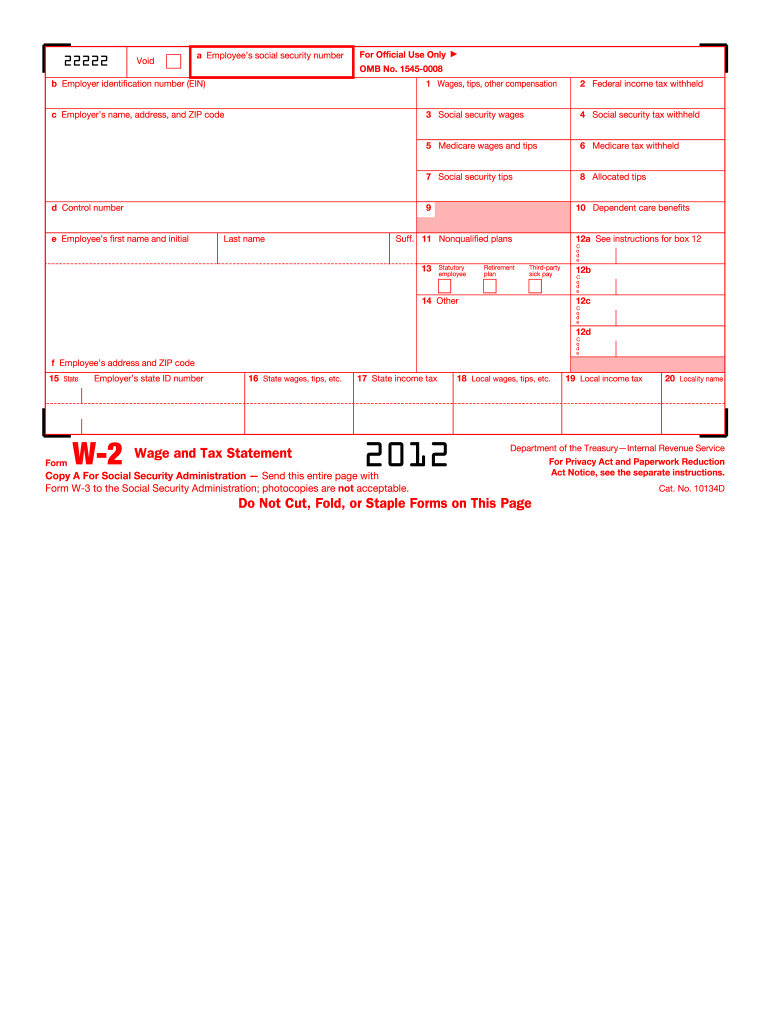

W 2 PDF Filler Form

What makes the w 2 form legally binding?

As the society takes a step away from office work, the completion of paperwork more and more occurs online. The w 2 form isn’t an exception. Dealing with it using digital tools differs from doing so in the physical world.

An eDocument can be considered legally binding given that certain needs are met. They are especially vital when it comes to signatures and stipulations associated with them. Typing in your initials or full name alone will not guarantee that the organization requesting the sample or a court would consider it performed. You need a trustworthy tool, like airSlate SignNow that provides a signer with a digital certificate. Furthermore, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your w 2 form when filling out it online?

Compliance with eSignature regulations is only a fraction of what airSlate SignNow can offer to make form execution legal and secure. Furthermore, it gives a lot of possibilities for smooth completion security smart. Let's quickly go through them so that you can stay assured that your w 2 form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are set to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy standards in the USA and Europe.

- Two-factor authentication: provides an extra layer of security and validates other parties identities through additional means, like a Text message or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the information securely to the servers.

Submitting the w 2 form with airSlate SignNow will give better confidence that the output form will be legally binding and safeguarded.

Quick guide on how to complete w 2 form

Finalize W 2 Pdf Filler effortlessly on any device

Web-based document management has gained popularity among businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without hold-ups. Handle W 2 Pdf Filler on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

Steps to modify and eSign W 2 Pdf Filler effortlessly

- Obtain W 2 Pdf Filler and then click Get Form to initiate the process.

- Use the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools specifically available from airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign W 2 Pdf Filler and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How do Hollywood actors get paid?

All Hollywood actors have to be members of the Screen Actor's Guild to perform in major productions. That means that they have to be compensated in a manner which can be audited by the guild to ensure that they are being paid fairly. This means checks, wire transfers, etc. Cash payments would not allow that to occur.Depending upon what level the performer is on there are several methods where they could be compensated:They can create an LLC (Limited Liability Company) or a corporation and have themselves paid through that. This allows them to be a private entity and can lessen their tax burden in many states. They would receive a 1099 at the end of each quarter and their business staff would be responsible for paying their taxes and withholding. These are often referred to as “loan outs.” They could, if they were bit performers, be paid normally and then receive a W-2 at the end of the year. The production company would do all of their withholding and issue them the necessary tax documentation. This method is not favored by many actors as it leaves them dependent on the production company to take care of their tax matters.Some smaller productions overseas might be willing to pay extras in cash on a daily basis. However, many producers would be loath to do this as it could cause security issues and it is a temptation for fraud and abuse.Some of the major stars receive what are term to gross points, which are percentage of the gross movie profits. These can be exceptional, especially if the film is a hit, so only a few performers will receive them. Many are promised “net profit points” which are nearly worthless as even the most profitable films rarely show a profit due to Hollywood accounting techniques.

-

Why would my boss have me fill out a W-2 form but yet still pay me with personal checks? I get paid by the hour. We work 12 to 14 hours with no overtime.

He did not have you fill out a W-2 form. A W-2 form is “issued” to all employees at the end of a calendar year, which summarizes all of an employee’s earnings and related income tax deductions made throughout the year. It is used as part of the information required to prepare a personal income tax return for employed individuals.If anything, assuming you are a new employee, he very likely had you fill out a W-9 form. This is a pretty standard procedure. It basically is a request for you to divulge your social security number so that a W-2 form can be issued to you at the end of the year. This information part of the information that will appear on an informational return submitted to the IRS, when your W-2 earnings are transmitted to them.That is the part that does make sense.The part that doesn’t make sense is why you were asked to fill out a W-9, yet are being paid with personal checks.If this is happening, in most cases, it would appear that he is paying “under the table.” I suspect no income taxes of any kind are being withheld.If I am correct, I would seriously think about leaving the company. This practice is illegal.Normally what happens is that a company paycheck is issued. State and federal income taxes are withheld from your gross pay and are forwarded on to local and federal government on your behalf. This is not happening from what you’ve described.Additionally, an employer must match the amounts withheld for social security and medicare and submit that match as well, again, on your behalf.It sounds like none of that is happening, if he’s cutting a personal check to pay you.Additionally, there are employment laws (both federal and state) which require an employer to pay overtime based on the number of hours worked. Typically, this is over 40 hours worked in a week or over eight hours worked in a day. Each state has different laws, so I’m not sure which applies to you.If you are being paid no overtime and are working 12–14 hours daily for five or more days a week, that is the second law your employer has broken. By law, you are entitled to fair overtime compensation, so it is something you might consider seeing a labor attorney about (to claim what is rightfully yours).Of course, I cannot say (and am not saying) for sure what is happening, but that is the appearance of what it looks like to me, based on what you’ve described.

-

Is my employer notified when I fill out my tax return using the information on the W-2 form they sent me?

No, and really, your employer does not care what you do with it. Their responsibility for your taxation reporting ends with their issuance of the form to you.You do realize that the I.R.S. also get a copy of it, don’t you? And, in handy computer data files.

-

What are some legal ways to earn money if you cannot legally be employed (i.e. not having to fill out a W-2 form)?

Online work, freelancing (aka independent contractor) and distant work. A lot of graphic design, tech (aka Computer Science) and numbers related work can be done from your own home. You will probably won’t get the benefits of working for a huge corporation, but it sure beats being homeless.The term “Legally allowed to work at X country” is complicated to apply to independent contractors hired over the internet because technically, the internet is not a country.I used to play in a Private Server for the videogame World of Warcraft. They offered developpers who applied for their team a salary between $4,000 and $5,000 USD a month. It’s quite low for a developper job, but the only requirements were having access to Skype to talk with your team mates.There are many legal companies that offer distance jobs.You can be a private accountant for small LLC’s or individuals and work from anywhere in the globe. A graphic artist has many websites availables to freelance and sell their workThe problem is that many freelancers don’t report self-enployment income tax. And some banks in the US (or other countries) do allow foreigners to open bank accounts just by providing your passport, proof of income and an address.Therein lies the problem. You don’t report taxes in the US because you’re not living in the US and are not a resident or citizen. But also, the tax offices (the IRS in the US or the Canadian Revenue Agency in Canada have no jurisdiction over foreing banks, so they don’t know that you’re making money.Freelancing is legal, but reporting taxes is something of a mix between legal income and working-under-the table income.The thing is, when people do that, they are often limited to a single bank account. If you start sending money from your US bank account to your Canadian bank account, the CRA might get suspicious because you’re supposedly unemployed, so they will wonder where you’re getting that money from, and might even ask for proof. Are you selling drugs? Traficking people? Or do you have a proof of self-employment income? Once you give that to them, they will obviously tax you and apply any penalties for tax evasion.

Create this form in 5 minutes!

How to create an eSignature for the w 2 form

How to generate an eSignature for your W 2 Form online

How to create an electronic signature for your W 2 Form in Google Chrome

How to create an eSignature for signing the W 2 Form in Gmail

How to make an eSignature for the W 2 Form from your mobile device

How to create an eSignature for the W 2 Form on iOS devices

How to make an eSignature for the W 2 Form on Android

People also ask

-

What is a W2 form template?

A W2 form template is a pre-designed document that allows employers to report annual wages and taxes withheld for each employee. Using a W2 form template can streamline the process of generating and issuing these forms, ensuring compliance with IRS regulations. airSlate SignNow provides a customizable W2 form template to make this process efficient.

-

How can I create a W2 form template using airSlate SignNow?

Creating a W2 form template with airSlate SignNow is straightforward. You can start by selecting our customizable template, inputting the required information, and saving it for future use. This allows you to quickly generate W2 forms for your employees while maintaining accuracy and consistency.

-

Is there a cost associated with using the W2 form template on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to the W2 form template and other features. Our plans are designed to be cost-effective, catering to businesses of all sizes. You can select a plan that best fits your needs and budget, ensuring you get value from our solution.

-

What features are included with the W2 form template?

The W2 form template on airSlate SignNow includes features such as easy customization, electronic signatures, and secure document storage. Additionally, the template is designed for compliance with IRS standards, ensuring that you can confidently provide your employees with accurate W2 forms. Enhanced tracking and reporting features are also available for better management.

-

What are the benefits of using airSlate SignNow's W2 form template?

Using airSlate SignNow's W2 form template offers several benefits, including time savings, reduced errors, and improved compliance. Businesses can create and eSign W2 forms quickly, allowing for a smoother payroll process. Additionally, our solution minimizes the need for paper, contributing to a more eco-friendly approach.

-

Can I integrate the W2 form template with other software?

Yes, airSlate SignNow supports integrations with various third-party applications, making it easy to connect the W2 form template with your existing payroll or HR software. This integration allows for seamless data transfer and enhanced workflow efficiency. Check our integrations page to see the compatible applications.

-

Is the W2 form template customizable to fit my business needs?

Absolutely! The W2 form template provided by airSlate SignNow is fully customizable, allowing you to tailor it to match your business's specific requirements. You can add your logo, modify sections, and ensure that all necessary information is included, making it an ideal fit for your payroll processes.

Get more for W 2 Pdf Filler

- Revocable living trust and is created in accordance with section 59 0901 et form

- New client information form cbs payroll

- On this day of in the year before form

- On the oath of to be the person who is described in form

- On the oath of to be the person who is described in and form

- Oct 23 z009 city clerk internet site city of los angeles form

- Mortgage purchase agreement this agreement form

- Nd inc cr form

Find out other W 2 Pdf Filler

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed