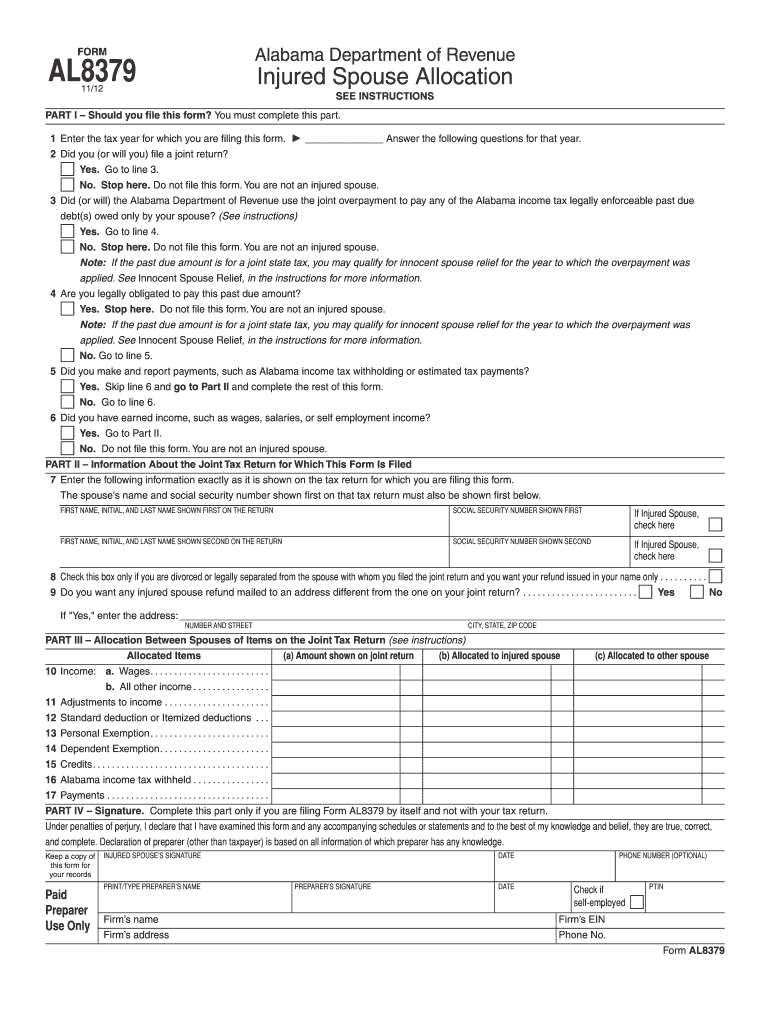

AL8379 Alabama Department of Revenue Revenue Alabama Form

Understanding the Alabama Form 40V

The Alabama Form 40V is a crucial document used by taxpayers in Alabama to report and pay their state income tax liabilities. This form is specifically designed for individuals who need to make estimated tax payments or who owe additional tax when filing their annual returns. Understanding its purpose and requirements is essential for compliance with state tax laws.

Steps to Complete the Alabama Form 40V

Completing the Alabama Form 40V involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, accurately calculate your estimated tax liability based on your income and applicable deductions. Fill out the form with your personal information, including your Social Security number and address. Finally, review the completed form for any errors before submitting it to the Alabama Department of Revenue.

Required Documents for Alabama Form 40V

To successfully complete the Alabama Form 40V, you will need several documents. These include:

- Previous year’s tax return for reference

- W-2 forms from employers

- 1099 forms for additional income

- Records of any deductions or credits you plan to claim

Having these documents ready will streamline the process and help ensure that your estimated tax payments are accurate.

Filing Deadlines for Alabama Form 40V

It is important to be aware of the filing deadlines associated with the Alabama Form 40V. Typically, estimated tax payments are due quarterly. The deadlines are usually April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes.

Legal Use of the Alabama Form 40V

The Alabama Form 40V is legally binding when completed and submitted according to the state’s tax regulations. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies may lead to legal consequences. Utilizing a reliable eSignature solution, like airSlate SignNow, can enhance the legitimacy of your submission by providing a secure and compliant way to sign and submit documents electronically.

Form Submission Methods for Alabama Form 40V

Taxpayers have several options for submitting the Alabama Form 40V. These include:

- Online submission through the Alabama Department of Revenue's website

- Mailing a paper copy to the designated address

- In-person submission at local revenue offices

Choosing the method that best suits your needs can help ensure timely processing of your payment.

Quick guide on how to complete al8379 alabama department of revenue revenue alabama

Prepare AL8379 Alabama Department Of Revenue Revenue Alabama effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, amend, and eSign your documents quickly without delays. Manage AL8379 Alabama Department Of Revenue Revenue Alabama on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign AL8379 Alabama Department Of Revenue Revenue Alabama without hassle

- Find AL8379 Alabama Department Of Revenue Revenue Alabama and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Edit and eSign AL8379 Alabama Department Of Revenue Revenue Alabama and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How would you calculate the annual revenue of Alabama’s college football program?

Data on all athletic revenue is made publicly available by the school, as is the case with most public universities. I'm not sure if the public release includes information split by sport, but in most cases football makes up the bulk of athletic revenues. USA Today maintains a useful compilation of this data for all schools that have released it. In 2013, Alabama athletics earned $143M in total revenue. The USA Today list also includes breakdowns by ticket sales/contributions/licensing and a few other categories if you click on individual schools.

-

Need to fill out Form 10C and Form 19. Where can I get a 1 rupee revenue stamp in Bangalore?

I believe you are trying to withdraw PF. If that is correct, then I think its not a mandatory thing as I was able to submit these forms to my ex-employer without the stamp. I did receive the PF!

-

How many people are going to move out of Alabama as a result of their new barbaric abortion laws?

No need to move. In the absence of humane ways to abort fetuses, women will go back to throwing babies away in dumpsters, tossing them off of cliffs, tossing them out of car windows on the freeways, flush their dismembered bodies down the toilet or down the garbage disposal, bury them in a forest or open field, or toss them in a body of water.Luckily, Alabama has all of the landmarks available for women to dispose of their babies as mentioned above. So instead of getting rid of kids in a humane manner in a clinic, women are now murderers. And they will likely get away with it because the births of the babies, prints and stuff haven't been documented in an actual hospital.So I hope Alabama gets used to a surge of dead baby bodies/body parts being discovered in random parts of the state.Though abortion is legal in New York. The tossing of the baby's body in body of water was the most recent strory up there with a baby's body being discovered in the East River. Honestly people, you can look all this stuff up.

-

How does the Alabama Department of Corrections determine someone’s "good time" when someone is transferred from a county jail to the state prison?

I don’t know what “good time” means, as I don’t know Alabama slang. But here’s the way the system works nationwide;Most Americans don’t know the difference between a jail and a prison.Jails are for (1) defendants awaiting trial and (2) prisoners who will serve less than a year. Jails are very limited operations with few programs.Prisons are for convicted criminals who will serve a year or more. Prisons are very large operations with a lot of programming.Contrary to popular superstition, the vast majority who go to jail or prison are guilty of their crimes. And no, they aren’t innocent little things who just smoked pot. Those in prison who are there for drugs, use and sell hard drugs, and have a history of violence thru street gangs. They are among the most dangerous of inmates. And correctional officers put their lives at risk to protect the public, as much as any police officer or soldier. And…………..contrary to another myth, inmates don’t have a fun time there with lots of benefits………….Jails and prisons are dangerous and very, very unpleasant.I have worked professionally in both settings during about 1/3 of my long career (Psychology/Counseling). Most of my time, though, was working in mental health settings, which have a lot less drama.

-

How is Facebook going to churn revenue out of WhatsApp?

Probably use the whatsapp conversation data and target audience more effectively on facebook. The CPM goes up, Facebook earns more.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How much revenue can Google get out of Facebook's data if it was available to them?

Well, it's said that Google+ cost an estimated $585 million to develop. It's very difficult to put any kind of exact number on how much revenue Google would generate with audience data similar to Facebook but, based on their investment in Google+, it's safe to assume a lot.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the al8379 alabama department of revenue revenue alabama

How to generate an eSignature for your Al8379 Alabama Department Of Revenue Revenue Alabama online

How to create an electronic signature for your Al8379 Alabama Department Of Revenue Revenue Alabama in Chrome

How to create an electronic signature for putting it on the Al8379 Alabama Department Of Revenue Revenue Alabama in Gmail

How to create an eSignature for the Al8379 Alabama Department Of Revenue Revenue Alabama right from your smartphone

How to make an electronic signature for the Al8379 Alabama Department Of Revenue Revenue Alabama on iOS

How to make an electronic signature for the Al8379 Alabama Department Of Revenue Revenue Alabama on Android

People also ask

-

What is the AL8379 form from the Alabama Department of Revenue?

The AL8379 form is a crucial document required by the Alabama Department of Revenue for various tax-related purposes. It helps in reporting tax liabilities and ensuring compliance with state tax regulations. Understanding the AL8379 Alabama Department of Revenue Revenue Alabama form is essential for businesses operating in the state.

-

How can airSlate SignNow assist with the AL8379 form submission?

AirSlate SignNow simplifies the submission process of the AL8379 form by allowing users to electronically sign and send documents securely. With our easy-to-use platform, you can ensure that your AL8379 Alabama Department of Revenue Revenue Alabama submissions are completed accurately and on time. This not only saves you time but also reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the AL8379 form?

AirSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you need basic e-signature capabilities or advanced features for handling the AL8379 Alabama Department of Revenue Revenue Alabama form, we have a plan for you. Explore our competitive pricing to find the right fit for your organization.

-

What features does airSlate SignNow provide for document management?

AirSlate SignNow provides a comprehensive set of features for document management, including template creation, automated workflows, and secure cloud storage. These tools make it easy to manage the AL8379 Alabama Department of Revenue Revenue Alabama documents efficiently. Enjoy seamless collaboration and tracking of your documents throughout the signing process.

-

Is airSlate SignNow compliant with Alabama Department of Revenue regulations?

Yes, airSlate SignNow is fully compliant with the regulations set forth by the Alabama Department of Revenue. Our platform ensures that all e-signatures and document submissions, including the AL8379 Alabama Department of Revenue Revenue Alabama form, meet legal standards. You can trust airSlate SignNow to keep your documents secure and compliant.

-

Can I integrate airSlate SignNow with other software for handling the AL8379 form?

Absolutely! AirSlate SignNow offers integrations with various software applications to enhance your workflow. Whether you need to connect with CRM systems, accounting tools, or other platforms for managing the AL8379 Alabama Department of Revenue Revenue Alabama form, our integration capabilities make it easy and efficient.

-

What benefits does airSlate SignNow offer for businesses submitting the AL8379 form?

Using airSlate SignNow provides numerous benefits, including faster processing times, improved accuracy, and enhanced security for your AL8379 Alabama Department of Revenue Revenue Alabama submissions. Our user-friendly interface and robust features streamline the entire process, allowing you to focus on your business instead of paperwork.

Get more for AL8379 Alabama Department Of Revenue Revenue Alabama

- Signed and sworn or affirmed before me on date by form

- Producers 88 new mexico rentalpooling form

- New mexico acknowledgmentsindividualus legal forms

- I name of agent certify under penalty of perjury that form

- Control number nm p004 pkg form

- Control number nm p005 pkg form

- Optional but preferred your social security number form

- Georgia statutory financial power of attorney division of form

Find out other AL8379 Alabama Department Of Revenue Revenue Alabama

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT