Revocable Trust Agreement Form

What is the Revocable Trust Agreement Form

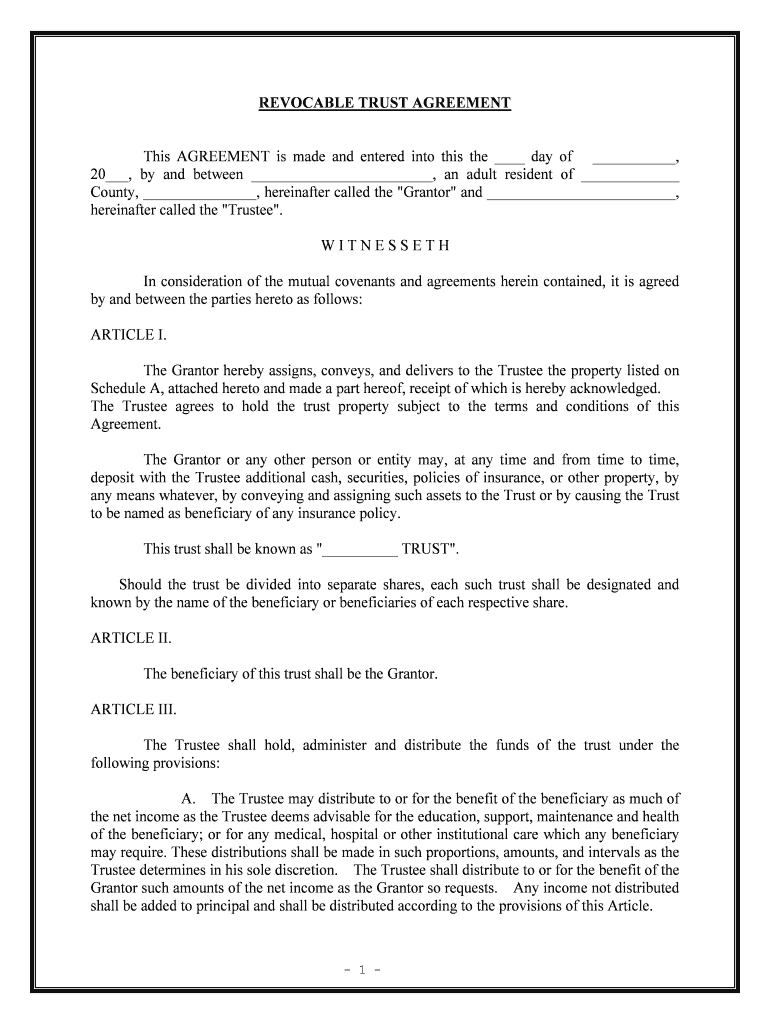

The Revocable Trust Agreement Form is a legal document that establishes a trust, allowing the grantor to retain control over the assets placed within it. This type of trust can be altered or revoked by the grantor at any time during their lifetime. The primary purpose of a revocable trust is to manage the distribution of assets upon the grantor's death, avoiding the probate process, which can be lengthy and costly. In addition, it allows for seamless management of the trust assets in case of the grantor's incapacity.

Steps to Complete the Revocable Trust Agreement Form

Completing the Revocable Trust Agreement Form involves several key steps:

- Gather necessary information about the grantor, beneficiaries, and assets to be included in the trust.

- Clearly define the terms of the trust, including how assets will be managed and distributed.

- Designate a trustee who will oversee the trust and ensure its terms are followed.

- Review the document for accuracy and completeness before signing.

- Consider having the document notarized to enhance its legal validity.

Legal Use of the Revocable Trust Agreement Form

The Revocable Trust Agreement Form is legally binding once it is properly completed and signed by the grantor. It is essential to adhere to state-specific laws regarding trusts, as these can vary significantly. In the United States, this form can be used to facilitate the transfer of assets, outline the management of the trust, and specify how and when beneficiaries will receive their inheritance. Legal counsel may be beneficial to ensure compliance with all relevant regulations.

Key Elements of the Revocable Trust Agreement Form

Key elements of the Revocable Trust Agreement Form include:

- Grantor Information: Details about the individual creating the trust.

- Trustee Designation: Identification of the person or entity responsible for managing the trust.

- Beneficiary Designation: Names and details of individuals or organizations that will benefit from the trust.

- Asset Description: A comprehensive list of assets included in the trust.

- Terms of Distribution: Guidelines for how and when the assets will be distributed to beneficiaries.

How to Obtain the Revocable Trust Agreement Form

The Revocable Trust Agreement Form can typically be obtained through various sources:

- Legal document preparation services that offer customizable templates.

- Online legal resources that provide downloadable forms.

- Consultation with an attorney specializing in estate planning who can draft the form according to specific needs.

Examples of Using the Revocable Trust Agreement Form

Examples of scenarios where the Revocable Trust Agreement Form may be beneficial include:

- A married couple wanting to ensure their assets are managed and distributed according to their wishes upon their deaths.

- An individual with minor children who wishes to appoint a guardian and manage their inheritance responsibly.

- A person with significant assets seeking to avoid probate and streamline the transfer of wealth to heirs.

Quick guide on how to complete revocable trust agreement form

Complete Revocable Trust Agreement Form effortlessly on any gadget

Digital document management has gained traction among organizations and individuals alike. It serves as an excellent eco-conscious substitute for traditional printed and signed papers, enabling you to locate the suitable form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Revocable Trust Agreement Form on any device using airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The simplest method to modify and eSign Revocable Trust Agreement Form without hassle

- Obtain Revocable Trust Agreement Form and then select Get Form to begin.

- Utilize the tools available to finish your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your selection. Edit and eSign Revocable Trust Agreement Form and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a multiple beneficiary grantor trust?

A multiple beneficiary grantor trust is a distinctive estate planning tool that allows one grantor to create a trust for multiple beneficiaries. This type of trust provides flexibility in managing and distributing assets according to the grantor's wishes. Utilizing a multiple beneficiary grantor trust can help in tax planning and asset protection for the beneficiaries.

-

How does a multiple beneficiary grantor trust work?

In a multiple beneficiary grantor trust, the grantor retains control over the assets while designating several beneficiaries who will receive the benefits. The trust can be structured to allow the grantor to make changes as necessary, ensuring that the trust meets evolving family needs. This arrangement helps in providing for multiple beneficiaries while maintaining managerial control over the trust assets.

-

What are the benefits of using a multiple beneficiary grantor trust?

Using a multiple beneficiary grantor trust offers numerous advantages, including flexibility in asset management and tax benefits. It allows the grantor to provide for different beneficiaries while controlling how assets are distributed. Additionally, it can help shield assets from creditors and ensure that family wealth is preserved across generations.

-

How do I set up a multiple beneficiary grantor trust?

Setting up a multiple beneficiary grantor trust typically involves working with an estate planning attorney who can help draft the trust document. This document outlines the assets, beneficiaries, and specific terms for managing the trust. After establishment, the grantor can begin transferring assets into the trust to benefit the designated beneficiaries.

-

Are there any costs involved in creating a multiple beneficiary grantor trust?

Yes, there are costs involved in creating a multiple beneficiary grantor trust, including attorney fees for drafting the trust document and potential fees for managing the trust once established. Additionally, there may be costs related to transferring assets into the trust. However, the long-term tax and asset management benefits often outweigh these initial expenses.

-

Can a multiple beneficiary grantor trust be changed after it's established?

Yes, a multiple beneficiary grantor trust can often be amended as long as the grantor retains control. This flexibility allows grantors to make changes in response to life events or shifts in family dynamics. However, certain changes may require legal documentation to ensure compliance with state laws.

-

What are common uses for a multiple beneficiary grantor trust?

Common uses for a multiple beneficiary grantor trust include providing for children from different marriages or ensuring that assets are distributed according to specific instructions. These trusts are also used for tax planning purposes, helping to minimize estate taxes for larger estates. Additionally, they can serve as tools for supporting charitable causes while benefiting multiple family members.

Get more for Revocable Trust Agreement Form

- Gc 400e1gc 405e1 cash assets on hand at end of form

- Standard accounting forms superior court riverside yumpu

- Judicial council of california california courts cagov form

- Gc 400b gc 405b schedule b gains on salesstandard and simplified accounts judicial council forms

- Gc 400c4 schedule c disbursements fiduciary and form

- Gc 400sumgc 405sum summary of accountstandard form

- Gc 400ph2gc 405ph2 non cash assets on hand at form

- Other charges not shown on another schedule describe form

Find out other Revocable Trust Agreement Form

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT