Instructions for Form 4952

What is the Instructions For Form 4952

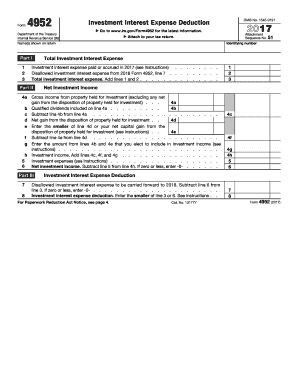

The instructions for 2014 Form 4952 provide detailed guidance for taxpayers who need to calculate the investment interest expense deduction. This form is essential for individuals and businesses that have incurred interest on loans taken out to purchase investments. The instructions clarify how to fill out the form correctly, ensuring that taxpayers can claim their eligible deductions while remaining compliant with IRS regulations.

Steps to complete the Instructions For Form 4952

Completing the instructions for 2014 Form 4952 involves several key steps:

- Gather necessary documentation, including records of investment interest expenses and any relevant financial statements.

- Review the instructions to understand the requirements and calculations involved.

- Fill out the form, ensuring that all required fields are completed accurately.

- Double-check calculations to confirm that the investment interest expense deduction is calculated correctly.

- Submit the completed form along with your tax return, either electronically or by mail.

Legal use of the Instructions For Form 4952

Understanding the legal use of the instructions for 2014 Form 4952 is crucial for compliance. The IRS mandates that taxpayers accurately report their investment interest expenses to avoid penalties. The form must be filled out in accordance with IRS guidelines, and any discrepancies may lead to audits or fines. Utilizing the form correctly ensures that taxpayers can substantiate their claims and comply with federal tax laws.

IRS Guidelines

The IRS provides specific guidelines for completing the instructions for Form 4952. These guidelines outline eligibility criteria, allowable deductions, and necessary documentation. Taxpayers should refer to the IRS website or consult the latest publications for any updates or changes to the guidelines that may affect their filings. Adhering to these guidelines is essential for a smooth tax filing process.

Filing Deadlines / Important Dates

Filing deadlines are critical when it comes to submitting the instructions for 2014 Form 4952. Generally, individual taxpayers must file their tax returns by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS calendar for any specific deadlines related to tax filings and ensure timely submission to avoid penalties.

Who Issues the Form

The instructions for 2014 Form 4952 are issued by the Internal Revenue Service (IRS), the federal agency responsible for tax administration in the United States. The IRS provides these instructions to help taxpayers accurately report their investment interest expenses and ensure compliance with tax laws. It is important to use the most current version of the form and instructions to avoid any issues during the filing process.

Quick guide on how to complete instructions for form 4952

Complete Instructions For Form 4952 effortlessly on any device

Online document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Instructions For Form 4952 on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Instructions For Form 4952 with ease

- Obtain Instructions For Form 4952 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information carefully and click on the Done button to save your updates.

- Select your preferred method to submit your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choice. Alter and electronically sign Instructions For Form 4952 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 4952

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the instructions for 2014 form 4952?

The instructions for 2014 form 4952 provide detailed steps to assist taxpayers in calculating the investment interest expense deduction. These instructions cover eligibility requirements, necessary forms to fill out, and how to properly report your expenses to maximize your tax benefits.

-

How can I access the instructions for 2014 form 4952?

You can access the instructions for 2014 form 4952 online through the IRS website or other tax-related resources. Ensure you download the latest version to get the correct guidelines for preparing your tax filings.

-

Are there any specific features in airSlate SignNow that help with tax document management?

Yes, airSlate SignNow includes features that streamline tax document management, such as eSigning, document sharing, and secure storage. These features can be particularly useful for organizing your forms, like the instructions for 2014 form 4952, and ensuring they are easily accessible as needed.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow employs industry-standard security measures, including encryption and secure user authentication, to keep your tax documents safe. Whether you're working with instructions for 2014 form 4952 or any other sensitive documents, your information remains protected throughout the signing process.

-

Is there a cost associated with using airSlate SignNow for tax filings?

airSlate SignNow offers various pricing plans based on the features you need, making it a cost-effective solution for businesses. You can choose a plan that fits your budget while still gaining access to essential tools for managing documents related to instructions for 2014 form 4952.

-

Can airSlate SignNow integrate with other tax software?

Yes, airSlate SignNow offers integrations with various tax software, making it easier to manage and sign documents related to your taxes. These integrations can help streamline your workflow, especially when dealing with instructions for 2014 form 4952 and similar tax documentation.

-

What benefits can I expect from using airSlate SignNow for signing tax documents?

Using airSlate SignNow for signing tax documents offers numerous benefits, including convenience, efficiency, and legal validity. You can quickly send, sign, and store your documents, like those involving instructions for 2014 form 4952, reducing the hassle of traditional paper processes.

Get more for Instructions For Form 4952

- Hipaa privacy authorization form authorization for

- Please provide the medications the member has a failure contraindication or intolerance to form

- Lincoln heritage life insurance co form

- Prior authorization form mental health inpatient and

- Transamerica annuity withdrawal form

- Patient questionnaire form bifulco medical group

- Patient consent form litholink

- Is it realhttpswwwmulticareorg form

Find out other Instructions For Form 4952

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later