Name of Title Insurer or Title Agent, a Form

What is the Name Of Title Insurer Or Title Agent, A

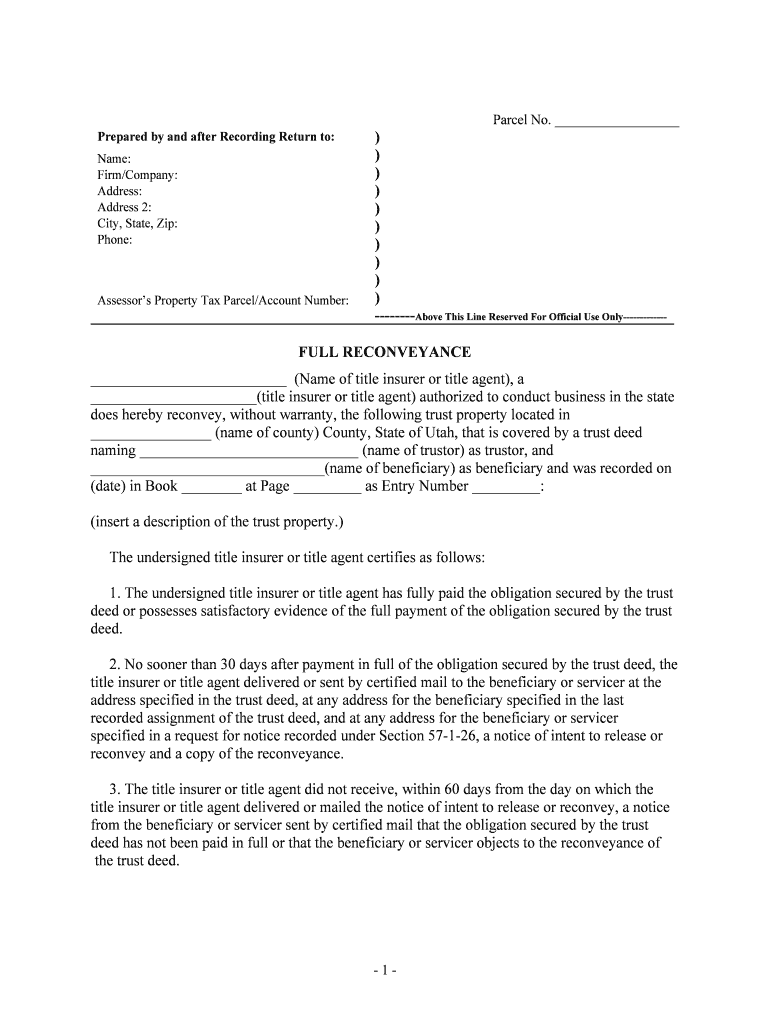

The Name Of Title Insurer Or Title Agent, A is a critical document in real estate transactions, serving to identify the title insurer or agent responsible for ensuring the title's validity. This form is essential for buyers, sellers, and lenders as it provides assurance regarding the ownership and any claims against the property. By detailing the title insurer or agent, the form facilitates a clear understanding of who is accountable for title insurance coverage, which protects against potential legal issues related to property ownership.

How to use the Name Of Title Insurer Or Title Agent, A

Using the Name Of Title Insurer Or Title Agent, A involves several straightforward steps. First, gather the necessary information about the property and the parties involved in the transaction. Next, accurately fill out the form with the title insurer or agent's name, address, and contact details. It is important to ensure that all information is correct to avoid delays in processing. Once completed, the form should be submitted as part of the closing documents, ensuring that all parties have access to the title insurance details.

Steps to complete the Name Of Title Insurer Or Title Agent, A

Completing the Name Of Title Insurer Or Title Agent, A can be done by following these steps:

- Collect property information, including the address and legal description.

- Identify the title insurer or title agent involved in the transaction.

- Fill in the form with accurate details, including the name and contact information of the title insurer or agent.

- Review the completed form for any errors or omissions.

- Submit the form along with other closing documents to ensure comprehensive coverage.

Legal use of the Name Of Title Insurer Or Title Agent, A

The Name Of Title Insurer Or Title Agent, A is legally binding when properly filled out and submitted. It serves as a formal declaration of the title insurer or agent involved in the transaction, which is crucial for establishing accountability. Compliance with local and federal regulations regarding real estate transactions is essential to ensure the form's legal validity. In the event of disputes regarding title issues, this form can be referenced to determine the responsible party.

