Calhfa Borrower Affidavit Form

What is the Calhfa Borrower Affidavit Form

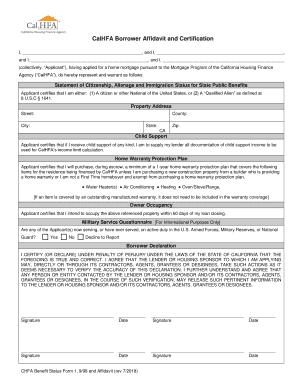

The Calhfa Borrower Affidavit Form is a legal document used by borrowers in California seeking assistance through the California Housing Finance Agency (CalHFA). This form serves to affirm the borrower's financial status and eligibility for various loan programs offered by CalHFA. It typically includes personal information, income details, and declarations regarding the borrower's financial situation. The form is crucial for ensuring that borrowers meet the necessary criteria for obtaining financial assistance in purchasing or refinancing a home.

How to use the Calhfa Borrower Affidavit Form

To effectively use the Calhfa Borrower Affidavit Form, borrowers should first ensure they have all necessary documentation ready. This includes proof of income, identification, and any other relevant financial information. Once the form is obtained, it should be filled out completely and accurately. Borrowers can then submit the completed form to their lender or the appropriate CalHFA representative. Utilizing electronic signature solutions can streamline this process, making it easier to complete and submit the form securely.

Steps to complete the Calhfa Borrower Affidavit Form

Completing the Calhfa Borrower Affidavit Form involves several key steps:

- Gather necessary documents, such as income statements and identification.

- Obtain the Calhfa Borrower Affidavit Form from a reliable source.

- Fill out the form with accurate and truthful information.

- Review the completed form for any errors or omissions.

- Sign the form electronically or in person, depending on submission requirements.

- Submit the form to your lender or CalHFA representative.

Key elements of the Calhfa Borrower Affidavit Form

The Calhfa Borrower Affidavit Form contains several key elements that are essential for its validity:

- Personal Information: This includes the borrower's name, address, and contact details.

- Income Details: Borrowers must provide information about their income sources and amounts.

- Declarations: This section requires borrowers to affirm their financial status and eligibility for assistance.

- Signature: A valid signature is necessary to confirm the authenticity of the information provided.

Legal use of the Calhfa Borrower Affidavit Form

The legal use of the Calhfa Borrower Affidavit Form is governed by state laws and regulations. To ensure that the form is legally binding, it must be completed accurately and submitted to the appropriate authorities. Compliance with eSignature laws, such as the ESIGN Act and UETA, is crucial when the form is signed electronically. This ensures that the document holds the same legal weight as a traditional paper form.

How to obtain the Calhfa Borrower Affidavit Form

Borrowers can obtain the Calhfa Borrower Affidavit Form through several channels. The form is typically available on the official CalHFA website, where borrowers can download it directly. Additionally, lenders participating in CalHFA programs may provide the form as part of their loan application process. It is important to ensure that the most current version of the form is used to avoid any issues during submission.

Quick guide on how to complete calhfa borrower affidavit form

Accomplish Calhfa Borrower Affidavit Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents promptly and without difficulties. Manage Calhfa Borrower Affidavit Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Calhfa Borrower Affidavit Form with ease

- Obtain Calhfa Borrower Affidavit Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact confidential information using the features that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form – via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searches, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Calhfa Borrower Affidavit Form and ensure smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the calhfa borrower affidavit form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the calhfa borrower affidavit form?

The calhfa borrower affidavit form is a document that borrowers use to affirm their eligibility for assistance programs. It helps streamline the application process by providing accurate and necessary information to lenders. Understanding this form is crucial for borrowers looking to benefit from CalHFA programs.

-

How can I fill out the calhfa borrower affidavit form using airSlate SignNow?

You can easily fill out the calhfa borrower affidavit form by uploading it to airSlate SignNow. Our platform allows you to complete the form digitally, ensuring you don't miss any required fields. With intuitive features, airSlate SignNow guides you through the process step-by-step.

-

Is there a cost associated with using airSlate SignNow for the calhfa borrower affidavit form?

Using airSlate SignNow to complete and eSign the calhfa borrower affidavit form is cost-effective. We offer flexible pricing plans that cater to businesses of various sizes. You can choose a plan that best fits your needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the calhfa borrower affidavit form?

airSlate SignNow provides crucial features to enhance your experience with the calhfa borrower affidavit form. These include secure eSigning, document tracking, and easy collaboration tools. Our platform ensures that filling out and sending forms is streamlined and efficient.

-

Can I integrate airSlate SignNow with other applications for the calhfa borrower affidavit form?

Yes, airSlate SignNow seamlessly integrates with various applications, making it easier to manage the calhfa borrower affidavit form. By connecting with tools like CRM platforms or cloud storage solutions, you can simplify your documentation workflow. Integration enhances productivity and keeps your documents organized.

-

What are the benefits of using airSlate SignNow for the calhfa borrower affidavit form?

Using airSlate SignNow for the calhfa borrower affidavit form offers several benefits, including time-saving and improved accuracy. Our electronic signing process reduces paperwork and the potential for errors. Moreover, it allows for quick turnaround times, making it easier for you to meet deadlines.

-

Is my data secure when using airSlate SignNow for the calhfa borrower affidavit form?

absolutely, security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to protect your data while you complete the calhfa borrower affidavit form. You can eSign documents with peace of mind, knowing that your information is safe.

Get more for Calhfa Borrower Affidavit Form

Find out other Calhfa Borrower Affidavit Form

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy