And Died on Leaving Assets to Be Administered with Estimated Values of Form

What is the And Died On Leaving Assets To Be Administered With Estimated Values Of

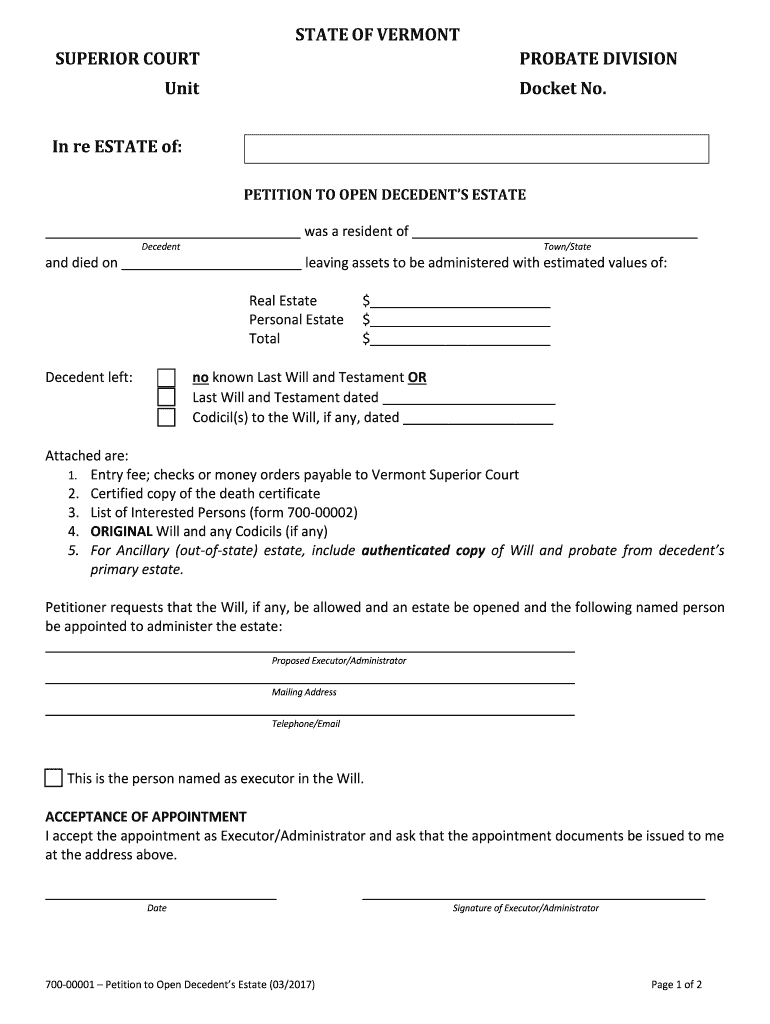

The form titled "And Died On Leaving Assets To Be Administered With Estimated Values Of" serves as a legal document that outlines the distribution of a deceased person's assets. This form is essential for ensuring that the deceased's estate is managed and distributed according to their wishes. It typically includes details about the estimated values of the assets left behind, which can range from real estate to personal belongings. Understanding this form is crucial for executors and beneficiaries involved in the estate administration process.

How to use the And Died On Leaving Assets To Be Administered With Estimated Values Of

Using the "And Died On Leaving Assets To Be Administered With Estimated Values Of" form involves several steps. First, gather all necessary information about the deceased's assets, including their estimated values. Next, fill out the form accurately, ensuring that all details reflect the current state of the estate. Once completed, the form should be signed by the appropriate parties, which may include the executor and witnesses, to validate its authenticity. Finally, submit the form to the relevant court or authority overseeing the estate administration.

Steps to complete the And Died On Leaving Assets To Be Administered With Estimated Values Of

Completing the "And Died On Leaving Assets To Be Administered With Estimated Values Of" form requires careful attention to detail. Follow these steps:

- Collect all relevant information about the deceased's assets.

- Determine the estimated values of each asset, consulting appraisers if necessary.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Obtain signatures from required parties, such as the executor and witnesses.

- Submit the completed form to the appropriate court or authority.

