Summary of Account of Trustee Form

What is the Summary Of Account Of Trustee

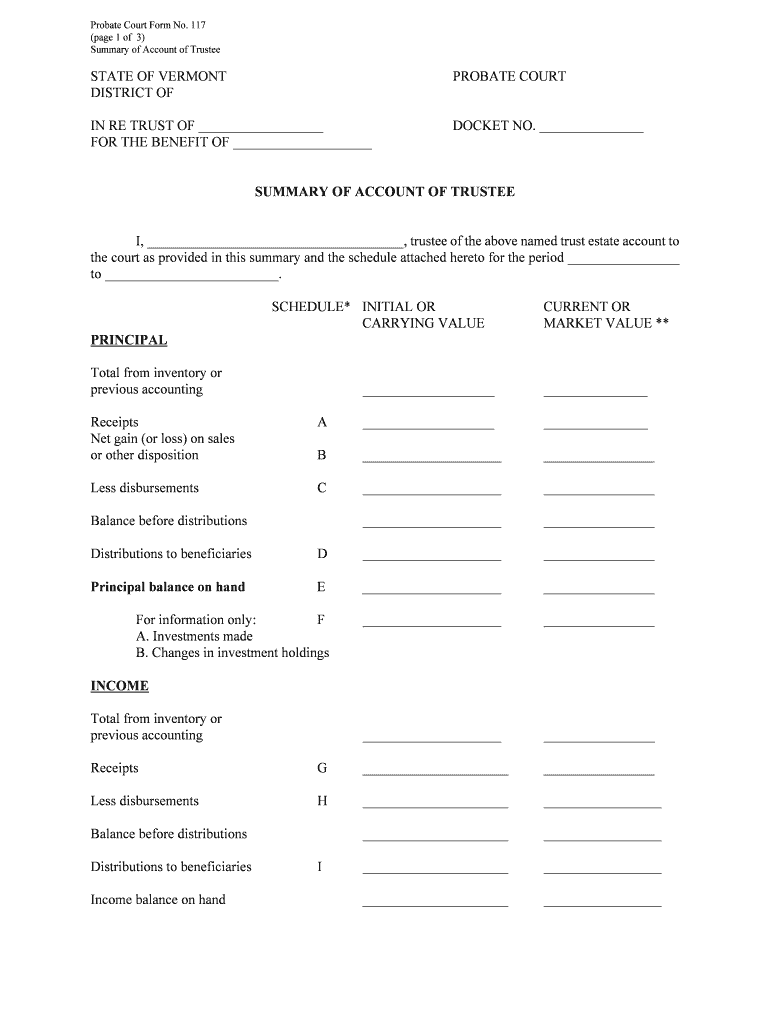

The Summary Of Account Of Trustee is a formal document that outlines the financial activities and transactions managed by a trustee on behalf of a trust or estate. This form serves as a comprehensive report, detailing income, expenses, distributions, and any other financial movements that have occurred during a specific reporting period. It is essential for maintaining transparency and accountability in the management of trust assets.

Typically, the summary includes key information such as the trust's assets, liabilities, and the net worth at the end of the reporting period. It may also highlight any significant changes or decisions made by the trustee that could affect the beneficiaries. This document is crucial for beneficiaries to understand the financial status of the trust and to ensure that the trustee is fulfilling their fiduciary duties.

How to use the Summary Of Account Of Trustee

Using the Summary Of Account Of Trustee involves several steps to ensure that it accurately reflects the financial activities of the trust. First, the trustee must gather all relevant financial documents, including bank statements, receipts, and records of distributions. This information will serve as the foundation for the summary.

Once the data is collected, the trustee should compile it into a clear and organized format. This can include categorizing transactions by type, such as income or expenses, and summarizing totals for each category. After completing the summary, the trustee should review it for accuracy and completeness before presenting it to the beneficiaries. This transparency is vital for maintaining trust and ensuring that all parties are informed about the trust's financial health.

Steps to complete the Summary Of Account Of Trustee

Completing the Summary Of Account Of Trustee requires careful attention to detail and organization. The following steps outline the process:

- Gather financial records: Collect all necessary documents, including bank statements, invoices, and receipts.

- Organize transactions: Categorize transactions into relevant sections, such as income, expenses, and distributions.

- Calculate totals: Sum up the amounts in each category to provide a clear overview of the trust's financial activities.

- Prepare the summary: Format the information into a structured document that clearly presents the financial data.

- Review for accuracy: Check the summary for any discrepancies or errors before finalizing it.

- Distribute to beneficiaries: Share the completed summary with all relevant parties to ensure transparency.

Key elements of the Summary Of Account Of Trustee

The Summary Of Account Of Trustee should include several key elements to provide a comprehensive overview of the trust's financial status. These elements typically encompass:

- Trust identification: Basic information about the trust, including its name and date of establishment.

- Trustee details: Information about the trustee, including their name and contact information.

- Reporting period: The specific timeframe covered by the summary.

- Financial transactions: A detailed account of all income, expenses, and distributions made during the reporting period.

- Ending balance: The total net worth of the trust at the end of the reporting period.

Legal use of the Summary Of Account Of Trustee

The Summary Of Account Of Trustee holds significant legal importance in the context of trust management. It serves as a formal record that can be used in legal proceedings to demonstrate the trustee's compliance with their fiduciary responsibilities. This document can be crucial in disputes between trustees and beneficiaries, as it provides evidence of the financial activities conducted on behalf of the trust.

Additionally, the summary may be required by courts or regulatory bodies to ensure that trustees are managing trust assets appropriately. Failure to provide a complete and accurate summary could result in legal consequences for the trustee, including potential claims of mismanagement or breach of fiduciary duty.

Examples of using the Summary Of Account Of Trustee

There are various scenarios in which the Summary Of Account Of Trustee is utilized. For instance, a trustee managing a family trust may prepare this summary annually to inform beneficiaries of the trust's financial performance. This practice fosters transparency and helps beneficiaries understand how their interests are being managed.

Another example is in the context of estate administration, where the executor of an estate may use a summary to report to the court and beneficiaries about the financial activities undertaken during the estate's settlement process. In both cases, the summary serves as a vital tool for communication and accountability.

Quick guide on how to complete summary of account of trustee

Effortlessly Complete Summary Of Account Of Trustee on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without hesitation. Manage Summary Of Account Of Trustee on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

Steps to Edit and Electronically Sign Summary Of Account Of Trustee with Ease

- Obtain Summary Of Account Of Trustee and click on Get Form to begin.

- Take advantage of the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Summary Of Account Of Trustee, ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Summary Of Account Of Trustee?

A Summary Of Account Of Trustee is a concise report that provides an overview of the financial activities managed by a trustee on behalf of a beneficiary. It includes details on income, expenses, and distributions, ensuring transparency and accountability in trust management. Understanding this summary is crucial for beneficiaries to grasp how their assets are being handled.

-

How does airSlate SignNow simplify the process of creating a Summary Of Account Of Trustee?

airSlate SignNow simplifies the creation of a Summary Of Account Of Trustee by offering template functionalities that allow users to generate documents quickly and efficiently. Users can easily insert the necessary financial data into carefully designed templates, reducing errors and saving time during the document preparation process.

-

What are the key features of airSlate SignNow for generating financial documents like the Summary Of Account Of Trustee?

Key features of airSlate SignNow include customizable templates, eSignature capabilities, and secure cloud storage. These features facilitate the efficient preparation, signing, and sharing of documents such as the Summary Of Account Of Trustee, all while ensuring that sensitive information remains protected.

-

Is there a pricing plan for using airSlate SignNow to manage my Summary Of Account Of Trustee?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. The plans are designed to be cost-effective while providing all necessary features for managing documents, including the Summary Of Account Of Trustee. You can choose a plan that fits your budget and specific needs for document management.

-

Can I integrate airSlate SignNow with other applications for managing trust accounts?

Absolutely! airSlate SignNow supports integrations with various applications that help streamline the management of trust accounts. This means you can easily connect your financial software or accounting systems to facilitate a seamless flow of information when creating documents like the Summary Of Account Of Trustee.

-

What benefits does airSlate SignNow provide for businesses managing trust accounts?

Using airSlate SignNow for managing trust accounts offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved collaboration among trustees and beneficiaries. By automating document signing and management, businesses can focus on their core activities while ensuring that important tasks, like generating a Summary Of Account Of Trustee, are handled swiftly.

-

How secure is the information shared in a Summary Of Account Of Trustee using airSlate SignNow?

The security of your information is of utmost importance at airSlate SignNow. To ensure the protection of documents like the Summary Of Account Of Trustee, airSlate SignNow employs strong encryption protocols and secure data storage methods. This guarantees that your sensitive financial information remains confidential and secure.

Get more for Summary Of Account Of Trustee

Find out other Summary Of Account Of Trustee

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple