Property 17 Form

What is the Property 17

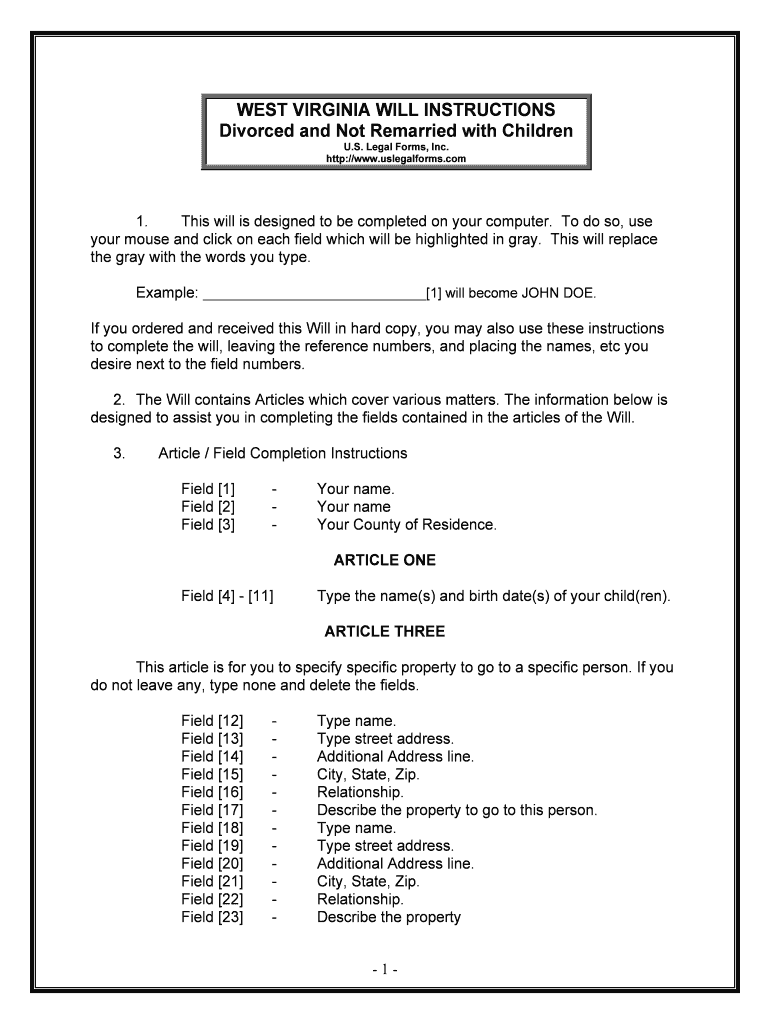

The Property 17 form is a specific document used in various legal and administrative contexts. It typically relates to property transactions, transfers, or declarations. Understanding the purpose of this form is essential for individuals and businesses involved in real estate or property management. The form ensures that all necessary information is documented and can be referenced in legal situations, providing clarity and protection for all parties involved.

How to use the Property 17

Using the Property 17 form involves several steps to ensure that all required information is accurately captured. Begin by gathering all relevant details about the property, including ownership information, property descriptions, and any applicable legal stipulations. Once you have the necessary information, fill out the form completely, ensuring that all sections are addressed. After completing the form, it may need to be signed by relevant parties, depending on the legal requirements in your jurisdiction.

Steps to complete the Property 17

Completing the Property 17 form requires careful attention to detail. Follow these steps for a successful submission:

- Gather necessary documents and information related to the property.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Obtain signatures from all required parties.

- Submit the form according to the specified guidelines, either electronically or via mail.

Legal use of the Property 17

The legal use of the Property 17 form is crucial for ensuring that property transactions are recognized and enforceable. This form must comply with relevant laws and regulations, which may vary by state. Proper execution of the form, including obtaining necessary signatures and adhering to submission protocols, can help protect against disputes and ensure that the transaction is legally binding.

Key elements of the Property 17

Several key elements must be included in the Property 17 form to ensure its validity and effectiveness. These elements typically consist of:

- Property description, including location and boundaries.

- Names and contact information of all parties involved.

- Details regarding the nature of the transaction (e.g., sale, lease, transfer).

- Signatures of all parties, confirming their agreement to the terms outlined.

Eligibility Criteria

Eligibility to use the Property 17 form generally depends on the nature of the transaction and the parties involved. Typically, individuals or entities engaged in property transactions, such as buyers, sellers, landlords, and tenants, may be eligible to complete this form. It is important to verify any specific requirements or restrictions that may apply based on local laws or regulations.

Quick guide on how to complete property 17

Effortlessly Prepare Property 17 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any hold-ups. Process Property 17 on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to Edit and Electronically Sign Property 17 with Ease

- Find Property 17 and select Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that function.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and eSign Property 17 and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Property 17 and how does it benefit businesses?

Property 17 is a powerful feature within airSlate SignNow that allows businesses to streamline their document management and signing processes. By enabling electronic signatures and secure document storage, Property 17 enhances efficiency and reduces turnaround time for contracts and agreements.

-

How much does it cost to access Property 17?

The pricing for accessing Property 17 within airSlate SignNow varies based on the subscription plan chosen. We offer several tiers to accommodate different business needs, ensuring that you can select a plan that provides the best value for utilizing Property 17's capabilities.

-

What features are included in Property 17?

Property 17 includes features such as customizable templates, advanced document tracking, and multi-party signing. These functionalities are designed to improve workflow efficiency and make document handling easier for businesses of all sizes.

-

Can Property 17 integrate with other software tools?

Yes, Property 17 offers seamless integrations with various software platforms, including CRM and productivity tools. This compatibility allows businesses to create a more cohesive workflow and leverage their existing technology alongside airSlate SignNow.

-

What are the security measures in place for Property 17?

Property 17 is equipped with robust security protocols, including SSL encryption and secure cloud storage, to protect your sensitive documents. Our commitment to security ensures that your data remains confidential, making airSlate SignNow a trustworthy solution for electronic signatures.

-

Is training available for using Property 17?

Absolutely! We provide comprehensive training resources and customer support to help users understand and maximize the benefits of Property 17. Whether you're new to e-signatures or looking to enhance your existing skills, our team is here to assist you.

-

How does Property 17 enhance collaboration in document signing?

Property 17 facilitates collaboration by allowing multiple signers to review and sign documents in real-time. This feature signNowly reduces delays and helps teams work together more effectively, ensuring that all necessary parties can weigh in on important agreements.

Get more for Property 17

- Name of participant form

- Of title 205 form

- Doctor verification affidavit form

- Wjhtc digital signage request form faa

- Veterinary health certificate for the export of dogs and cats from the united states of america to aphis usda form

- Sri lanka immigration passport form

- Dl26 form

- Oshpd functional program form

Find out other Property 17

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form