A Transaction Term Sheet Guidelines. This ensures that all documents and data are synchronized across platforms.

-

What are the benefits of using airSlate SignNow for M&A transactions?

Using airSlate SignNow for M&A transactions simplifies document management and enhances team collaboration. The platform provides a secure and compliant way to handle sensitive documents like M&A Transaction Term Sheet Guidelines. Additionally, its cost-effective solutions help save both time and money.

-

Is airSlate SignNow secure for managing M&A Transaction Term Sheets?

Absolutely, airSlate SignNow employs robust security measures to protect confidential information within M&A Transaction Term Sheets. With advanced encryption and secure cloud storage, businesses can trust that their sensitive documents are safe. Regular security updates and compliance checks add an extra layer of protection.

Get more for M&A Transaction Term Sheet Guideline

Find out other M&A Transaction Term Sheet Guideline

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now