And State of Wisconsin, to Wit Form

What is the And State Of Wisconsin, To wit

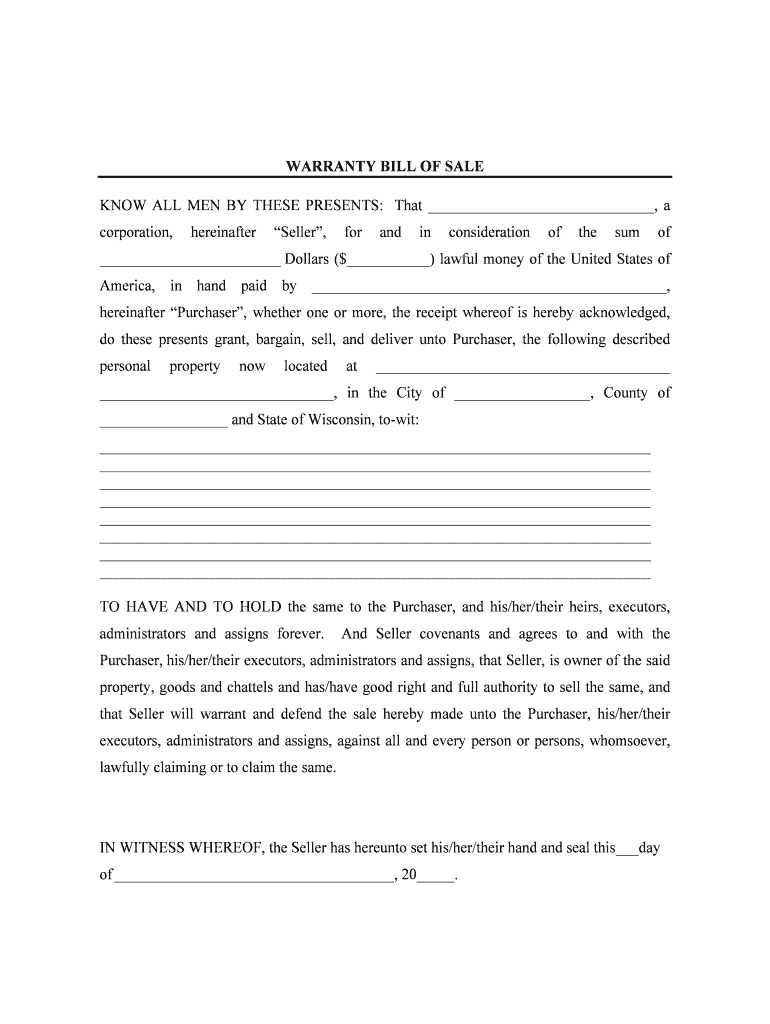

The And State Of Wisconsin, To wit form is a legal document used primarily in Wisconsin for various purposes, including declarations and affidavits. This form serves to provide clarity and specificity in legal matters, ensuring that all parties involved understand the context and details of the agreement or statement being made. It is essential for maintaining legal integrity and can be utilized in both personal and business contexts.

How to use the And State Of Wisconsin, To wit

Using the And State Of Wisconsin, To wit form involves a few key steps. First, identify the specific purpose of the form, whether it's for a legal declaration, an affidavit, or another use. Next, gather all necessary information and documents that will support the claims or statements made in the form. Once the form is filled out, it must be signed by the appropriate parties, ensuring that all signatures are executed in compliance with Wisconsin law. Utilizing a reliable digital platform can streamline this process, making it easier to fill out and eSign the document securely.

Steps to complete the And State Of Wisconsin, To wit

Completing the And State Of Wisconsin, To wit form involves several straightforward steps:

- Begin by downloading the form from a trusted source or accessing it through a digital platform.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill in the necessary details, ensuring accuracy and completeness.

- Review the form for any errors or omissions before proceeding to sign.

- Sign the document electronically or in person, depending on the method chosen.

- Submit the completed form as required, whether online, by mail, or in person.

Legal use of the And State Of Wisconsin, To wit

The And State Of Wisconsin, To wit form is legally binding when completed correctly and signed by all necessary parties. To ensure its legal standing, it must adhere to the requirements set forth by Wisconsin law regarding signatures, notarization, and submission methods. Utilizing a digital signature solution that complies with federal and state eSignature laws can enhance the form's validity and security.

Key elements of the And State Of Wisconsin, To wit

Key elements of the And State Of Wisconsin, To wit form include:

- Identification of Parties: Clearly state the names and roles of all individuals involved.

- Statement of Facts: Provide a detailed account of the facts or claims being made.

- Signatures: Ensure that all required parties sign the document to validate it.

- Date: Include the date of signing, which is crucial for legal timelines.

State-specific rules for the And State Of Wisconsin, To wit

In Wisconsin, specific rules govern the use of the And State Of Wisconsin, To wit form. These include requirements for notarization, witness signatures, and proper submission methods. It is important to familiarize yourself with Wisconsin statutes that pertain to the execution of legal documents to avoid any issues that may arise from non-compliance. Additionally, using a platform that ensures adherence to these state-specific regulations can provide peace of mind.

Quick guide on how to complete and state of wisconsin to wit

Complete And State Of Wisconsin, To wit effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without interruptions. Manage And State Of Wisconsin, To wit on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to edit and electronically sign And State Of Wisconsin, To wit with ease

- Find And State Of Wisconsin, To wit and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes just a few seconds and carries the same legal significance as a conventional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign And State Of Wisconsin, To wit and ensure outstanding communication throughout any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 'And State Of Wisconsin, To wit'?

airSlate SignNow is a powerful eSignature platform that enables businesses to send and eSign important documents efficiently. In 'And State Of Wisconsin, To wit,' our solution meets legal requirements, ensuring that your electronic signatures are valid and compliant with state laws.

-

How much does airSlate SignNow cost for businesses in 'And State Of Wisconsin, To wit'?

Pricing for airSlate SignNow is designed to be budget-friendly, providing various plans that cater to different business needs. In 'And State Of Wisconsin, To wit,' businesses can select a plan that aligns with their volume of document transactions while enjoying the full suite of features.

-

What features does airSlate SignNow offer that are beneficial for businesses in 'And State Of Wisconsin, To wit'?

airSlate SignNow offers a comprehensive range of features including document templates, mobile access, and integration with other applications. Businesses in 'And State Of Wisconsin, To wit' can streamline their workflows and improve productivity using these robust functionalities.

-

Can I integrate airSlate SignNow with my existing software systems in 'And State Of Wisconsin, To wit'?

Yes, airSlate SignNow offers seamless integration capabilities with popular software, including customer relationship management (CRM) tools and document management systems. This compatibility ensures that businesses in 'And State Of Wisconsin, To wit' can enhance their existing workflows.

-

How secure is airSlate SignNow for eSigning documents in 'And State Of Wisconsin, To wit'?

Security is a top priority for airSlate SignNow; we implement advanced encryption and compliance with international eSignature regulations. For businesses operating in 'And State Of Wisconsin, To wit,' our platform ensures that signatures and documents are securely managed and stored.

-

What are the benefits of using airSlate SignNow for remote teams in 'And State Of Wisconsin, To wit'?

airSlate SignNow is particularly beneficial for remote teams as it allows them to eSign documents from anywhere, reducing delays and enhancing efficiency. In 'And State Of Wisconsin, To wit,' this solution supports collaboration, ensuring that all team members can manage workflows effectively, regardless of their location.

-

Is there customer support available for airSlate SignNow users in 'And State Of Wisconsin, To wit'?

Yes, airSlate SignNow provides dedicated customer support to assist users with any inquiries or challenges. Businesses in 'And State Of Wisconsin, To wit' can access support resources through various channels, ensuring they get help whenever needed.

Get more for And State Of Wisconsin, To wit

- Trillium health application health care form

- Care request form

- Trauma checklist form

- Dlo order form

- The p53 gene and cancer answers fill online printable form

- Reasons for delays in getting your biopsy and cytology test form

- The applicable limits of liability and are subject to the retentions form

- Lightning affidavit 312732324 form

Find out other And State Of Wisconsin, To wit

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors