Blind Trust Form

What is the Blind Trust

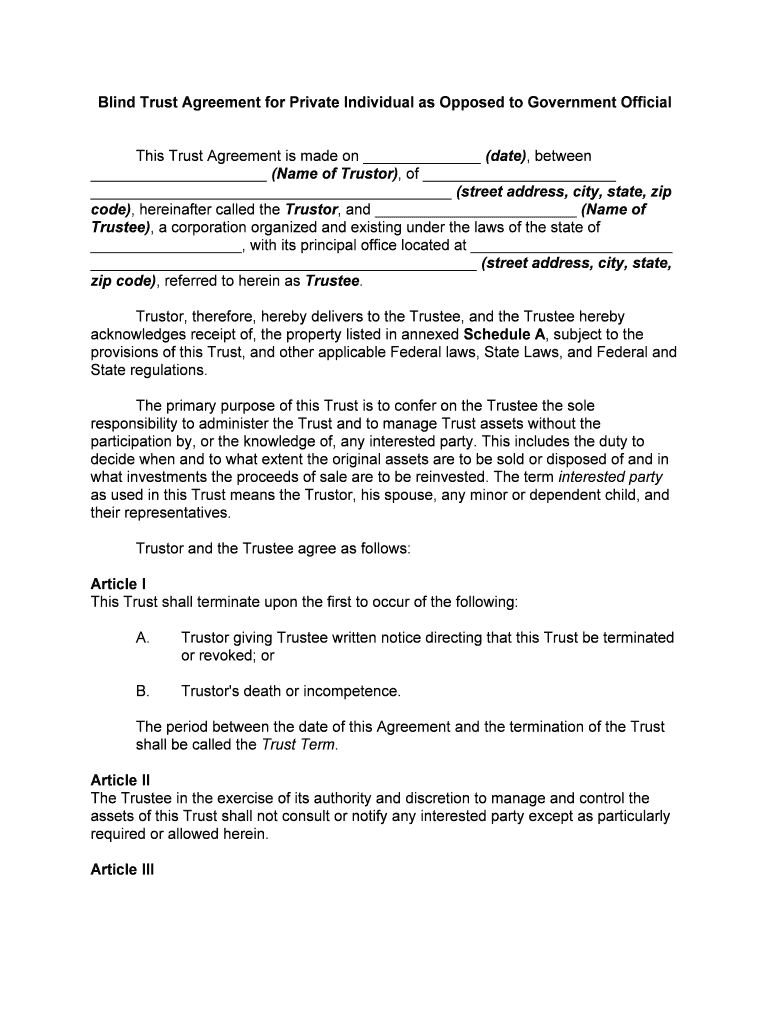

A blind trust is a financial arrangement where the trustor relinquishes control over the assets placed in the trust. This means that the individual does not have knowledge of the specific assets or transactions occurring within the trust. The purpose of a blind trust is to avoid any conflicts of interest, particularly for public officials or individuals in positions where personal interests may interfere with their duties. By using a blind trust, the trustor can ensure that their financial decisions are made independently, without personal bias.

Steps to complete the Blind Trust

Completing a blind trust involves several key steps to ensure compliance with legal requirements and to facilitate proper management of the trust assets. The process typically includes:

- Consulting with a legal professional to understand the implications and requirements of establishing a blind trust.

- Drafting a trust agreement that outlines the terms, including the powers of the trustee and the rights of the beneficiaries.

- Identifying and transferring assets into the trust, which may include cash, real estate, or investments.

- Appointing a qualified trustee who will manage the assets without input from the trustor.

- Ensuring compliance with state-specific regulations and federal guidelines regarding blind trusts.

Legal use of the Blind Trust

The legal use of a blind trust is primarily to mitigate conflicts of interest, especially for individuals in public service or those with significant financial responsibilities. It is essential to adhere to legal standards set forth by both state and federal laws. For instance, the trust must be irrevocable, meaning the trustor cannot alter the terms once established. Additionally, the trustee must act in the best interest of the beneficiaries, ensuring that all transactions are handled transparently and ethically.

Required Documents

Establishing a blind trust requires specific documentation to ensure its legality and functionality. Key documents typically include:

- Trust agreement: A legal document that outlines the terms and conditions of the trust.

- Asset transfer documents: These may include deeds, titles, or account statements to officially transfer ownership of assets into the trust.

- Identification documents: Personal identification for the trustor and trustee to verify their identities.

- Tax identification number: Necessary for tax reporting purposes, especially if the trust generates income.

Who Issues the Form

The forms related to blind trusts are typically issued by state regulatory agencies or can be drafted by legal professionals specializing in trust law. It is important to consult with a qualified attorney to ensure that the forms comply with local laws and regulations. Additionally, some states may have specific forms that need to be filed with the state government to officially recognize the blind trust.

Eligibility Criteria

To establish a blind trust, certain eligibility criteria must be met. Generally, the trustor must be an individual capable of entering into a legal agreement, which means they should be of legal age and mentally competent. Furthermore, the assets placed into the trust must be legally owned by the trustor. Individuals in positions of public trust, such as government officials, may also need to meet additional ethical standards to qualify for using a blind trust as a means to avoid conflicts of interest.

Quick guide on how to complete blind trust

Effortlessly Prepare Blind Trust on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct format and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without hold-ups. Manage Blind Trust on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related procedure today.

How to edit and eSign Blind Trust with ease

- Obtain Blind Trust and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Forget about lost or mismanaged documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Blind Trust while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a government form application, and how can airSlate SignNow help?

A government form application is a document used to request services or permissions from government authorities. airSlate SignNow simplifies this process by allowing users to create, send, and eSign government form applications quickly and securely, ensuring compliance with local regulations.

-

How does airSlate SignNow ensure the security of my government form applications?

airSlate SignNow employs advanced encryption and security measures to protect your government form applications. With features like two-factor authentication and secure cloud storage, you can trust that your sensitive information is safe throughout the signing process.

-

What are the pricing options for using airSlate SignNow for government form applications?

airSlate SignNow offers various pricing plans to suit different needs, including options for individuals, small businesses, and enterprises. Each plan provides features specifically designed to streamline the creation and management of government form applications without breaking the bank.

-

Can I integrate airSlate SignNow with other software for government form application processing?

Yes, airSlate SignNow seamlessly integrates with numerous software applications to enhance your government form application processes. Whether you use CRMs, document management systems, or cloud storage solutions, our integrations simplify the workflow and save you time.

-

What features does airSlate SignNow offer specifically for government form applications?

airSlate SignNow includes features tailored for government form applications, such as customizable templates, automated workflows, and signature tracking. These tools help ensure that your applications are completed accurately and submitted on time.

-

What are the benefits of using airSlate SignNow for government form applications?

Using airSlate SignNow for government form applications streamlines your workflow, reduces processing times, and minimizes the risk of errors. Its user-friendly interface allows you to focus on what matters, ensuring that all documents are handled efficiently and effectively.

-

Is there customer support available for users of airSlate SignNow with government form applications?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with their government form applications. Whether you have a question about features or need technical assistance, our support team is here to help you every step of the way.

Get more for Blind Trust

- First attempt at contracts flashcardsquizlet form

- Include foundation pad preparation compacting and soil boring form

- Gas pipe outlets form

- Scope of work refrigeration work involves the use of hand tools instruments and gauges form

- Scope of work drainage services may include plumbing repair work for drains sinks form

- Scope of work brick masonry is the construction process in which masons tools form

- Roofing contract pdf heilmagnetismus heil magnetismus form

- Service as per specifications from electric company overhead form

Find out other Blind Trust

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe