Legal Action Letter Form

What is the Legal Action Letter

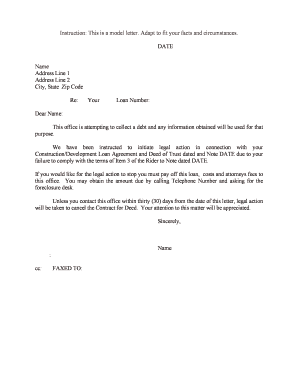

A legal action letter serves as a formal notification to a debtor regarding outstanding debts. It outlines the amount owed and the consequences of failing to pay, including potential legal action. This document is crucial for establishing a record of communication between the creditor and debtor, ensuring that all parties are aware of the situation. The letter should be clear, concise, and professional, maintaining a respectful tone while conveying the seriousness of the matter.

Key Elements of the Legal Action Letter

When drafting a legal action letter, certain key elements must be included to ensure its effectiveness:

- Contact Information: Include the creditor's name, address, and phone number, as well as the debtor's information.

- Debt Details: Clearly state the amount owed, the original creditor, and any relevant account numbers.

- Deadline for Payment: Specify a reasonable timeframe for the debtor to respond or make payment.

- Consequences of Non-Payment: Outline the potential legal actions that may be taken if the debt remains unpaid.

- Signature: The letter should be signed by the creditor or an authorized representative to lend credibility.

Steps to Complete the Legal Action Letter

Completing a legal action letter involves several important steps:

- Gather Information: Collect all necessary details about the debt, including amounts, dates, and any previous communications.

- Draft the Letter: Use a professional tone and ensure all key elements are included.

- Review for Accuracy: Double-check all information for accuracy and completeness.

- Send the Letter: Choose a method of delivery that provides proof of receipt, such as certified mail.

- Document Everything: Keep a copy of the letter and any correspondence for your records.

How to Use the Legal Action Letter

The legal action letter can be used as a final attempt to collect a debt before pursuing legal action. It serves to inform the debtor of their obligations and the potential consequences of non-compliance. This letter can also be beneficial in court, as it demonstrates that the creditor made a reasonable effort to resolve the issue amicably. It is essential to ensure that the letter is sent in compliance with applicable laws and regulations to avoid any illegal debt collection practices.

Examples of Using the Legal Action Letter

Examples of scenarios where a legal action letter may be utilized include:

- A business attempting to collect overdue invoices from a client.

- A landlord notifying a tenant of unpaid rent.

- A creditor addressing a consumer who has defaulted on a loan.

In each case, the letter should be tailored to the specific circumstances, ensuring that all relevant details are included.

Legal Use of the Legal Action Letter

To ensure the legal action letter is used appropriately, it must adhere to federal and state regulations regarding debt collection. This includes compliance with the Fair Debt Collection Practices Act (FDCPA), which outlines acceptable practices for debt collectors. The letter should not contain any misleading information or threats that could be considered harassment. By following legal guidelines, creditors can protect themselves from potential legal repercussions and maintain a professional approach to debt collection.

Quick guide on how to complete legal action letter

Finalize Legal Action Letter seamlessly on any gadget

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the right template and securely preserve it online. airSlate SignNow equips you with all the tools necessary to generate, edit, and eSign your documents swiftly without delays. Handle Legal Action Letter on any gadget using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Legal Action Letter effortlessly

- Obtain Legal Action Letter and then click Get Form to begin.

- Leverage the tools we provide to fill out your form.

- Emphasize pertinent parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Legal Action Letter and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the cmre collection agency and how does it work?

The cmre collection agency specializes in debt recovery and management solutions that help businesses efficiently collect outstanding payments. By utilizing advanced technologies and a dedicated team, the cmre collection agency streamlines the collection process, ensuring timely communication with debtors.

-

What features does the cmre collection agency offer?

The cmre collection agency provides a range of features including automated debt reminders, performance tracking, and detailed reporting tools. These features empower businesses to manage their collections effectively while maintaining transparency and control over the process.

-

How much does the cmre collection agency cost?

Pricing for the cmre collection agency varies based on service levels and the specific needs of your business. Typically, the cmre collection agency offers competitive rates that are designed to be budget-friendly while maximizing your debt recovery efforts.

-

What are the benefits of using the cmre collection agency?

Using the cmre collection agency can signNowly enhance your cash flow by improving the rate of successful debt recovery. Additionally, their professional approach minimizes potential disputes, helping to maintain positive relationships with your clients while resolving outstanding debts.

-

Can the cmre collection agency integrate with other business software?

Yes, the cmre collection agency offers integration capabilities with various business software solutions, including CRM systems and accounting software. This ensures that you can synchronize data seamlessly and manage your collections alongside other critical business functions.

-

How does the cmre collection agency ensure compliance with regulations?

The cmre collection agency adheres to all relevant laws and regulations governing debt collection practices. Their team is trained in compliance matters, ensuring that your business operates within legal boundaries while pursuing debt recovery on your behalf.

-

Is there a minimum debt amount that the cmre collection agency will handle?

The cmre collection agency is flexible and can handle various debt amounts, catering to businesses of all sizes. Whether you have small or large debts to collect, the cmre collection agency is equipped to manage your collection needs efficiently.

Get more for Legal Action Letter

- Gun license vic form

- Dhs 3340 eng asset assessment for medical assistance for long term care services ma ltc form is used by a married person who

- Dog training contract template form

- Cbp form 434

- Health insurance information form

- Marijuana premises boundary sketch form

- Cars 511 request form iowa dot forms

- Sumter county florida homestead exemption application form

Find out other Legal Action Letter

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now