Application of Member for Refund of Accumulated Contributions Solidated Retirement System Form

Application of Member for Refund of Accumulated Contributions

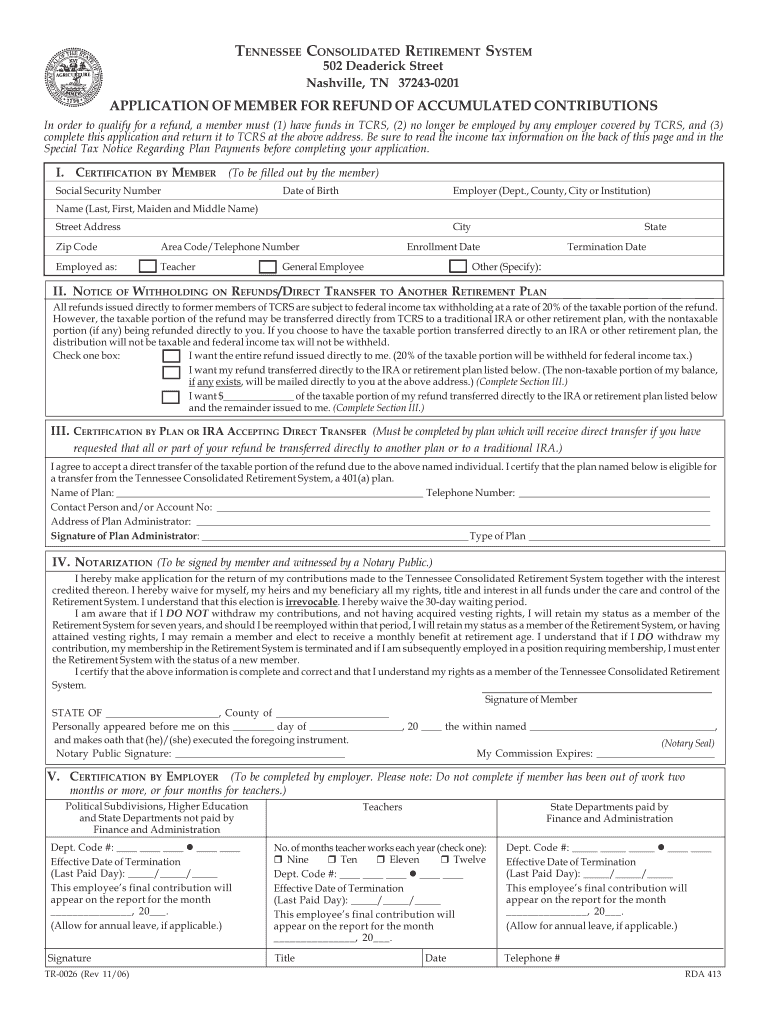

The Application of Member for Refund of Accumulated Contributions is a crucial document for individuals seeking to withdraw their contributions from the Tennessee Consolidated Retirement System. This form is designed for members who wish to receive a refund of their accumulated contributions after leaving employment. Understanding the purpose of this form is essential for ensuring that the process is completed correctly and efficiently.

Steps to Complete the Application Form

Completing the Application of Member for Refund of Accumulated Contributions involves several important steps:

- Obtain the form from the appropriate source, such as the Tennessee Consolidated Retirement System website or local office.

- Fill in personal information, including your name, address, and Social Security number.

- Provide details regarding your employment history and the reason for the refund request.

- Sign and date the form to confirm the accuracy of the information provided.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Legal Use of the Application Form

The Application of Member for Refund of Accumulated Contributions is legally binding once submitted. It must comply with state regulations governing retirement systems in Tennessee. Ensuring that the form is filled out accurately and submitted within the required timeframe is essential to avoid delays or penalties. Members should be aware of their rights and responsibilities when requesting a refund, as improper submissions may lead to complications.

Required Documents for Submission

When submitting the Application of Member for Refund of Accumulated Contributions, certain documents may be required to support your request. Commonly needed documents include:

- A copy of your identification, such as a driver's license or passport.

- Proof of employment history, which may include pay stubs or tax documents.

- Any additional forms or documentation specified by the Tennessee Consolidated Retirement System.

Eligibility Criteria for Refund

To qualify for a refund of accumulated contributions, members must meet specific eligibility criteria set by the Tennessee Consolidated Retirement System. Generally, these criteria include:

- Separation from employment with a participating employer.

- A minimum period of contributions to the retirement system.

- Submission of the application within the designated timeframe following employment termination.

Form Submission Methods

The Application of Member for Refund of Accumulated Contributions can be submitted through various methods to accommodate different preferences:

- Online submission via the Tennessee Consolidated Retirement System's secure portal.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local retirement system offices for direct assistance.

Quick guide on how to complete application of member for refund of accumulated contributions solidated retirement system form

Complete Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form effortlessly on any device

Digital document handling has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to generate, edit, and eSign your documents quickly and efficiently. Manage Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form effortlessly

- Find Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or via invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Edit and eSign Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Do we have to separately fill out the application forms of medial institutions like AMU apart from the NEET application form for 2017?

No there's no separate exam to get into AMU , the admission will be based on your NEET score.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the application of member for refund of accumulated contributions solidated retirement system form

How to generate an eSignature for your Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form in the online mode

How to create an electronic signature for your Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form in Chrome

How to create an eSignature for putting it on the Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form in Gmail

How to create an eSignature for the Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form straight from your mobile device

How to generate an eSignature for the Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form on iOS devices

How to create an eSignature for the Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form on Android

People also ask

-

What is the 'Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form'?

The 'Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form' is a crucial document for members looking to withdraw their accumulated contributions from their retirement fund. This form helps streamline the refund process, ensuring that members receive their funds efficiently and accurately.

-

How can airSlate SignNow help with the 'Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form'?

airSlate SignNow provides an efficient platform for electronically signing and managing the 'Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form'. Our easy-to-use interface allows users to fill out and send this form securely, enhancing the overall user experience.

-

Is there a cost associated with using airSlate SignNow for the 'Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form'?

Yes, airSlate SignNow offers various pricing plans tailored to meet different needs. While there may be a fee associated with sending and eSigning the 'Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form', our plans are cost-effective and provide excellent value for businesses.

-

What features does airSlate SignNow offer for handling the 'Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form'?

airSlate SignNow offers features such as document templates, real-time tracking, and secure cloud storage specifically for the 'Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form'. These features ensure that your documents are managed efficiently and securely.

-

Can I integrate airSlate SignNow with other software for the 'Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form'?

Absolutely! airSlate SignNow provides seamless integrations with various software platforms, making it easy to manage the 'Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form' alongside your existing tools. This integration streamlines workflows and simplifies document management.

-

What are the benefits of using airSlate SignNow for the refund application process?

Using airSlate SignNow for the 'Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form' enhances efficiency and reduces delays. Our platform not only simplifies the signing process but also ensures that all documents are securely stored and easily accessible, allowing for a smoother refund experience.

-

Is my data safe when using airSlate SignNow for the refund application?

Yes, your data security is a top priority at airSlate SignNow. When managing the 'Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form', we utilize advanced encryption and security protocols to protect your sensitive information throughout the entire process.

Get more for Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form

Find out other Application Of Member For Refund Of Accumulated Contributions Solidated Retirement System Form

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form