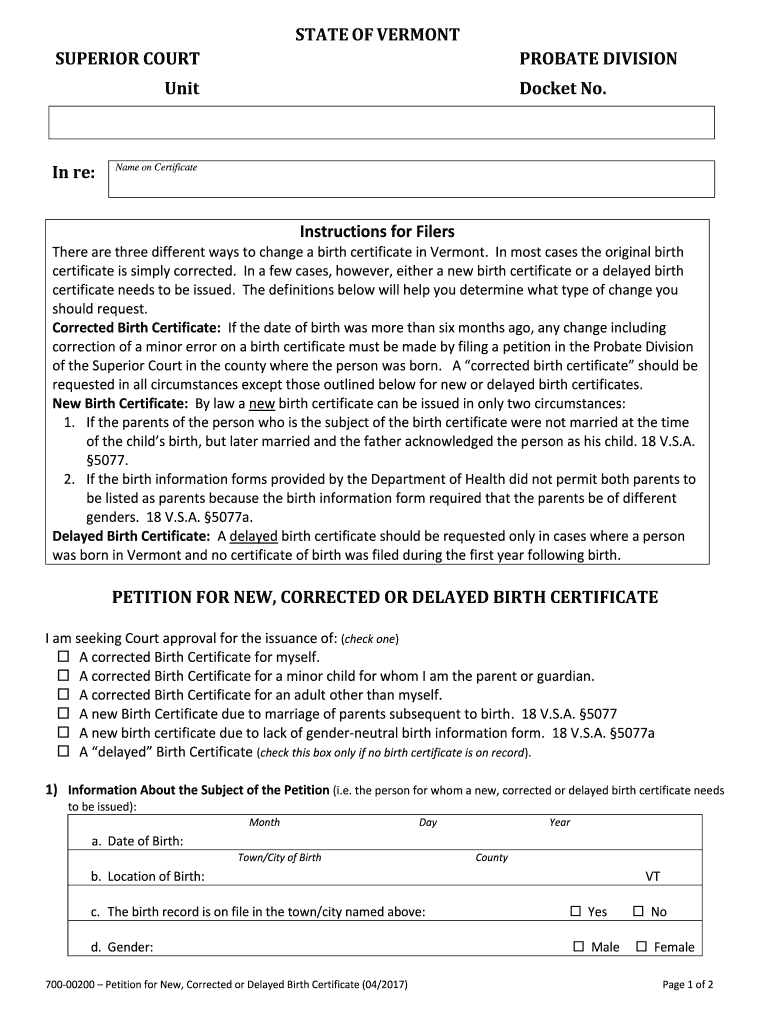

Instructions for Filers Form

What is the Instructions For Filers

The Instructions For Filers is a crucial document that provides detailed guidance on how to properly complete and submit specific forms required by the IRS or other regulatory bodies. These instructions ensure that individuals and businesses understand the necessary steps to comply with tax regulations and reporting requirements. This document outlines the purpose of the form, eligibility criteria, and any relevant legal considerations, making it an essential resource for anyone who needs to file tax-related documents.

Steps to complete the Instructions For Filers

Completing the Instructions For Filers involves a systematic approach to ensure accuracy and compliance. Here are the key steps:

- Read the instructions thoroughly to understand the requirements and purpose of the form.

- Gather all necessary documents and information, such as income statements, identification numbers, and any supporting documentation.

- Fill out the form carefully, following the guidelines provided in the instructions.

- Review the completed form for accuracy, ensuring that all information is correct and all required fields are filled.

- Submit the form according to the specified submission methods, whether online, by mail, or in person.

Legal use of the Instructions For Filers

The legal use of the Instructions For Filers is paramount for ensuring that submissions are valid and recognized by the IRS or other authorities. Adhering to the guidelines provided in the instructions helps filers avoid penalties and ensures that their documents are processed correctly. It is essential to follow all legal stipulations regarding signatures, dates, and required attachments to maintain compliance with federal and state regulations.

Filing Deadlines / Important Dates

Filing deadlines are critical when submitting the Instructions For Filers. Each form has specific due dates that must be adhered to in order to avoid penalties. It is important to check the IRS calendar or the specific guidelines associated with the form to ensure timely submission. Missing a deadline can result in late fees or other consequences, so keeping track of these important dates is essential for all filers.

Required Documents

To complete the Instructions For Filers, certain documents are typically required. These may include:

- Income statements such as W-2s or 1099s.

- Identification numbers, including Social Security numbers or Employer Identification Numbers.

- Previous year’s tax return for reference.

- Any additional documentation that supports deductions or credits claimed.

Having these documents ready can streamline the filing process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Instructions For Filers can be done through various methods, depending on the specific form and the preferences of the filer. Common submission methods include:

- Online submission through the IRS e-file system or designated platforms.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices or authorized locations.

Choosing the right method can depend on the complexity of the form and the urgency of the submission.

IRS Guidelines

The IRS provides comprehensive guidelines that govern the use of the Instructions For Filers. These guidelines include detailed information on eligibility, filing requirements, and compliance expectations. It is important for filers to familiarize themselves with these guidelines to ensure that they meet all necessary criteria and avoid any potential issues during the filing process. Regularly checking for updates on IRS regulations can also help filers stay informed about any changes that may affect their submissions.

Quick guide on how to complete instructions for filers

Effortlessly Complete Instructions For Filers on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the needed form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Handle Instructions For Filers on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Simplest Way to Edit and eSign Instructions For Filers with Ease

- Obtain Instructions For Filers and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize crucial parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Alter and eSign Instructions For Filers and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the Instructions For Filers when using airSlate SignNow?

The Instructions For Filers on airSlate SignNow provide a clear and straightforward guide on how to send and eSign documents efficiently. These instructions simplify the process, making it easier for users to understand each step involved in document handling. By following these guidelines, filers can maximize the benefits of our solution.

-

How does airSlate SignNow's pricing compare to other eSignature solutions?

When looking at pricing, airSlate SignNow offers competitive rates that cater to businesses of all sizes. The Instructions For Filers detail the various pricing tiers and how they align with your specific needs. Our cost-effective solution ensures you receive maximum value without compromising on features.

-

What features stand out in the Instructions For Filers for airSlate SignNow?

The Instructions For Filers highlight key features such as document templates, customizable workflows, and secure cloud storage. These features are designed to enhance the productivity of your team while ensuring document security. Users will find that our intuitive interface makes these features more accessible than ever.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow supports various integrations with popular software solutions, enhancing your workflow efficiency. The Instructions For Filers provide insights on how to set up these integrations seamlessly. This capability allows you to consolidate your tools and improve your document management process.

-

What security measures are in place for users following the Instructions For Filers?

airSlate SignNow implements robust security measures, including data encryption and secure access protocols, ensuring that your documents are safe. The Instructions For Filers outline the security features that protect your sensitive information during the eSigning process. Trust in our solution to keep your documents secure at every step.

-

How quickly can I start using airSlate SignNow after reviewing the Instructions For Filers?

You can begin using airSlate SignNow almost immediately after reviewing the Instructions For Filers. The onboarding process is designed to be quick and user-friendly, allowing you to send documents in no time. Our support resources are readily available should you need additional guidance.

-

What benefits can I expect from Following the Instructions For Filers on airSlate SignNow?

By following the Instructions For Filers, you can signNowly improve your document handling efficiency and accuracy. Users consistently report reduced turnaround times and streamlined processes. Our solution empowers you to focus more on your core business, rather than getting bogged down by paperwork.

Get more for Instructions For Filers

Find out other Instructions For Filers

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online