Nm Summons Form

What is the Nm Summons

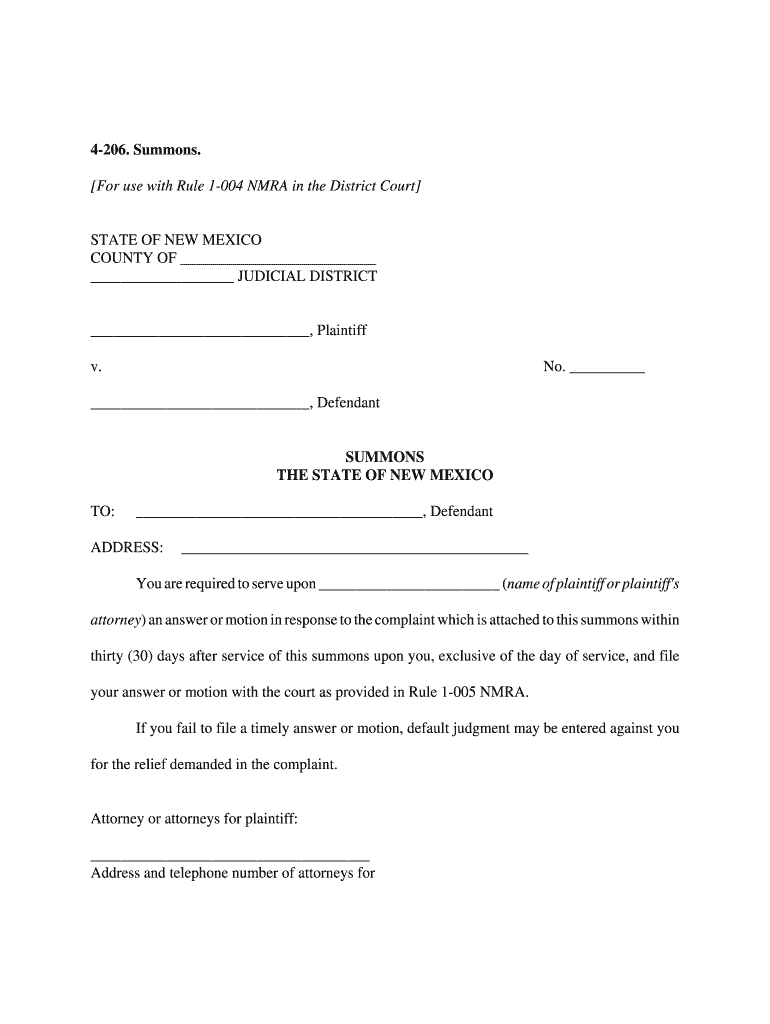

The Nm summons, specifically the nm 4206 summons, is a legal document used in the state of New Mexico. It serves as a formal notification that a legal action has been initiated against an individual or entity. This summons outlines the nature of the case and provides essential information regarding the court and the parties involved. Understanding the purpose and implications of the nm summons is crucial for anyone who receives it, as it can impact their legal rights and obligations.

How to use the Nm Summons

Using the nm summons involves several key steps. First, it is important to read the summons carefully to understand the claims being made. Next, the recipient must respond within the specified timeframe, typically by filing an answer with the court. This response should address the allegations and provide any defenses. If the recipient fails to respond, a default judgment may be entered against them. It is advisable to consult with a legal professional to ensure proper handling of the summons and to understand the potential consequences.

Steps to complete the Nm Summons

Completing the nm summons requires attention to detail. Follow these steps to ensure accuracy:

- Obtain the latest version of the nm summons from a reliable source.

- Fill in the required fields, including the case number, court name, and parties involved.

- Provide your contact information and any relevant details regarding the case.

- Review the document for completeness and accuracy.

- Sign and date the summons before submitting it to the appropriate court.

Legal use of the Nm Summons

The nm summons is a legally binding document that must be used in accordance with New Mexico state laws. It is essential to ensure that the summons is served properly to the defendant, as improper service can lead to delays or dismissal of the case. The summons must also comply with the New Mexico Rules of Civil Procedure, which outline specific requirements for format and content. Legal professionals often assist in navigating these requirements to ensure compliance and effectiveness.

Key elements of the Nm Summons

Several key elements must be included in the nm summons for it to be valid. These include:

- The title of the court where the case is filed.

- The names of the parties involved in the case.

- The case number assigned by the court.

- A clear statement of the claims being made against the defendant.

- Instructions for the defendant on how to respond and the deadline for doing so.

Who Issues the Form

The nm summons is typically issued by the court where the legal action is filed. Once a plaintiff submits their complaint, the court generates the summons and provides it to the plaintiff for service. It is the responsibility of the plaintiff to ensure that the summons is properly served to the defendant, following the legal guidelines set forth by New Mexico law. Courts may also provide guidance on how to fill out and submit the summons correctly.

Quick guide on how to complete form 4 206

Quickly complete and submit your Nm Summons

Robust tools for digital document exchange and authorization are vital for enhancing processes and the ongoing improvement of your forms. When handling legal documents and signing a Nm Summons, an appropriate signing solution can save you signNow amounts of time and resources with every submission.

Locate, fill out, modify, endorse, and distribute your legal paperwork with airSlate SignNow. This platform provides all you require to create efficient paper submission workflows. Its extensive library of legal forms and intuitive navigation will assist you in obtaining your Nm Summons promptly, and the editor with our signing feature will enable you to finalize and authorize it immediately.

Approve your Nm Summons in a few easy steps

- Search for the Nm Summons you need in our library utilizing search or catalog views.

- Examine the form details and preview it to confirm it meets your requirements and legal obligations.

- Click Retrieve form to access it for modification.

- Complete the form using the all-inclusive toolbar.

- Double-check the information you provided and click the Sign option to validate your document.

- Select one of three options to insert your signature.

- Complete your edits and store the document, then download it onto your device or share it right away.

Enhance each phase of your document preparation and authorization with airSlate SignNow. Experience a more effective online approach that considers every aspect of managing your documentation.

Create this form in 5 minutes or less

FAQs

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How do I fill up the ITR 4 form?

Guidance to File ITR 4Below are mentioned few common guidelines to consider while filing your ITR 4 form:If any schedule is not relevant/applicable to you, just strike it out and write —NA— across itIf any item/particular is not applicable/relevant to you, just write NA against itIndicate nil figures by writing “Nil” across it.Kindly, put a “-” sign prior to any negative figure.All figures shall be rounded off to the nearest one rupee except figures for total income/loss and tax payable. Those shall be rounded off to the nearest multiple of ten.If you are an Employer individual, then you must mark Government if you are a Central/State Government employee. You should tick PSU if you are working in a public sector company of the Central/State Government.Sequence to fill ITR 4 formThe easiest way to fill out your ITR-4 Form is to follow this order:Part AAll the schedulesPart BVerificationModes to file ITR 4 FormYou can submit your ITR-4 Form either online or offline. It is compulsory to file ITR in India electronically (either through Mode 3 or Mode 4) for the following assesses:Those whose earning exceeds Rs. 5 lakhs per yearThose possessing any assets outside the boundary of India (including financial interest in any entity) or signing authority in any account outside India.Those claiming relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR applyOffline:By furnishing a return in a tangible l paper formBy furnishing a bar-coded returnThe Income Tax Department will issue you an acknowledgment as a form of response/reply at the time of submission of your tangible paper return.Online/Electronically:By furnishing the return electronically using digital signature certificate.By sending the data electronically and then submitting the confirmation of the return in Return Form ITR-VIf you submit your ITR-4 Form by electronic means under digital signature, the acknowledgment/response will be sent to your registered email id. You can even download it manually from the official income tax website. For this, you are first required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing.Keep in mind that ITR-4 is an annexure-less form. It means you don’t have to attach any documents when you send it.TaxRaahi is your income tax return filing online companion. Get complete assistance and tax saving tips from experts.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How much do accountants charge for helping you fill out a W-4 form?

A W-4 is a very simple form to instruct your employer to withhold the proper tax. It's written in very plain English and is fairly easy to follow. I honestly do not know of a CPA that will do one of these. If you're having trouble and cannot find a tutorial you like on line see if you can schedule a probing meeting. It should take an accounting student about 10 minutes to walk you through. There is even a worksheet on the back.If you have mitigating factors such as complex investments, partnership income, lies or garnishments, talk to your CPA about those, and then ask their advice regarding the W4 in the context of those issues.

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the form 4 206

How to make an eSignature for the Form 4 206 online

How to make an eSignature for the Form 4 206 in Chrome

How to make an electronic signature for signing the Form 4 206 in Gmail

How to create an electronic signature for the Form 4 206 right from your smartphone

How to generate an electronic signature for the Form 4 206 on iOS

How to create an eSignature for the Form 4 206 on Android devices

People also ask

-

What is an Nm Summons and how can airSlate SignNow assist with it?

An Nm Summons is a legal document that requires an individual to appear in court. With airSlate SignNow, you can easily create, send, and eSign Nm Summons documents, ensuring that all parties involved have access to the necessary legal paperwork in a timely manner.

-

How does airSlate SignNow enhance the eSigning process for Nm Summons?

airSlate SignNow streamlines the eSigning process for Nm Summons by providing a user-friendly platform where documents can be signed electronically. This not only saves time but also ensures that your Nm Summons is securely stored and easily accessible for future reference.

-

What pricing plans does airSlate SignNow offer for handling Nm Summons?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling Nm Summons. Whether you are a small business or a large enterprise, our plans provide cost-effective solutions that enable efficient document management and eSigning.

-

Can I integrate airSlate SignNow with other applications for managing Nm Summons?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your ability to manage Nm Summons efficiently. By connecting with tools like Google Drive, Dropbox, and Salesforce, you can automate document workflows and keep all your legal documents organized.

-

What features does airSlate SignNow provide for creating Nm Summons?

airSlate SignNow includes robust features for creating Nm Summons, such as customizable templates and drag-and-drop functionality. You can easily add fields for signatures, dates, and other necessary information, ensuring that your Nm Summons meets legal requirements.

-

Is airSlate SignNow secure for handling sensitive Nm Summons?

Absolutely! airSlate SignNow prioritizes security, offering features like end-to-end encryption and secure cloud storage. This ensures that your Nm Summons and any sensitive information contained within are protected from unauthorized access.

-

How does airSlate SignNow improve document tracking for Nm Summons?

With airSlate SignNow, you can track the status of your Nm Summons in real-time. You will receive notifications when documents are viewed and signed, providing transparency and ensuring that you stay informed throughout the signing process.

Get more for Nm Summons

- Owners initials form

- New york mechanics lien lien release dos and donts form

- Lhwca procedure manual united states department of labor form

- Nys division of licensing services new york department form

- To as grantors do hereby grant release and warrant unto a limited form

- Proof of service of notice of lienindividual form

- Fillable online competency based salary structure design form

- Criminal law new york state unified court form

Find out other Nm Summons

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later