$ This Amount is Called "principal", Plus Interest, Form

What is the $ this Amount Is Called "principal", Plus Interest

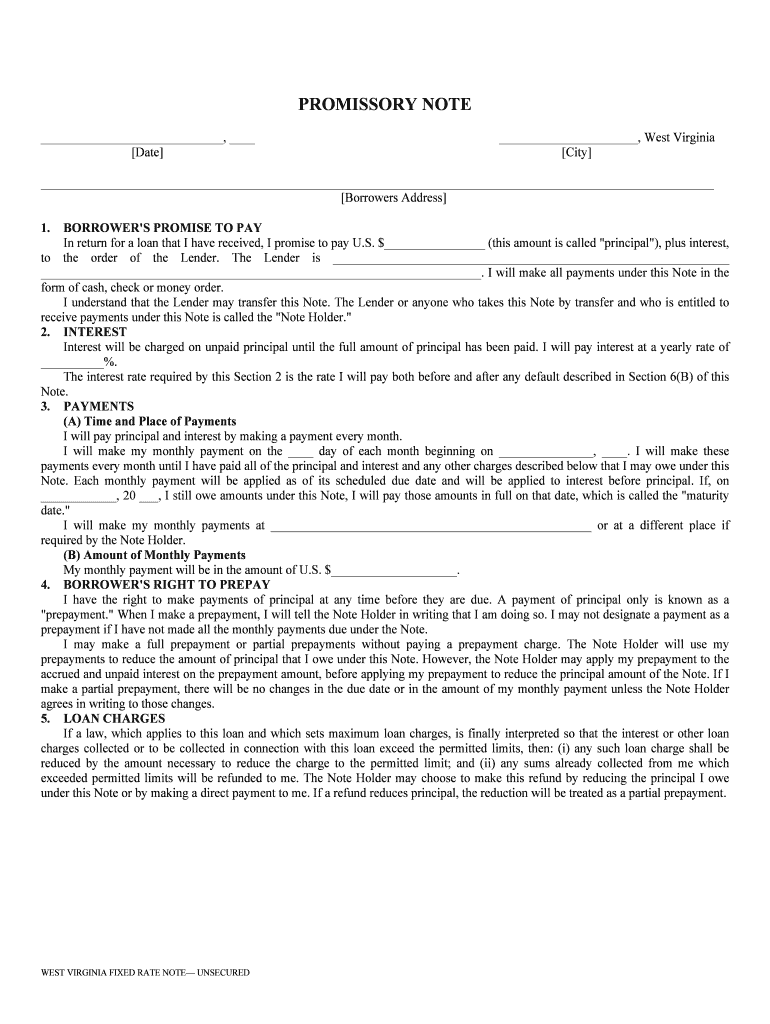

The term "principal" refers to the original sum of money borrowed or invested, excluding any interest or additional fees. In financial contexts, this amount is crucial as it serves as the basis for calculating interest. When discussing loans or investments, the phrase "plus interest" indicates that the total amount owed or earned will include the principal amount along with any accrued interest over time. Understanding this concept is essential for managing personal finances, as it affects repayment plans and overall financial health.

How to use the $ this Amount Is Called "principal", Plus Interest

Using the principal amount plus interest involves understanding how interest rates apply to the principal over time. To calculate the total amount owed or earned, one must first determine the interest rate and the duration for which the money is borrowed or invested. For example, if you borrow a principal of one thousand dollars at an interest rate of five percent for one year, you would calculate the interest as follows: one thousand multiplied by five percent equals fifty dollars. Therefore, the total amount to be repaid would be one thousand fifty dollars.

Steps to complete the $ this Amount Is Called "principal", Plus Interest

Completing the necessary calculations involving the principal and interest can be done in a few simple steps:

- Identify the principal amount you are working with.

- Determine the interest rate applicable to the principal.

- Establish the time period for which the interest will accrue.

- Calculate the interest by multiplying the principal by the interest rate and the time period.

- Add the calculated interest to the principal to find the total amount due.

Legal use of the $ this Amount Is Called "principal", Plus Interest

The legal implications of the principal amount plus interest are significant in various financial agreements. Contracts, loan agreements, and investment documents often specify the principal amount and the interest terms. It is essential to ensure that these documents comply with applicable laws and regulations. Understanding how the principal and interest are defined in legal terms can help protect your rights and obligations in financial transactions, making it crucial to consult legal or financial professionals when drafting or signing such agreements.

