Irrevocable Trust Form

What is the irrevocable trust form

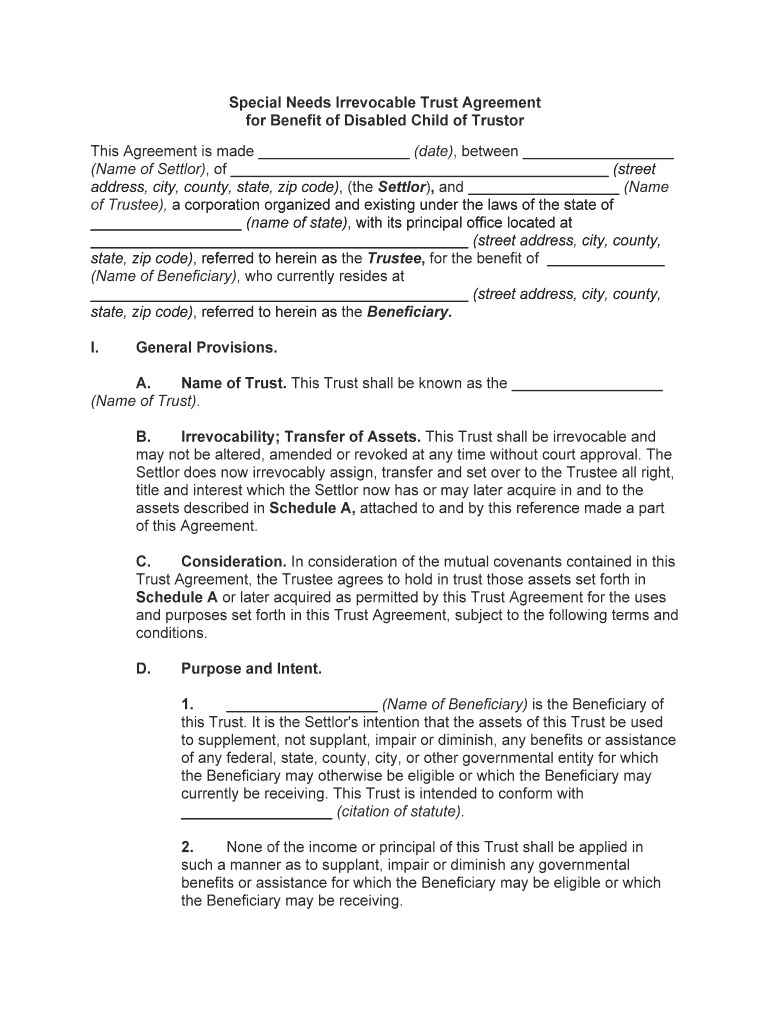

An irrevocable trust form is a legal document that establishes a trust that cannot be modified or revoked after its creation. This type of trust is often used for estate planning, asset protection, and tax benefits. Once assets are transferred into an irrevocable trust, the grantor relinquishes control over those assets, which can provide significant advantages, particularly in protecting assets from creditors and reducing estate taxes. The irrevocable trust form typically includes details about the trust's purpose, the trustee's responsibilities, and the beneficiaries who will receive the assets.

Steps to complete the irrevocable trust form

Completing the irrevocable trust form involves several key steps to ensure that it is legally binding and accurately reflects the grantor's intentions. First, gather all necessary information, including the names of the grantor, trustee, and beneficiaries, as well as a list of assets to be included in the trust. Next, carefully fill out the form, ensuring that all details are accurate and complete. It is essential to consult with a legal professional to review the form and ensure compliance with state laws. Once completed, the form must be signed in the presence of a notary public to validate the trust.

Legal use of the irrevocable trust form

The irrevocable trust form serves a critical legal function in estate planning and asset management. By transferring assets into an irrevocable trust, the grantor effectively removes those assets from their taxable estate, which can reduce estate taxes upon death. Additionally, the irrevocable trust can provide protections against creditors, ensuring that the assets are preserved for the beneficiaries. It is important to understand that once the trust is established, the grantor cannot alter its terms or reclaim the assets, making it essential to carefully consider this decision.

Key elements of the irrevocable trust form

Several key elements must be included in the irrevocable trust form to ensure its effectiveness and legality. These elements typically include:

- Grantor Information: The name and address of the individual creating the trust.

- Trustee Information: The name and contact details of the person or entity responsible for managing the trust.

- Beneficiary Information: Names and details of individuals or entities that will benefit from the trust.

- Asset Description: A detailed list of assets being transferred into the trust.

- Trust Purpose: A statement outlining the purpose of the trust and how the assets should be managed or distributed.

How to obtain the irrevocable trust form

The irrevocable trust form can typically be obtained through a variety of sources. Many legal websites offer downloadable templates that comply with state laws. Additionally, legal professionals can provide customized forms tailored to specific needs. It is advisable to consult with an attorney who specializes in estate planning to ensure that the form meets all legal requirements and adequately reflects the grantor's intentions.

Examples of using the irrevocable trust form

There are several scenarios in which an irrevocable trust form may be beneficial. For instance, a parent may establish an irrevocable trust for a special needs child to ensure that the child receives financial support without jeopardizing eligibility for government benefits. Another example is using an irrevocable trust to protect assets from creditors in the event of a lawsuit or bankruptcy. Additionally, individuals may use this form to facilitate the transfer of wealth to heirs while minimizing estate taxes.

Quick guide on how to complete irrevocable trust form

Effortlessly Prepare Irrevocable Trust Form on Any Device

The management of documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools essential for generating, editing, and eSigning your documents quickly and without any delays. Manage Irrevocable Trust Form on any device with the airSlate SignNow Android or iOS applications and simplify your document-related processes today.

The Easiest Way to Edit and eSign Irrevocable Trust Form

- Locate Irrevocable Trust Form and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

No more lost or misplaced files, tedious document searches, or errors requiring new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device of your choice. Edit and eSign Irrevocable Trust Form to ensure effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an irrevocable trust form?

An irrevocable trust form is a legal document that establishes a trust that cannot be modified or revoked by the grantor after it is created. This form outlines the terms and conditions of the trust, including the management and distribution of assets. Understanding the intricacies of an irrevocable trust form is vital for effective estate planning.

-

How do I complete an irrevocable trust form using airSlate SignNow?

To complete an irrevocable trust form using airSlate SignNow, simply upload your document onto our platform and use the editing tools to fill in the required information. Once complete, you can send the form for eSignature seamlessly. Our user-friendly interface ensures that anyone can complete their irrevocable trust form with ease.

-

What are the advantages of using airSlate SignNow for irrevocable trust forms?

Using airSlate SignNow for your irrevocable trust forms offers a range of benefits, including streamlined document management and enhanced security for sensitive information. Our platform allows for easy collaboration and eSigning, ensuring that your irrevocable trust form is completed efficiently. Additionally, you gain access to audit trails for greater accountability.

-

Is there a cost associated with creating an irrevocable trust form on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but our pricing is competitive and tailored to suit various business needs. We offer flexible subscription plans that provide excellent value for the features you receive, including unlimited eSigning and document templates for your irrevocable trust form. You can choose a plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other applications for better management of irrevocable trust forms?

Absolutely! AirSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and Dropbox. This allows you to manage your irrevocable trust form and other documents more effectively, streamlining your workflow and enhancing productivity across your organization.

-

What features will help me manage my irrevocable trust form effectively?

AirSlate SignNow includes several features that assist in managing your irrevocable trust form, such as automated reminders, custom workflows, and mobile access. You can also utilize templates to ensure consistency in your documents and enhance your efficiency. These tools help you stay organized while ensuring compliance with legal standards.

-

How secure is my information when using airSlate SignNow for my irrevocable trust form?

Security is a top priority at airSlate SignNow. We use advanced encryption methods and secure servers to protect your information, including your irrevocable trust form. Additionally, we comply with industry standards and regulations to ensure that your data remains confidential and secure throughout the signing process.

Get more for Irrevocable Trust Form

- Report card sample form

- Unauthorized use of a motor vehicle demand letter texas form

- Pasrr form 100449095

- Monthly monitoring record for wastewater treatment facilities form dnr mo

- Of termination 30 day notice pinalcountyaz form

- Printable miranda warning card form

- Sa0408 2002 summary of a 2001 nchrp study on this issue including current state dot practices rating models and external form

- Property comparison worksheet form

Find out other Irrevocable Trust Form

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy