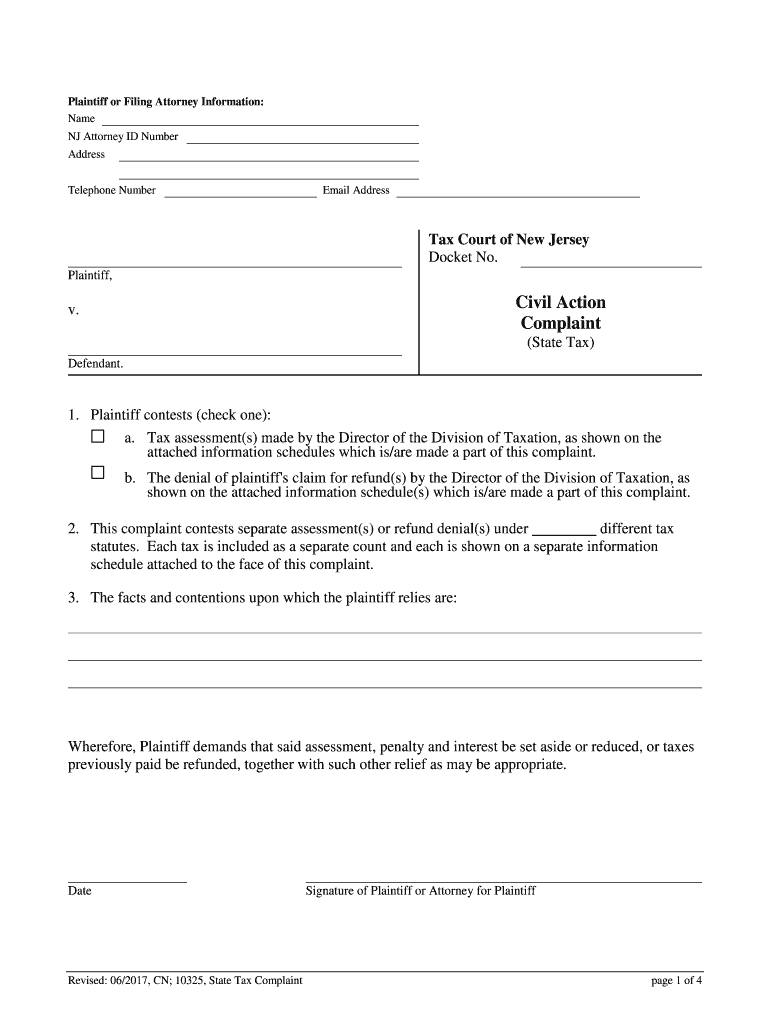

State Tax Form

What is the State Tax

The state tax refers to the taxes levied by individual states on income, property, sales, and various transactions. Each state in the U.S. has its own tax laws, rates, and regulations. State taxes are essential for funding public services, including education, transportation, and healthcare. Understanding the specific tax obligations in your state is crucial for compliance and financial planning.

Steps to complete the State Tax

Completing the state tax form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, such as income statements, W-2s, and any relevant deductions or credits. Next, fill out the form carefully, ensuring that all information is correct. Double-check your calculations to avoid errors. Once completed, review the form for accuracy before submitting it through the appropriate method, whether online, by mail, or in person.

Legal use of the State Tax

The legal use of the state tax form is governed by state laws and regulations. To be considered valid, the form must be filled out accurately and submitted by the designated deadlines. Additionally, using a reliable eSignature solution can enhance the legal standing of your submission, ensuring that it meets the requirements set forth by state authorities. Compliance with these regulations is vital to avoid penalties and ensure that your tax obligations are met.

Filing Deadlines / Important Dates

Each state has specific deadlines for filing state tax returns, which can vary from year to year. Generally, the deadline for filing is aligned with the federal tax deadline, typically April 15. However, some states may have different dates or offer extensions. It is essential to check your state's tax authority website for the most current filing deadlines and ensure timely submission to avoid late fees or penalties.

Required Documents

To complete the state tax form accurately, you will need several key documents. These typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Proof of any deductions or credits, such as receipts or tax documents

- Previous year’s tax return for reference

Having these documents ready will streamline the process and help ensure that your submission is complete and accurate.

Who Issues the Form

The state tax form is issued by the tax authority of each individual state. This authority is responsible for creating and maintaining tax forms, guidelines, and regulations. To obtain the correct form, taxpayers should visit their state’s official tax website, where they can find the necessary documents and instructions for filing.

Penalties for Non-Compliance

Failure to comply with state tax regulations can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action. Each state has its own set of consequences for non-compliance, which can vary in severity. It is crucial for taxpayers to understand their obligations and file their state tax returns accurately and on time to avoid these repercussions.

Quick guide on how to complete state tax

Complete State Tax effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the appropriate form and securely save it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly without delays. Handle State Tax on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to alter and electronically sign State Tax with ease

- Obtain State Tax and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign State Tax and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to State Tax?

airSlate SignNow is a digital signature solution that enables businesses to send and eSign documents easily. As it pertains to State Tax, our platform helps streamline the preparation and signing of tax-related documents, ensuring compliance with state regulations.

-

How does airSlate SignNow assist with filing State Tax documents?

With airSlate SignNow, you can securely sign and send your State Tax documents from anywhere. Our platform allows for quick and easy collaboration with tax professionals, ensuring timely submission of your tax filings.

-

What are the pricing options for airSlate SignNow?

We offer flexible pricing plans for airSlate SignNow to meet various business needs. Whether you’re a small business or a larger organization dealing with State Tax documents, our plans are designed to provide cost-effective solutions without compromising on features.

-

What features does airSlate SignNow offer for managing State Tax-related documents?

airSlate SignNow provides a host of features including secure eSigning, document tracking, and templates designed specifically for State Tax purposes. These features ensure that your document workflow is efficient and compliant with state requirements.

-

Is airSlate SignNow compliant with State Tax regulations?

Yes, airSlate SignNow is compliant with major regulatory frameworks that govern State Tax documents. Our platform ensures that all signed documents adhere to state laws, helping you avoid any legal pitfalls.

-

Can airSlate SignNow be integrated with other tax software?

Absolutely! airSlate SignNow integrates seamlessly with various tax software applications, allowing for smooth transfer and management of State Tax documents. This integration enhances your workflow and minimizes the risk of errors during document handling.

-

What are the benefits of using airSlate SignNow for State Tax management?

Using airSlate SignNow for State Tax management offers numerous benefits, including increased efficiency, reduced costs, and improved document security. Our platform simplifies the signing process and helps ensure that you meet all necessary deadlines.

Get more for State Tax

- Board resolution free board of directors resolution form

- Name change forms new york state unified court system

- New york consolidated laws surrogates court codes findlaw form

- Bond fee form

- Theoffice crossword clue crossword solverwordplayscom form

- 26 printable free small estate affidavit form templates fillable

- Construction pricing and contracting form

- How to form a corporation in ohionolo

Find out other State Tax

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself