Tax Sale Monday, August 26, St Louis County Form

Understanding the St Louis County Tax Sale

The St Louis County tax sale is a critical event where properties with unpaid taxes are auctioned to recover the owed amounts. Scheduled for Monday, August 26, this sale allows buyers to acquire properties at potentially lower prices while helping the county recoup lost revenue. Understanding the process and the implications of participating in this sale is essential for both buyers and sellers.

Steps to Participate in the Tax Sale

Participating in the St Louis County tax sale involves several important steps. First, familiarize yourself with the properties listed for auction. The county typically provides a tax sale list that details the properties available. Next, ensure you meet any eligibility criteria, such as being a registered bidder. On the day of the sale, arrive prepared with necessary documentation and funds to complete your purchase. Understanding the bidding process is crucial, as it often involves competitive offers.

Legal Considerations for the Tax Sale

Engaging in the St Louis County tax sale requires awareness of legal obligations and rights. Buyers should understand that purchasing a property through this sale does not automatically grant clear title. It is vital to research any existing liens or encumbrances on the property. Additionally, compliance with local laws and regulations is necessary to ensure a valid purchase. Buyers may want to consult legal professionals to navigate these complexities effectively.

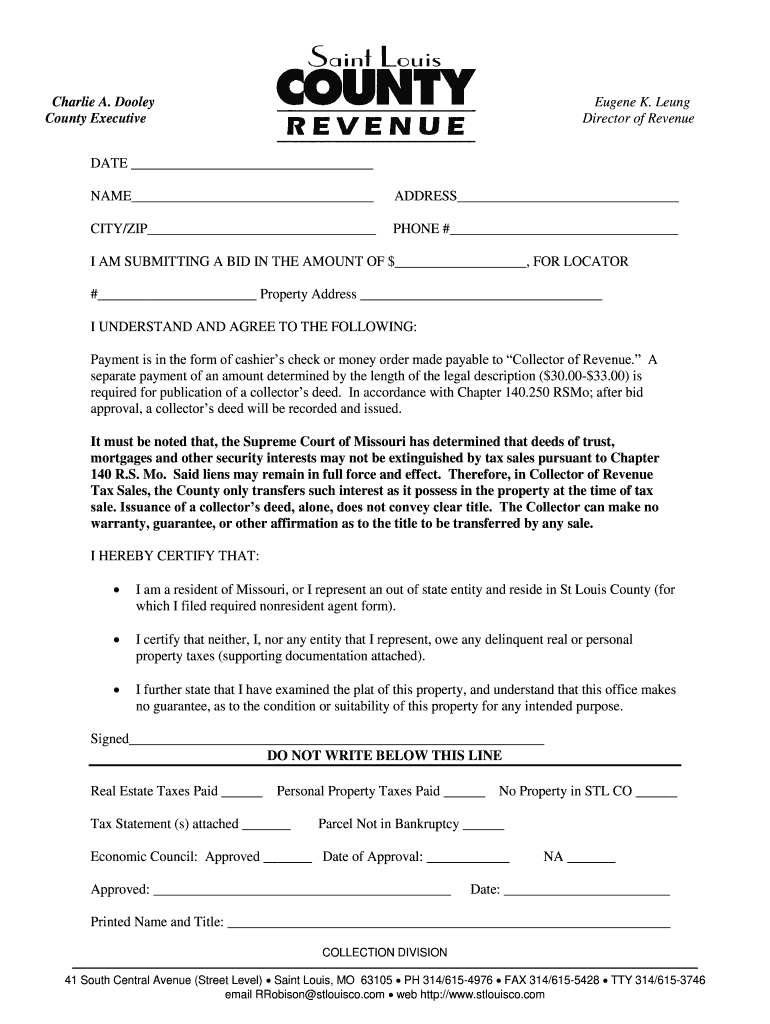

Required Documents for the Tax Sale

To participate in the St Louis County tax sale, certain documents are typically required. This may include identification, proof of registration as a bidder, and financial documentation to demonstrate the ability to pay. It's advisable to check with the St Louis County tax office for a complete list of required documents ahead of the sale date to ensure a smooth process.

Form Submission Methods for Tax Sale Participation

Participants in the St Louis County tax sale can submit necessary forms through various methods. While in-person submission is common, many counties now offer online submission options for convenience. It is essential to confirm the accepted methods for submitting forms and ensure that all documentation is completed accurately to avoid any delays or issues during the sale.

Key Dates and Deadlines for the Tax Sale

Awareness of important dates related to the St Louis County tax sale is crucial for prospective buyers. The date of the sale, August 26, is the primary focus, but there are often deadlines for registration, document submission, and payment. Keeping track of these dates will help ensure that participants do not miss critical opportunities to engage in the sale.

Quick guide on how to complete st louis county post third sale form

Complete Tax Sale Monday, August 26, St Louis County effortlessly on any gadget

Managing documents online has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Tax Sale Monday, August 26, St Louis County on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Tax Sale Monday, August 26, St Louis County with ease

- Locate Tax Sale Monday, August 26, St Louis County and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Tax Sale Monday, August 26, St Louis County and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

Create this form in 5 minutes!

How to create an eSignature for the st louis county post third sale form

How to create an eSignature for the St Louis County Post Third Sale Form in the online mode

How to make an eSignature for the St Louis County Post Third Sale Form in Chrome

How to create an eSignature for putting it on the St Louis County Post Third Sale Form in Gmail

How to create an electronic signature for the St Louis County Post Third Sale Form straight from your smartphone

How to make an eSignature for the St Louis County Post Third Sale Form on iOS devices

How to create an electronic signature for the St Louis County Post Third Sale Form on Android OS

People also ask

-

What is included in the airSlate SignNow post third sale features?

The airSlate SignNow post third sale features offer advanced signature options, customizable templates, and seamless collaboration tools. These features ensure that your document signing process is efficient and secure. Additionally, they enable businesses to scale their operations with ease.

-

How can I benefit from a post third sale strategy with airSlate SignNow?

Implementing a post third sale strategy with airSlate SignNow allows businesses to enhance customer retention and streamline contract renewals. By utilizing our eSignature capabilities, companies can automate follow-up processes, thereby increasing productivity. This approach ultimately helps in driving more revenue through effective management of customer relationships.

-

What pricing plans are available for airSlate SignNow after the post third sale?

After the post third sale, airSlate SignNow offers flexible pricing plans that cater to different business needs. Customers can choose from various subscription options based on the number of users and features required. This scalability ensures businesses only pay for what they need while maximizing their investments.

-

Are there any integrations available for airSlate SignNow post third sale?

Yes, airSlate SignNow supports multiple integrations to enhance your post third sale operations. You can connect with popular CRM tools, cloud storage services, and management software seamlessly. These integrations help streamline workflows and improve overall efficiency, making document management simpler.

-

How secure is the airSlate SignNow platform for post third sale transactions?

AirSlate SignNow prioritizes security with advanced encryption protocols to protect all post third sale transactions. Our platform complies with industry standards and regulations, ensuring that your sensitive data remains confidential. You can trust airSlate SignNow for a safe and reliable eSigning experience.

-

What support options are available for users after the post third sale?

After the post third sale, airSlate SignNow provides comprehensive support options. Users can access a dedicated help center, video tutorials, and live chat assistance to resolve any issues quickly. This ongoing support ensures that customers can maximize the use of their eSigning tools effectively.

-

Can I customize templates for post third sale documents with airSlate SignNow?

Absolutely! AirSlate SignNow allows you to customize templates for all your post third sale documents. This feature ensures that your agreements and contracts reflect your brand’s identity while meeting your specific business requirements. Custom templates save time and enhance consistency across documents.

Get more for Tax Sale Monday, August 26, St Louis County

- Control number nv p089 pkg form

- This form is a template for a letter of recommendation for receipt of an academic scholarship

- Control number nv p092 pkg form

- Control number nv p093 pkg form

- My true and lawful attorney in fact to act with the form

- Nevada zip have made constituted and appointed and by these presents do make form

- Nevada foreclosure laws and proceduresnolo form

- Restoration of civil rights sierra nevada record sealing form

Find out other Tax Sale Monday, August 26, St Louis County

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template