Download California Form 540A Taxhow Net Taxhow

Understanding California Tax Form 540

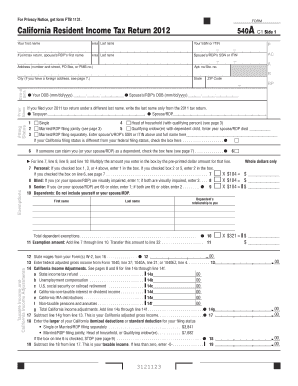

The California Tax Form 540 is a critical document for residents who need to report their income and calculate their state tax obligations. This form is specifically designed for California residents and is used to file personal income tax returns. It allows taxpayers to detail their income, claim deductions, and determine their tax liability. Understanding the components of this form is essential for accurate filing and compliance with state tax laws.

Steps to Complete California Tax Form 540

Completing the California Tax Form 540 involves several key steps:

- Gather Necessary Documents: Collect all relevant financial documents, including W-2s, 1099s, and records of other income.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: List all sources of income, including wages, interest, dividends, and any other income.

- Claim Deductions: Identify and claim any deductions you are eligible for, such as mortgage interest or property taxes.

- Calculate Tax Liability: Use the tax tables provided to determine your tax owed based on your taxable income.

- Sign and Date the Form: Ensure that you sign and date the form before submission.

Filing Deadlines for California Tax Form 540

It is important to be aware of the filing deadlines for the California Tax Form 540 to avoid penalties. Typically, the deadline for filing is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also check for any updates or changes to deadlines that may occur due to specific circumstances, such as natural disasters or state announcements.

Legal Use of California Tax Form 540

The California Tax Form 540 must be completed and submitted in compliance with state tax laws. Electronic signatures are accepted, provided that the signature meets the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act. This ensures that digitally signed documents are legally binding and recognized by the state. It is crucial to use a reliable platform that provides a secure method for signing and submitting the form.

Required Documents for Filing Form 540

To successfully complete California Tax Form 540, certain documents are required:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductible expenses, such as medical bills and mortgage interest

- Previous year’s tax return for reference

Form Submission Methods for California Tax Form 540

Taxpayers have several options for submitting their California Tax Form 540:

- Online Submission: Many taxpayers choose to file electronically through approved e-filing software.

- Mail: Completed forms can be mailed to the appropriate address provided by the California Franchise Tax Board.

- In-Person: Some taxpayers may opt to deliver their forms in person at designated tax offices.

Quick guide on how to complete download california form 540a taxhownet taxhow

Complete Download California Form 540A Taxhow net Taxhow seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Download California Form 540A Taxhow net Taxhow on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Download California Form 540A Taxhow net Taxhow effortlessly

- Obtain Download California Form 540A Taxhow net Taxhow and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Download California Form 540A Taxhow net Taxhow to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

After filling out Form 6, how many days does it require to get your voter ID? Should I download it online?

I think it takes 2-3 months to verify your application and further other process then will get registered as voter in electoral roll. Then the voter Id will dispatch to you through BLO of your part of constituency.If you fill the form 6 on nvsp.in then you can check or track the status of your application.You will not supposed to get the digital copy of your voter Id online.I hope this will help you…..

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the download california form 540a taxhownet taxhow

How to generate an electronic signature for the Download California Form 540a Taxhownet Taxhow online

How to generate an electronic signature for the Download California Form 540a Taxhownet Taxhow in Google Chrome

How to make an electronic signature for signing the Download California Form 540a Taxhownet Taxhow in Gmail

How to make an electronic signature for the Download California Form 540a Taxhownet Taxhow straight from your smartphone

How to make an electronic signature for the Download California Form 540a Taxhownet Taxhow on iOS devices

How to create an eSignature for the Download California Form 540a Taxhownet Taxhow on Android

People also ask

-

What is airSlate SignNow and how does it relate to Download California Form 540A Taxhow net Taxhow?

airSlate SignNow is a powerful e-signature solution that allows businesses to send and sign documents efficiently. If you need to Download California Form 540A Taxhow net Taxhow, airSlate SignNow streamlines the process, ensuring your tax documents are signed and submitted quickly and securely.

-

How can I Download California Form 540A Taxhow net Taxhow using airSlate SignNow?

To Download California Form 540A Taxhow net Taxhow using airSlate SignNow, simply access our platform, upload your form, and use our e-signature features to complete it. The intuitive interface makes it easy to navigate the process, ensuring you can manage your tax forms with minimal hassle.

-

Is there a cost associated with using airSlate SignNow to Download California Form 540A Taxhow net Taxhow?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. While you can start with a free trial, accessing features to Download California Form 540A Taxhow net Taxhow may require a subscription, providing excellent value for the efficiency it brings.

-

What features does airSlate SignNow offer for users needing to Download California Form 540A Taxhow net Taxhow?

airSlate SignNow offers a range of features including e-signatures, document templates, and automated workflows. These tools enhance your ability to Download California Form 540A Taxhow net Taxhow efficiently, making it easier to manage your tax documents and ensure compliance.

-

How secure is airSlate SignNow for Downloading California Form 540A Taxhow net Taxhow?

Security is a top priority at airSlate SignNow. When you Download California Form 540A Taxhow net Taxhow, your documents are protected with advanced encryption and compliance with industry standards, ensuring that your sensitive information remains confidential.

-

Can I integrate airSlate SignNow with other applications to assist in Downloading California Form 540A Taxhow net Taxhow?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Salesforce, enhancing your workflow. This integration makes it easier to Download California Form 540A Taxhow net Taxhow by allowing you to access and manage your documents from multiple platforms.

-

What are the benefits of using airSlate SignNow for Downloading California Form 540A Taxhow net Taxhow?

Using airSlate SignNow to Download California Form 540A Taxhow net Taxhow offers numerous benefits, including time savings, reduced paperwork, and improved accuracy. The e-signature capabilities help you finalize your tax forms quickly and securely, streamlining your filing process.

Get more for Download California Form 540A Taxhow net Taxhow

Find out other Download California Form 540A Taxhow net Taxhow

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple