To EmployersWithholders NameAddress Form

What is the TO EmployersWithholders NameAddress

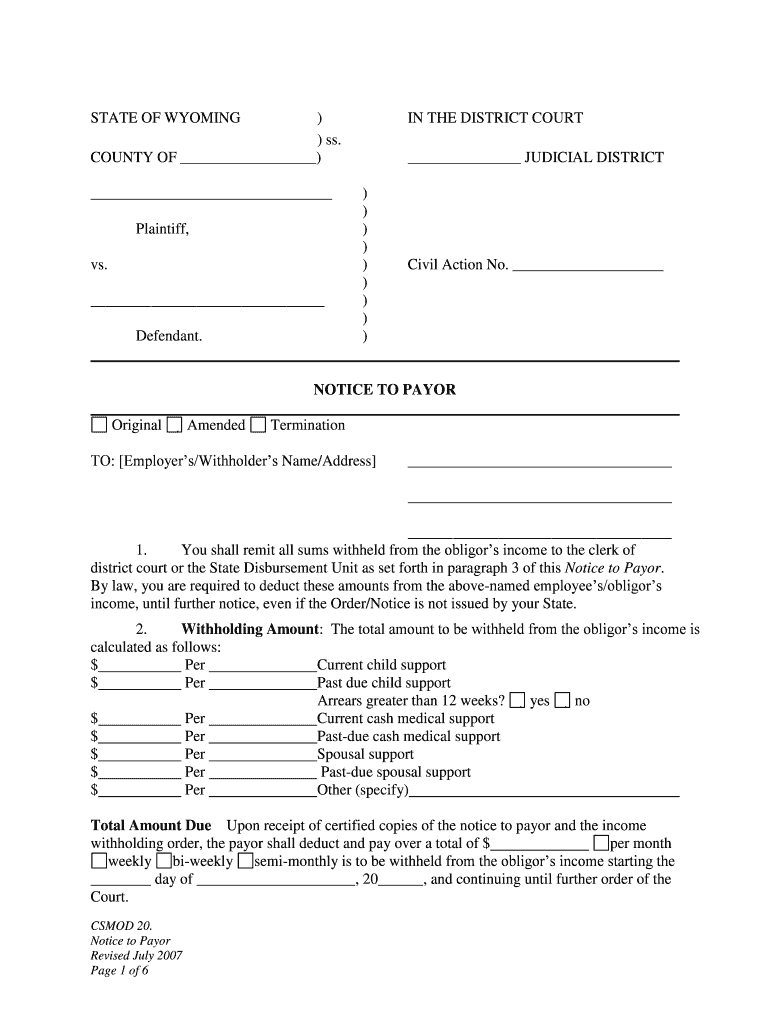

The TO EmployersWithholders NameAddress form is a crucial document used primarily for tax reporting purposes. It provides essential information about employers and withholders, including their names and addresses. This form is typically utilized by businesses to report income paid to employees and contractors, ensuring compliance with federal tax regulations. Understanding this form is vital for accurate tax reporting and maintaining proper records.

How to use the TO EmployersWithholders NameAddress

Using the TO EmployersWithholders NameAddress form involves several key steps. First, gather all necessary information about the employers and withholders, including their legal names and addresses. Next, fill out the form accurately, ensuring that all details are correct to avoid any discrepancies. After completing the form, it can be submitted electronically or via mail, depending on the specific requirements of the tax authority. Utilizing a digital solution like signNow can streamline this process, allowing for easy eSigning and submission.

Steps to complete the TO EmployersWithholders NameAddress

Completing the TO EmployersWithholders NameAddress form requires careful attention to detail. Follow these steps:

- Gather necessary information, including names and addresses of all employers and withholders.

- Access the form through a reliable platform or source.

- Fill in the required fields accurately, ensuring all information is current and complete.

- Review the form for any errors or omissions before finalizing.

- Submit the form as instructed, either online or by mail.

Legal use of the TO EmployersWithholders NameAddress

The legal use of the TO EmployersWithholders NameAddress form is governed by federal tax laws. This form must be completed accurately to fulfill tax obligations and avoid penalties. It serves as an official record for the IRS, documenting income paid to employees and contractors. Compliance with the legal requirements surrounding this form is essential for both employers and withholders to ensure proper reporting and adherence to tax regulations.

Examples of using the TO EmployersWithholders NameAddress

There are various scenarios in which the TO EmployersWithholders NameAddress form is utilized. For instance, a small business owner may use this form to report wages paid to employees throughout the year. Similarly, independent contractors may need to provide this information to their clients for accurate tax reporting. Each example highlights the form's importance in maintaining transparent and compliant financial records.

Filing Deadlines / Important Dates

Filing deadlines for the TO EmployersWithholders NameAddress form are critical for compliance. Typically, employers must submit this form by January thirty-first of the following year after payments have been made. It is essential to be aware of these dates to avoid penalties and ensure timely reporting. Keeping a calendar of important tax deadlines can help manage these obligations effectively.

Quick guide on how to complete to employerswithholders nameaddress

Complete TO EmployersWithholders NameAddress effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle TO EmployersWithholders NameAddress on any device with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign TO EmployersWithholders NameAddress without effort

- Locate TO EmployersWithholders NameAddress and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign TO EmployersWithholders NameAddress and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it help TO EmployersWithholders NameAddress?

airSlate SignNow is a versatile eSignature platform that streamlines the process of sending and signing documents. For TO EmployersWithholders NameAddress, it provides a cost-effective solution to manage signatures efficiently, ensuring that documentation is handled securely and swiftly.

-

What features does airSlate SignNow offer for TO EmployersWithholders NameAddress?

airSlate SignNow includes features like customizable templates, advanced workflow management, and secure document storage. These features specifically benefit TO EmployersWithholders NameAddress by making document management more organized and efficient.

-

How does airSlate SignNow benefit TO EmployersWithholders NameAddress in terms of pricing?

airSlate SignNow offers competitive pricing plans tailored for businesses of various sizes, making it affordable for TO EmployersWithholders NameAddress. The platform provides the flexibility to choose a plan that fits the budget while still accessing all essential eSignature features.

-

Can airSlate SignNow integrate with other software for TO EmployersWithholders NameAddress?

Yes, airSlate SignNow integrates with popular business tools like Google Workspace, Salesforce, and others. This allows TO EmployersWithholders NameAddress to streamline their workflow by linking eSignature functionalities directly with the software they already use.

-

Is airSlate SignNow suitable for all types of documents for TO EmployersWithholders NameAddress?

Absolutely! airSlate SignNow supports a wide range of document types, making it suitable for contracts, agreements, and any documents requiring signatures. This versatility is particularly beneficial for TO EmployersWithholders NameAddress, as it covers various business needs.

-

How secure is airSlate SignNow for TO EmployersWithholders NameAddress?

airSlate SignNow prioritizes security with robust encryption and compliance with industry standards. This ensures that documents signed within the platform for TO EmployersWithholders NameAddress remain confidential and safe from unauthorized access.

-

What is the onboarding process like for TO EmployersWithholders NameAddress?

The onboarding process for airSlate SignNow is user-friendly and designed for quick integration. TO EmployersWithholders NameAddress will find step-by-step guides and support available to help them start sending and signing documents with ease.

Get more for TO EmployersWithholders NameAddress

- 1350 abl 900c abl 900 checklist you are only eligible to form

- Fillable online form ct 184 fax email print pdffiller

- Fillable online sc4506 south carolina department of form

- Wwwtaxnygovpdfcurrentformsdepartment of taxation and finance instructions for form ct 3

- Department of taxation and finance instructions for form department of taxation and finance instructions for form department of

- Abl 571 checklist abl 571c 1350 sc department of form

- Pdf form it 21059 underpayment of estimated income tax by

- Wwwmichigangovdocumentscislccmanmixedmichigan department of licensing and regulatory affairs form

Find out other TO EmployersWithholders NameAddress

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT