Mortgage Loan Disclosure Statement 2008

What is the mortgage loan disclosure statement?

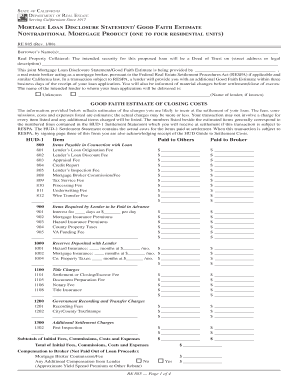

The mortgage loan disclosure statement is a crucial document that outlines the terms and conditions of a mortgage loan. It is designed to provide borrowers with clear and concise information about their loan, including interest rates, payment schedules, and any associated fees. This statement ensures that borrowers understand their financial obligations before committing to a mortgage. It is typically required by law and must be provided to the borrower within a specified timeframe after applying for a mortgage.

Key elements of the mortgage loan disclosure statement

Understanding the key elements of the mortgage loan disclosure statement is essential for borrowers. The statement typically includes the following components:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Monthly Payment: The amount due each month, including principal and interest.

- Loan Term: The duration over which the loan must be repaid.

- Fees: Any additional costs associated with the loan, such as origination fees or closing costs.

These elements help borrowers make informed decisions regarding their mortgage options.

Steps to complete the mortgage loan disclosure statement

Completing the mortgage loan disclosure statement involves several important steps:

- Gather Information: Collect necessary personal and financial information, including income, assets, and credit history.

- Review Terms: Carefully read through the terms and conditions outlined in the disclosure statement.

- Fill Out the Form: Accurately complete the disclosure statement with the required information.

- Sign the Document: Provide your signature to confirm your understanding and agreement to the terms.

- Submit the Form: Send the completed disclosure statement to the lender or mortgage broker.

Following these steps ensures that the mortgage loan disclosure statement is completed correctly and submitted on time.

Legal use of the mortgage loan disclosure statement

The legal use of the mortgage loan disclosure statement is governed by federal and state regulations. In the United States, the Truth in Lending Act (TILA) mandates that lenders provide this statement to borrowers to promote transparency in lending practices. The document must be delivered within three business days of receiving a loan application. Failure to comply with these regulations can result in penalties for the lender, including potential legal action from borrowers.

How to obtain the mortgage loan disclosure statement

Obtaining the mortgage loan disclosure statement is typically straightforward. Borrowers can request this document from their lender or mortgage broker during the application process. It is important to ensure that the statement is provided in a timely manner to allow for proper review before finalizing the loan agreement. Additionally, many lenders offer online access to the disclosure statement, making it easier for borrowers to obtain and review the necessary information.

Digital vs. paper version of the mortgage loan disclosure statement

Both digital and paper versions of the mortgage loan disclosure statement are legally acceptable, but there are distinct advantages to using digital formats. Digital versions can be filled out and signed electronically, streamlining the process and reducing the need for physical paperwork. This method also enhances security and allows for easier storage and retrieval of documents. However, some borrowers may prefer paper versions for their tangible nature and ease of review. Ultimately, the choice between digital and paper formats depends on individual preferences and circumstances.

Quick guide on how to complete mortgage loan disclosure statement

Complete Mortgage Loan Disclosure Statement effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as a perfect environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow offers all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Mortgage Loan Disclosure Statement on any platform using the airSlate SignNow Android or iOS applications and streamline any document-based task today.

How to adjust and electronically sign Mortgage Loan Disclosure Statement with ease

- Locate Mortgage Loan Disclosure Statement and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you'd like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mortgage Loan Disclosure Statement and ensure effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage loan disclosure statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mortgage loan disclosure statement?

A mortgage loan disclosure statement is a document that outlines the key details of a mortgage loan, including terms, interest rates, and fees. This statement is essential for borrowers to understand their obligations and the costs associated with their loan. Using airSlate SignNow, you can easily create and manage mortgage loan disclosure statements, ensuring compliance and clarity.

-

How does airSlate SignNow simplify the process of creating mortgage loan disclosure statements?

airSlate SignNow streamlines the creation of mortgage loan disclosure statements through its intuitive interface and customizable templates. This enables you to quickly fill in necessary details and send documents for electronic signatures. The platform's efficiency saves time and reduces errors compared to traditional methods.

-

What are the benefits of using airSlate SignNow for mortgage loan disclosure statements?

Using airSlate SignNow for mortgage loan disclosure statements offers several benefits, including faster processing times and enhanced security features. The platform ensures that your documents are signed and stored securely, which helps you maintain compliance with regulatory requirements. Furthermore, electronic signatures speed up the overall mortgage process for both lenders and borrowers.

-

Are there any integrations available for airSlate SignNow regarding mortgage loan disclosure statements?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing the management of mortgage loan disclosure statements. This includes integration with CRM systems, accounting software, and cloud storage solutions, facilitating a more cohesive workflow. These integrations help keep all your data organized and accessible.

-

What is the pricing structure for airSlate SignNow when managing mortgage loan disclosure statements?

airSlate SignNow offers a flexible pricing structure that caters to businesses of all sizes, especially those handling mortgage loan disclosure statements. Depending on your needs, you can choose from various plans that include key features such as eSigning, document management, and support. This cost-effective solution provides value by enhancing your document workflows.

-

Can airSlate SignNow help ensure compliance with mortgage loan disclosure statement regulations?

Absolutely! airSlate SignNow is designed to help businesses comply with the regulations surrounding mortgage loan disclosure statements. The platform includes features that support secure document handling and ensure that all necessary disclosures are included, making compliance easier for lenders and borrowers alike.

-

What types of documents can be sent and signed along with mortgage loan disclosure statements?

In addition to mortgage loan disclosure statements, airSlate SignNow allows you to send and sign a variety of documents such as loan applications, agreements, and addendums. This flexibility means that all related paperwork can be managed within a single platform, improving efficiency. This comprehensive approach is beneficial for both clients and lenders.

Get more for Mortgage Loan Disclosure Statement

- Kennesaw state universitys black and gold book by form

- Does submitting sir affect admissionscollege confidential form

- Practical nursing pn certificate program rcc form

- Associate degree nursingrobeson community college form

- Official independent student number in collegedocx form

- Osa disability verification form sacred heart university

- Date student interview request form thank you for considering planned parenthood for your upcoming school project

- Application for candidate corresponding form

Find out other Mortgage Loan Disclosure Statement

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document