Legal use of the And Died On Leaving Assets To Be Administered With Estimated Values Of

The legal use of the "And Died On Leaving Assets To Be Administered With Estimated Values Of" form is to facilitate the proper administration of an estate after a person's death. This form is recognized under U.S. law and must adhere to specific legal standards to be considered valid. It is crucial for ensuring that the distribution of assets aligns with the deceased's wishes and complies with state probate laws. Failure to use this form correctly can lead to disputes among beneficiaries and potential legal challenges.

Key elements of the And Died On Leaving Assets To Be Administered With Estimated Values Of

Several key elements are essential to the "And Died On Leaving Assets To Be Administered With Estimated Values Of" form. These include:

- Decedent's Information: Full name, date of birth, and date of death.

- Asset Details: Description and estimated values of all assets.

- Executor Information: Name and contact details of the executor handling the estate.

- Beneficiary Information: Names and relationships of individuals entitled to inherit.

- Signatures: Required signatures from the executor and witnesses to validate the form.

State-specific rules for the And Died On Leaving Assets To Be Administered With Estimated Values Of

State-specific rules regarding the "And Died On Leaving Assets To Be Administered With Estimated Values Of" form can vary significantly. Each state has its own probate laws and requirements for estate administration. It is essential to consult the probate court or an attorney in the relevant state to understand any additional requirements or variations in the form. This ensures compliance with local laws and helps prevent delays in the estate administration process.

Quick guide on how to complete and died on leaving assets to be administered with estimated values of

Effortlessly Prepare And Died On Leaving Assets To Be Administered With Estimated Values Of on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the right form and securely retain it online. airSlate SignNow provides all the features necessary to create, modify, and electronically sign your documents quickly and without interruptions. Handle And Died On Leaving Assets To Be Administered With Estimated Values Of on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign And Died On Leaving Assets To Be Administered With Estimated Values Of with Ease

- Locate And Died On Leaving Assets To Be Administered With Estimated Values Of and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or conceal sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign And Died On Leaving Assets To Be Administered With Estimated Values Of while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it help those who have died on leaving assets to be administered with estimated values of?

airSlate SignNow is a digital signature solution that helps streamline document signing and management. It is particularly useful for individuals and families dealing with estates of those who have died on leaving assets to be administered with estimated values of, ensuring that necessary paperwork is processed efficiently.

-

How much does airSlate SignNow cost for users managing estates?

airSlate SignNow offers a variety of pricing plans tailored to meet the needs of individuals, businesses, and estates. For users managing estates of individuals who died on leaving assets to be administered with estimated values of, we provide cost-effective solutions that simplify the paperwork involved in probate and asset management.

-

What features does airSlate SignNow offer for estate management?

airSlate SignNow includes features like eSigning, document templates, and automated workflows, making it easier to manage the documents needed when someone has died on leaving assets to be administered with estimated values of. These features help ensure that all necessary signatures and documentation are collected in a timely manner.

-

Is airSlate SignNow secure for handling sensitive estate documents?

Yes, airSlate SignNow prioritizes security, using encryption and secure storage to protect sensitive information related to estates. This is crucial for documents concerning individuals who died on leaving assets to be administered with estimated values of, ensuring that all data is handled safely and confidentially.

-

Can airSlate SignNow integrate with other tools for estate management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications to facilitate better estate management. If you are navigating issues related to those who died on leaving assets to be administered with estimated values of, these integrations can help streamline your workflow.

-

How can airSlate SignNow help with the probate process?

airSlate SignNow simplifies the probate process by providing an efficient platform for eSigning and managing required documents. This is essential for those dealing with individuals who have died on leaving assets to be administered with estimated values of, as it reduces the time spent on paperwork.

-

What benefits does airSlate SignNow provide for families managing estate assets?

Families managing estate assets can benefit from airSlate SignNow's user-friendly interface, which reduces the complexities of document management and signing. This is particularly helpful for those who have died on leaving assets to be administered with estimated values of, allowing families to focus on what truly matters during a difficult time.

Get more for And Died On Leaving Assets To Be Administered With Estimated Values Of

- Request to file a complaint with the oklahoma state department of form

- 2500 n lincoln blvd ste 412 form

- State of missouri hiring substitute teacher rolling meadow form

- Missouri general bill of sale form

- Description of complaint complaint investigation form

- Cheerleading registration form

- Instructions for your convenience this form has been created for use when selling a non titled vessel

- Docketing information check all that apply dms

Find out other And Died On Leaving Assets To Be Administered With Estimated Values Of

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement