Ordinances and Real Estate Taxes for the Year 20 Form

What is the Ordinances And Real Estate Taxes For The Year 20

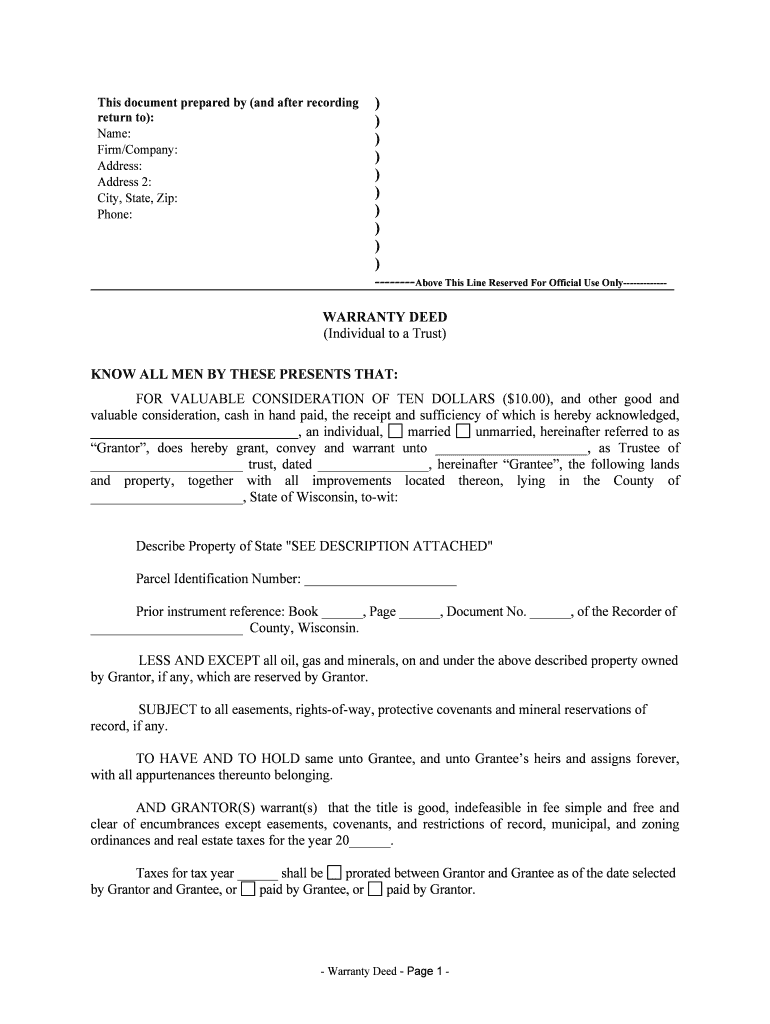

The Ordinances and Real Estate Taxes for the Year 20 form is a crucial document that outlines the specific tax obligations for property owners within a given jurisdiction. This form typically details the assessed value of properties, applicable tax rates, and any exemptions or deductions available to taxpayers. Understanding this form is essential for compliance with local tax laws and for ensuring that property owners are aware of their financial responsibilities regarding real estate taxes.

Steps to complete the Ordinances And Real Estate Taxes For The Year 20

Completing the Ordinances and Real Estate Taxes for the Year 20 form involves several key steps:

- Gather all necessary documentation, including property deeds, previous tax statements, and any relevant financial records.

- Review the form carefully to understand the specific requirements and sections that need to be filled out.

- Provide accurate information regarding the property, including its location, size, and assessed value.

- Include any applicable exemptions or deductions that may reduce the overall tax liability.

- Ensure that all signatures and dates are correctly entered to validate the form.

- Submit the completed form by the designated deadline, either online or via mail, as per local regulations.

Legal use of the Ordinances And Real Estate Taxes For The Year 20

The legal use of the Ordinances and Real Estate Taxes for the Year 20 form is governed by local and state tax laws. This form must be completed accurately to ensure compliance with tax obligations. Failure to submit the form or providing incorrect information can lead to penalties, including fines or additional taxes owed. It is essential that property owners understand their rights and responsibilities when filling out this form to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Ordinances and Real Estate Taxes for the Year 20 form vary by jurisdiction. Typically, these deadlines are set annually and may fall on specific dates, such as April 15 or June 30. It is important for property owners to be aware of these dates to ensure timely submission. Missing the deadline may result in late fees or penalties, which can increase the overall tax burden.

Who Issues the Form

The Ordinances and Real Estate Taxes for the Year 20 form is usually issued by local government authorities, such as county assessors or tax collectors. These offices are responsible for determining property values and establishing tax rates. Property owners can typically obtain the form directly from their local tax office or through official government websites.

Penalties for Non-Compliance

Non-compliance with the Ordinances and Real Estate Taxes for the Year 20 form can result in various penalties. These may include financial penalties, such as fines or interest on unpaid taxes, and potential legal action for failure to comply with tax obligations. Property owners should take care to submit the form accurately and on time to avoid these consequences.

Quick guide on how to complete ordinances and real estate taxes for the year 20

Complete Ordinances And Real Estate Taxes For The Year 20 effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without interruptions. Manage Ordinances And Real Estate Taxes For The Year 20 on any device with airSlate SignNow’s Android or iOS applications and enhance any document-focused procedure today.

How to modify and eSign Ordinances And Real Estate Taxes For The Year 20 with ease

- Obtain Ordinances And Real Estate Taxes For The Year 20 and click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form retrieval, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Ordinances And Real Estate Taxes For The Year 20 and guarantee seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key ordinances affecting real estate taxes for the year 20?

The key ordinances affecting real estate taxes for the year 20 typically include local tax rates, assessment practices, and any changes in state laws. It's vital to stay informed about these ordinances to ensure compliance and optimize your tax obligations. By understanding these factors, property owners can navigate ordinances and real estate taxes for the year 20 more effectively.

-

How can I manage ordinances and real estate taxes for the year 20 using airSlate SignNow?

airSlate SignNow simplifies the management of ordinances and real estate taxes for the year 20 by allowing users to easily eSign essential documents. This platform provides templates and workflows that ensure compliance with relevant ordinances. Additionally, users can track document statuses to ensure timely submissions, making management straightforward.

-

Can airSlate SignNow help with understanding changes in ordinances for real estate taxes for the year 20?

Yes, airSlate SignNow can assist in understanding changes in ordinances and real estate taxes for the year 20 by offering comprehensive templates for tax-related documents. These templates can be customized according to recent ordinance changes, ensuring that users stay compliant. Users can also utilize collaborative features to consult with tax professionals directly within the platform.

-

What pricing plans are available for airSlate SignNow and do they cover ordinances and real estate taxes for the year 20?

AirSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes access to features that enable users to manage ordinances and real estate taxes for the year 20 seamlessly. By investing in the right plan, businesses can ensure they have the tools necessary for effective document management and compliance.

-

Are there any integrations available for managing ordinances and real estate taxes for the year 20?

Yes, airSlate SignNow integrates with several platforms to facilitate the management of ordinances and real estate taxes for the year 20. These integrations enhance workflows by allowing users to import data from other systems, making tax management more efficient. Users can ensure they are compliant by using these integrated services to keep their documents accurate and up-to-date.

-

What are the benefits of using airSlate SignNow for ordinances and real estate taxes for the year 20?

Using airSlate SignNow for managing ordinances and real estate taxes for the year 20 offers several benefits, including cost-effectiveness, ease of use, and enhanced compliance. The platform allows for quick eSigning of documents, reducing the time spent on administrative tasks. This efficiency helps businesses stay organized and informed about their tax obligations.

-

Can I collaborate with my team on ordinances and real estate taxes for the year 20 via airSlate SignNow?

Absolutely! AirSlate SignNow provides collaborative features that enable teams to work together on documents related to ordinances and real estate taxes for the year 20. This includes real-time editing, comments, and notifications to keep everyone informed, which is essential for meeting deadlines and ensuring compliance.

Get more for Ordinances And Real Estate Taxes For The Year 20

- Santa barbara county assessor business property statement form 571 l 2013

- Boe 571 l p1 rev 17 02 11 2012 form

- Form boe 571 l 2016

- Field trip request packet dadeschoolsnet miami dade form

- Example of certificate of occupancy form

- Supplier prequalification form

- Dekalb county registered agent form

- Dbpr re 13 broker transactions form

Find out other Ordinances And Real Estate Taxes For The Year 20

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple