Quitclaim Deed What Are the Tax Implications?Money Form

Understanding the Quitclaim Deed and Its Tax Implications

A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees. This means that the grantor (the person transferring the property) does not guarantee that they own the property or that it is free of liens. When it comes to tax implications, the transfer of property via a quitclaim deed can have various effects, particularly concerning property taxes and potential capital gains taxes. It's essential to be aware of how these implications can affect both the grantor and the grantee.

Steps to Complete the Quitclaim Deed

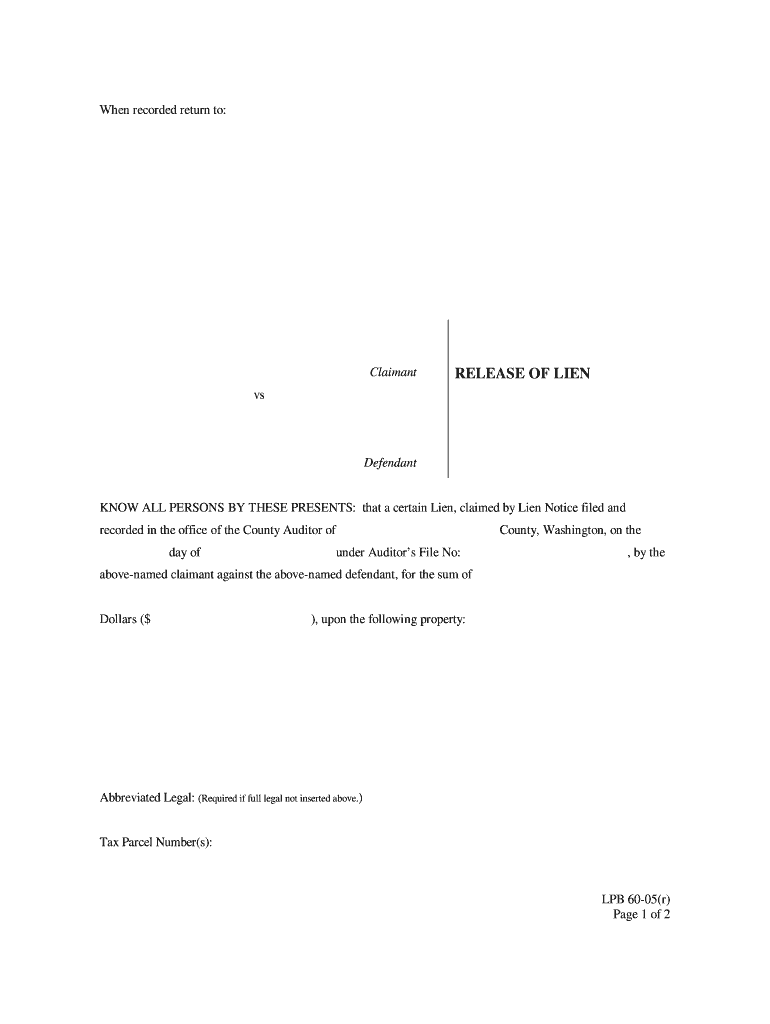

Completing a quitclaim deed involves several key steps to ensure that the transfer of property is legally binding and recognized. First, you must gather the necessary information, including the legal description of the property and the names of the parties involved. Next, you will need to fill out the quitclaim deed form accurately. After that, both parties should sign the document in the presence of a notary public to validate the signatures. Finally, the completed deed must be filed with the appropriate county or local office to make the transfer official.

IRS Guidelines on Quitclaim Deeds

The Internal Revenue Service (IRS) provides specific guidelines regarding the tax implications of property transfers, including those made via quitclaim deeds. Generally, if the transfer of property results in a change of ownership, it may trigger a reassessment of property taxes. Additionally, if the property is sold for a profit, the grantor may be subject to capital gains tax. Understanding these guidelines is crucial for both parties to avoid unexpected tax liabilities.

State-Specific Rules for Quitclaim Deeds

Each state in the U.S. has its own regulations regarding quitclaim deeds, including how they must be executed and recorded. Some states may require specific language in the deed, while others may have particular filing fees or deadlines. It is essential to consult your state’s laws to ensure compliance and avoid potential legal issues. Researching local requirements can provide clarity on how to properly execute a quitclaim deed in your jurisdiction.

Required Documents for Filing a Quitclaim Deed

When filing a quitclaim deed, certain documents are typically required to accompany the deed itself. These may include a completed quitclaim deed form, proof of identity for the parties involved, and any applicable tax forms related to the transfer. Additionally, some jurisdictions may require a property tax statement or a title search report. Ensuring that all necessary documents are included can help facilitate a smooth filing process.

Penalties for Non-Compliance with Quitclaim Deeds

Failing to comply with the legal requirements for executing and filing a quitclaim deed can result in various penalties. These may include fines, the inability to enforce the deed, or complications in property ownership disputes. It is crucial to follow all legal steps and ensure proper documentation to avoid these potential issues. Understanding the consequences of non-compliance can help both parties navigate the process more effectively.

Quick guide on how to complete quitclaim deed what are the tax implicationsmoney

Complete Quitclaim Deed What Are The Tax Implications?Money effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to access the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Work on Quitclaim Deed What Are The Tax Implications?Money using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Quitclaim Deed What Are The Tax Implications?Money without hassle

- Locate Quitclaim Deed What Are The Tax Implications?Money and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of your documents or mask sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Quitclaim Deed What Are The Tax Implications?Money and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a quitclaim deed and how does it relate to tax implications?

A quitclaim deed is a legal document used to transfer ownership of property without guarantees regarding the title. When considering a quitclaim deed, it’s essential to understand the tax implications involved. Quitclaim Deed What Are The Tax Implications?Money can vary based on factors like the property's value and jurisdiction, so consulting a tax professional is advisable.

-

How can airSlate SignNow assist with the quitclaim deed process?

airSlate SignNow offers a streamlined method for preparing, signing, and executing quitclaim deeds. Utilizing our platform can simplify the process, making it easier to manage and share critical documents securely. Understanding Quitclaim Deed What Are The Tax Implications?Money is vital, and our solution provides the necessary documentation to help clarify these aspects.

-

Are there fees associated with using airSlate SignNow for quitclaim deeds?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for businesses and individuals. Our service is designed to be cost-effective while ensuring compliance and ease of use. Understanding Quitclaim Deed What Are The Tax Implications?Money is a key feature of our offerings to help you plan budgetably.

-

What features does airSlate SignNow provide for quitclaim deeds?

airSlate SignNow provides robust features like customizable templates, secure eSigning, and document tracking. These features allow users to manage quitclaim deeds efficiently while ensuring compliance with legal standards. Knowing Quitclaim Deed What Are The Tax Implications?Money can help streamline this process without any hitches.

-

How does eSigning a quitclaim deed affect tax implications?

eSigning a quitclaim deed through airSlate SignNow does not change the tax implications of the property transfer. It's crucial to recognize that while the online execution simplifies the process, understanding Quitclaim Deed What Are The Tax Implications?Money remains essential when finalizing the transaction with tax authorities.

-

Can airSlate SignNow integrate with other business tools for managing quitclaim deeds?

Yes, airSlate SignNow integrates seamlessly with various business tools and software to enhance your workflow. These integrations can help manage documents related to quitclaim deeds better, ensuring all relevant tax implications are addressed comprehensively. Stay informed on Quitclaim Deed What Are The Tax Implications?Money while utilizing our platform for optimal efficiency.

-

How can I ensure compliance when using a quitclaim deed?

To ensure compliance when executing a quitclaim deed, it's important to use proper templates and seek professional legal advice. airSlate SignNow supports compliance through its user-friendly interface and document management features. Staying informed about Quitclaim Deed What Are The Tax Implications?Money is key to avoiding legal complications.

Get more for Quitclaim Deed What Are The Tax Implications?Money

- Anti ragging form

- Uwezo fund application form

- Ic 01 principles of insurance pdf download form

- Texas standardized credentialing application pdf form

- Personal financial statement old national bank form

- First time buyer declaration customer details ful form

- Centrepay is a voluntary bill paying service which is for form

- Imm 5507 e form

Find out other Quitclaim Deed What Are The Tax Implications?Money

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application