I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting Form

What is the I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting

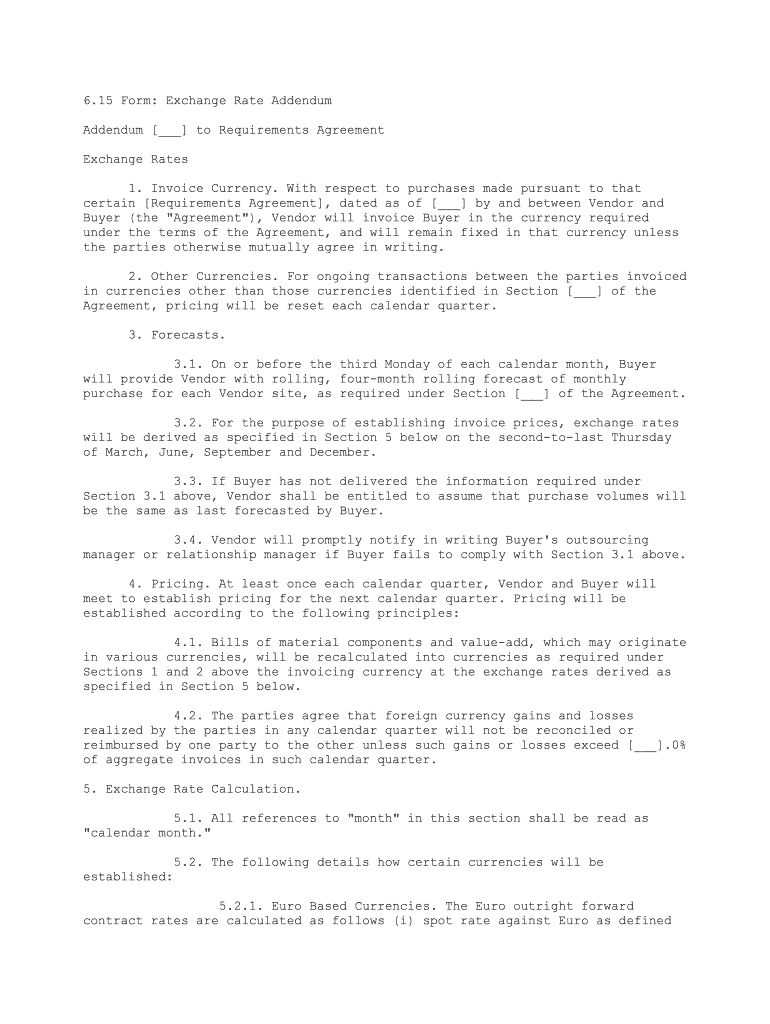

The I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting provides guidelines for U.S. federal agencies on how to account for foreign currency transactions. This chapter is part of the Treasury Financial Manual (TFM) and outlines the necessary procedures and principles for accurately reporting foreign currency transactions in financial statements. It aims to ensure consistency and compliance with federal accounting standards, particularly in relation to exchange rates and the valuation of foreign currency assets and liabilities.

Steps to complete the I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting

Completing the I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting involves several key steps:

- Identify all foreign currency transactions that need to be reported.

- Determine the appropriate exchange rates to use for conversion, which may include historical rates or current market rates.

- Record the transactions in the accounting system, ensuring that they are accurately reflected in the financial statements.

- Review the entries for compliance with federal accounting standards and guidelines outlined in the TFM.

- Prepare any necessary documentation to support the reported amounts, including contracts or invoices.

Legal use of the I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting

The legal use of the I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting is essential for federal agencies to maintain compliance with federal regulations. Adhering to the guidelines ensures that all foreign currency transactions are reported accurately and transparently. This compliance helps to prevent legal issues related to financial misreporting and ensures that agencies can effectively manage their foreign currency exposures.

Key elements of the I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting

Several key elements are critical to understanding the I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting:

- Exchange Rate Determination: Guidelines on how to select and apply exchange rates for transaction reporting.

- Transaction Types: Definitions of various foreign currency transactions, including purchases, sales, and conversions.

- Reporting Requirements: Specifications on how to report foreign currency transactions in financial statements.

- Documentation Standards: Requirements for maintaining records that support foreign currency accounting entries.

How to use the I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting

Using the I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting effectively involves understanding its structure and applying its guidelines to your agency's accounting practices. Agencies should familiarize themselves with the chapter's content, ensuring that all relevant personnel are trained in its application. Regular reviews and updates to accounting practices should be conducted to align with any changes in the TFM guidelines.

Examples of using the I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting

Examples of using the I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting include:

- Recording a purchase of goods from a foreign supplier, where the transaction is denominated in a foreign currency.

- Converting foreign currency cash holdings into U.S. dollars for reporting purposes at the end of the fiscal year.

- Documenting the impact of foreign currency fluctuations on financial statements, such as gains or losses from currency conversions.

Quick guide on how to complete i tfm part 2 chapter 3200 foreign currency accounting

Execute I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting effortlessly on any gadget

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the features necessary to create, edit, and eSign your documents swiftly and without interruptions. Manage I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting on any gadget using airSlate SignNow Android or iOS applications, and streamline any document-related process today.

The simplest method to modify and eSign I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting without effort

- Find I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting and click on Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device of your choice. Modify and eSign I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting?

I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting is an essential guideline for accountants and financial professionals managing transactions in multiple currencies. It provides clarity on how to record and report foreign currency transactions efficiently. Using tools like airSlate SignNow can streamline your accounting processes with electronic signatures and the management of related documents.

-

How does airSlate SignNow help with I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting?

airSlate SignNow offers functionalities that simplify document management and electronic signatures, essential for compliance with I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting. The platform allows for the quick exchange of contracts and documentation that pertain to foreign currency transactions. This reduces errors and enhances efficiency in the accounting process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans to accommodate various business sizes and needs. These plans provide access to essential features for document management and eSigning that align with I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting compliance. Prospective customers can choose a plan that fits their specific requirements, ensuring cost-effectiveness.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow can be easily integrated with numerous accounting software platforms. This streamlines your workflow and helps ensure compliance with I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting by managing all documents in one place. Integration allows for seamless data transfer across systems, enhancing productivity and accuracy.

-

What are the key features of airSlate SignNow?

Key features of airSlate SignNow include customizable templates, secure eSigning, document tracking, and organization capabilities. These features are crucial for businesses dealing with I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting as they simplify compliance while ensuring that all documents related to foreign currency transactions are well managed. This contributes to a more organized accounting process.

-

How can airSlate SignNow improve compliance with currency exchange regulations?

Using airSlate SignNow can enhance compliance with currency exchange regulations through its secure document handling and tracking features. This is particularly relevant for I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting, where accurate and timely documentation of transactions is necessary. The platform ensures that every step of the process is easily accessible and auditable.

-

Is airSlate SignNow user-friendly for teams not familiar with technology?

Absolutely, airSlate SignNow is designed with user-friendliness in mind, making it accessible for teams with varying technical skills. Whether you're working on I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting or any other task, the intuitive interface simplifies the eSigning process. Training resources are also available to help users get up to speed quickly.

Get more for I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting

- Nursing home tennessee benha form

- Hs 0169 form

- Tennessee department of health ocrclinton on site survey form

- License as an emergency medical services practitioner form

- The durable power of attorney health care and finances form

- Acute flaccid myelitis patient summary form centers for

- Notice of injured employee rights and responsibilities in the form

- Home inventory checklist pdf texas department of insurance form

Find out other I TFM PART 2 CHAPTER 3200 Foreign Currency Accounting

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template