Examples of using the $ this Amount Is Called "principal", Plus Interest

Practical examples of the principal plus interest concept can be found in various financial scenarios:

- A home mortgage where the principal is the loan amount, and interest is calculated monthly based on the remaining balance.

- A savings account where the principal is the initial deposit, and interest is earned over time, increasing the total balance.

- A personal loan where the borrower must repay the principal along with any interest accrued during the loan period.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding how interest on loans or investments is treated for tax purposes. Interest income is generally taxable, while interest paid on certain loans may be deductible. It is important to keep accurate records of principal amounts and interest calculations for tax reporting. Taxpayers should refer to IRS publications or consult with tax professionals to ensure compliance with all relevant tax laws and regulations.

Quick guide on how to complete this amount is called quotprincipalquot plus interest

Complete $ this Amount Is Called "principal", Plus Interest, effortlessly on any device

The management of online documents has become increasingly favored by companies and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents promptly without any delays. Manage $ this Amount Is Called "principal", Plus Interest, on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to alter and eSign $ this Amount Is Called "principal", Plus Interest, seamlessly

- Locate $ this Amount Is Called "principal", Plus Interest, and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign $ this Amount Is Called "principal", Plus Interest, and guarantee effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the principal amount in airSlate SignNow and how does it relate to interest?

The principal amount in airSlate SignNow refers to the initial sum of money involved in an agreement, and it is typically the amount that you're looking to manage alongside any accruing interest. When you utilize our eSigning solutions, understanding that '$ this Amount Is Called "principal", Plus Interest,' is essential for financial assessments and contract management.

-

How can airSlate SignNow help me manage documents related to loans that involve principal and interest?

airSlate SignNow offers streamlined functionalities that assist users in effectively managing documents related to loans, including those that involve a '$ this Amount Is Called "principal", Plus Interest,'. Our platform enables easy creation, signing, and storage of loan agreements, helping you keep track of essential financial obligations.

-

What are the pricing plans for airSlate SignNow, and do they cater to different business needs?

airSlate SignNow provides a range of pricing plans designed to cater to various business needs, ensuring organizations of all sizes can benefit from our services. Each plan includes features that assist in managing '$ this Amount Is Called "principal", Plus Interest,' documentation efficiently, offering you cost-effective solutions tailored to your requirements.

-

Can airSlate SignNow integrate with other financial software and what benefits does it bring?

Yes, airSlate SignNow integrates seamlessly with various financial software platforms, enhancing the management of documents that involve '$ this Amount Is Called "principal", Plus Interest,'. This integration allows for easier data transfer and ensures that all financial calculations and agreements are accurately reflected across systems.

-

What features does airSlate SignNow offer that help track principal amounts and interest rates?

airSlate SignNow includes features such as document tracking, notifications, and templates that simplify the monitoring of '$ this Amount Is Called "principal", Plus Interest,'. By having access to these functionalities, businesses can easily manage their financial documents and ensure compliance with all necessary regulations.

-

How does airSlate SignNow ensure the security of documents containing principal amounts and interest?

Security is a priority at airSlate SignNow, and we implement robust measures to protect documents that contain sensitive information like '$ this Amount Is Called "principal", Plus Interest,'. Our platform utilizes encryption, secure access controls, and audit trails to ensure that your financial agreements are safe from unauthorized access.

-

Why should I choose airSlate SignNow over other eSigning solutions for managing principal and interest documents?

Choosing airSlate SignNow means leveraging an easy-to-use, cost-effective solution tailored for businesses looking to efficiently handle '$ this Amount Is Called "principal", Plus Interest,' documentation. Our user-friendly interface and comprehensive features set us apart, making document management simpler and more effective.

Get more for $ this Amount Is Called "principal", Plus Interest,

- Infodok 233 form

- 24 hour recall template form

- Health status questionnaire this paper provides a report of a local housing system analysis lhsa exercise carried out on the form

- Attestato di competenza arca regione lombardia form

- Real estate deal sheet template form

- Medical lien packet pdf graham lundberg amp peschel form

- Transcript request tcat memphis tcatmemphis form

- Transcript request form technical education center osceola

Find out other $ this Amount Is Called "principal", Plus Interest,

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement