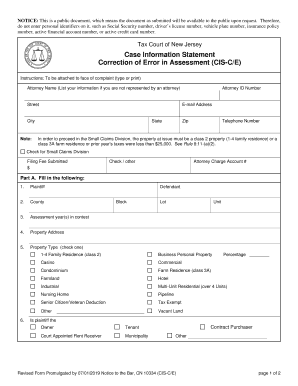

Correction of Error in Assessment CIS CE Correction of Error in Assessment CIS CE Form

What is the Correction Of Error In Assessment CIS CE

The Correction Of Error In Assessment CIS CE is a formal document used to rectify mistakes in previously submitted assessments within the CIS CE framework. This form is essential for ensuring that any discrepancies in tax assessments are corrected promptly, allowing taxpayers to maintain compliance with regulatory requirements. It serves to amend errors related to income, deductions, and other relevant financial details that may have been inaccurately reported.

How to use the Correction Of Error In Assessment CIS CE

Using the Correction Of Error In Assessment CIS CE involves several key steps. First, gather all relevant documentation that supports the correction, such as previous assessments and any new information. Next, fill out the form accurately, ensuring that all sections are completed and that the corrections are clearly indicated. Once completed, submit the form to the appropriate tax authority, either online or via traditional mail, depending on the submission guidelines provided by the state or local jurisdiction.

Steps to complete the Correction Of Error In Assessment CIS CE

To complete the Correction Of Error In Assessment CIS CE, follow these steps:

- Review the original assessment to identify errors.

- Collect supporting documents that validate the corrections.

- Obtain the Correction Of Error In Assessment CIS CE form from the appropriate tax authority.

- Fill out the form, clearly indicating the errors and the correct information.

- Sign and date the form, ensuring all required signatures are present.

- Submit the completed form through the designated method.

Legal use of the Correction Of Error In Assessment CIS CE

The legal use of the Correction Of Error In Assessment CIS CE is critical for ensuring that taxpayers remain compliant with tax laws. This form must be used in accordance with the guidelines set forth by the IRS and state tax authorities. Proper completion and submission of the form can prevent penalties and interest on unpaid taxes that may arise from incorrect assessments. It is important to adhere to all legal requirements to ensure the validity of the corrections made.

Required Documents

When submitting the Correction Of Error In Assessment CIS CE, certain documents may be required to support your claims. These typically include:

- Copies of the original assessment notices.

- Documentation that supports the correction, such as receipts or bank statements.

- Any correspondence with tax authorities regarding the original assessment.

Filing Deadlines / Important Dates

Filing deadlines for the Correction Of Error In Assessment CIS CE can vary by state and the specific circumstances of the assessment. Generally, it is advisable to submit the correction as soon as the error is identified to avoid potential penalties. Taxpayers should consult their state tax authority for specific deadlines related to their situation, ensuring that they comply with all relevant timelines.

Quick guide on how to complete correction of error in assessment cis ce correction of error in assessment cis ce

Complete Correction Of Error In Assessment CIS CE Correction Of Error In Assessment CIS CE seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files swiftly without delays. Handle Correction Of Error In Assessment CIS CE Correction Of Error In Assessment CIS CE on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Correction Of Error In Assessment CIS CE Correction Of Error In Assessment CIS CE effortlessly

- Locate Correction Of Error In Assessment CIS CE Correction Of Error In Assessment CIS CE and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Edit and eSign Correction Of Error In Assessment CIS CE Correction Of Error In Assessment CIS CE and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Correction Of Error In Assessment CIS CE feature in airSlate SignNow?

The Correction Of Error In Assessment CIS CE feature in airSlate SignNow allows users to easily correct mistakes in assessment documents. This feature ensures that any errors can be efficiently rectified, maintaining the accuracy and integrity of important documents. Utilizing this feature simplifies the process, making it quick and user-friendly.

-

How much does airSlate SignNow cost for using the Correction Of Error In Assessment CIS CE feature?

airSlate SignNow offers a range of pricing plans that include access to the Correction Of Error In Assessment CIS CE feature. Pricing is designed to be affordable and provides excellent value for businesses seeking effective document management solutions. You can explore different plans on our website to find the one that best fits your needs.

-

What are the benefits of using airSlate SignNow for Correction Of Error In Assessment CIS CE?

Using airSlate SignNow for Correction Of Error In Assessment CIS CE provides numerous benefits, including enhanced accuracy in your documents and the ability to make real-time updates. This leads to increased compliance and reduces the likelihood of disputes over document integrity. Ultimately, it streamlines your workflow and saves your team valuable time.

-

Can I integrate airSlate SignNow with other applications for Correction Of Error In Assessment CIS CE?

Yes, airSlate SignNow supports integrations with various applications to enhance your Correction Of Error In Assessment CIS CE processes. By connecting with popular tools like CRM systems and cloud storage, you can streamline your document management workflow. This flexibility allows for a more cohesive and efficient operation tailored to your business needs.

-

Is airSlate SignNow secure for making corrections in assessment documents?

Absolutely, airSlate SignNow prioritizes security, especially when it comes to sensitive information involved in Correction Of Error In Assessment CIS CE. We use advanced encryption and compliance measures to protect your documents, ensuring that your corrections are secure and confidential. You can trust that your data is well-guarded when using our platform.

-

How long does it take to implement the Correction Of Error In Assessment CIS CE feature?

Implementing the Correction Of Error In Assessment CIS CE feature in airSlate SignNow is quick and user-friendly. Most users can start using the feature within minutes, thanks to our intuitive interface and easy setup process. You’ll be able to correct assessment errors effectively without any extensive training.

-

Does airSlate SignNow offer customer support for issues related to Correction Of Error In Assessment CIS CE?

Yes, airSlate SignNow provides dedicated customer support to assist with any issues related to Correction Of Error In Assessment CIS CE. Our support team is available via chat, email, or phone to ensure you receive the help you need promptly. Whether you have questions or require technical assistance, we are here to help you.

Get more for Correction Of Error In Assessment CIS CE Correction Of Error In Assessment CIS CE

- Nomination for award of community service form

- Request for compromise on a debt form

- Your membership to the national light club has been revoked form

- Reference character reference from a friend form

- Confirmation of oral agreement form

- Letter to restaurant complaint form

- 2nd3rd contact form

- Learn the rules related to employees use of vehicles bizfilings form

Find out other Correction Of Error In Assessment CIS CE Correction Of Error In Assessment CIS CE

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template