Key elements of the Name Of Title Insurer Or Title Agent, A

Several key elements must be included in the Name Of Title Insurer Or Title Agent, A to ensure its effectiveness:

- Title Insurer or Agent Name: Clearly state the full name of the title insurer or agent.

- Contact Information: Include the address, phone number, and email of the title insurer or agent.

- Property Details: Provide the legal description and address of the property being insured.

- Transaction Information: Indicate the nature of the transaction, such as sale or refinance.

- Signatures: Ensure that all necessary parties sign the document to validate it.

State-specific rules for the Name Of Title Insurer Or Title Agent, A

Each state may have specific regulations governing the use of the Name Of Title Insurer Or Title Agent, A. It is important to consult state laws to understand any unique requirements, such as additional disclosures or specific formatting. These regulations can impact how the form is filled out and submitted, making it crucial for parties involved in real estate transactions to be aware of their state's rules to ensure compliance and avoid potential legal issues.

Quick guide on how to complete name of title insurer or title agent a

Complete Name Of Title Insurer Or Title Agent, A effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the features you need to create, edit, and eSign your documents rapidly without delays. Handle Name Of Title Insurer Or Title Agent, A on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Name Of Title Insurer Or Title Agent, A with ease

- Find Name Of Title Insurer Or Title Agent, A and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Name Of Title Insurer Or Title Agent, A and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of the Name Of Title Insurer Or Title Agent, A. in real estate transactions?

The Name Of Title Insurer Or Title Agent, A. plays a crucial role in ensuring that property titles are clear and marketable. They conduct thorough title searches, identify any potential issues, and provide title insurance to protect buyers and lenders from future claims. This service is essential to facilitate smooth real estate transactions.

-

How does airSlate SignNow integrate with the services of the Name Of Title Insurer Or Title Agent, A.?

airSlate SignNow seamlessly integrates with the Name Of Title Insurer Or Title Agent, A. to streamline document management processes. By using our eSignature tools, clients can efficiently send and sign documents directly related to title insurance, enhancing collaboration between parties involved in real estate deals.

-

What features does airSlate SignNow offer for working with the Name Of Title Insurer Or Title Agent, A.?

airSlate SignNow provides features like customizable document templates, real-time tracking, and secure storage, all of which are beneficial when working with the Name Of Title Insurer Or Title Agent, A. These tools simplify the signing process and ensure that title documents are handled efficiently and securely.

-

Is there a cost to use airSlate SignNow with Name Of Title Insurer Or Title Agent, A. services?

Using airSlate SignNow comes with competitive pricing plans designed to fit various business needs. While the specific cost may vary depending on your usage and required features, our solution provides excellent value for the services offered alongside the Name Of Title Insurer Or Title Agent, A. It's worth considering for any business involved in real estate.

-

What are the benefits of using airSlate SignNow alongside the Name Of Title Insurer Or Title Agent, A.?

The combination of airSlate SignNow and the Name Of Title Insurer Or Title Agent, A. provides multiple benefits, including improved efficiency and reduced paperwork. Businesses can save time by automating the signature process and ensuring that all necessary title documents are organized and easily accessible.

-

Can airSlate SignNow help me if I need to appeal a decision from the Name Of Title Insurer Or Title Agent, A.?

Yes, airSlate SignNow can support your appeal process by allowing you to efficiently prepare and send any necessary documentation. With our user-friendly interface, you can collaborate with legal representatives and the Name Of Title Insurer Or Title Agent, A. to ensure that all required paperwork is submitted promptly.

-

How can I get support for issues related to the Name Of Title Insurer Or Title Agent, A. while using airSlate SignNow?

airSlate SignNow offers comprehensive customer support to assist with any questions regarding the Name Of Title Insurer Or Title Agent, A. You can access resources through our help center, contact support via chat or email, and receive guidance tailored to your specific issues with title transactions.

Get more for Name Of Title Insurer Or Title Agent, A

- Form l 01

- Manure transport project form

- Fast track claim for payment fast track claim for payment form

- Employment history nycgov form

- Business entity questionnaire form

- Foreign registration statement pennsylvania department of form

- Foreign registration statement utah division of corporations form

- Oklahoma limited liability forms oklahoma secretary of state

Find out other Name Of Title Insurer Or Title Agent, A

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe