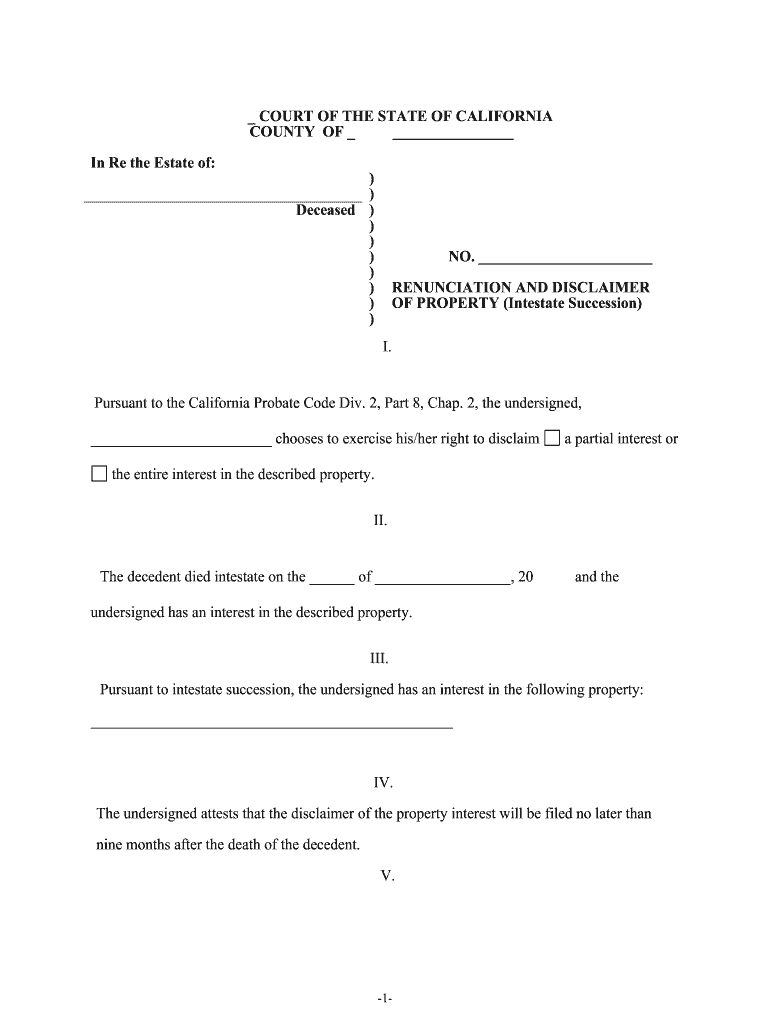

Intestate Succession California Form

What is intestate succession in California

Intestate succession in California refers to the legal process that determines how a deceased person's assets are distributed when they die without a valid will. Under California law, the estate is divided among the deceased's heirs according to a specific hierarchy. This process ensures that the property is passed on to family members, typically starting with the spouse and children. If there are no direct descendants, the estate may go to parents, siblings, or more distant relatives. Understanding intestate succession is crucial for anyone looking to navigate property distribution in the absence of a will.

Steps to complete intestate succession in California

Completing intestate succession in California involves several key steps to ensure proper distribution of the estate. First, it is essential to determine whether the deceased had any outstanding debts, as these must be settled before distributing assets. Next, the executor or administrator of the estate must file a petition for probate in the appropriate court, which includes providing details about the deceased's assets and heirs. Once the court approves the petition, the executor can begin the process of inventorying the estate, notifying creditors, and ultimately distributing the assets according to California's intestate succession laws. Each step requires careful attention to detail to ensure compliance with legal requirements.

Key elements of intestate succession in California

Several key elements define intestate succession in California. The first element is the hierarchy of heirs, which dictates who inherits the estate. Spouses and children are given priority, followed by parents and siblings. Another important element is the concept of community property, which applies to assets acquired during marriage. These assets are typically divided equally between the surviving spouse and the deceased's estate. Additionally, California law outlines specific procedures for handling real property, personal property, and debts, ensuring a structured approach to asset distribution. Understanding these elements helps heirs navigate the complexities of intestate succession.

Required documents for intestate succession in California

When initiating intestate succession in California, specific documents are necessary to facilitate the process. Key documents include the death certificate of the deceased, which verifies their passing, and a petition for probate, which outlines the request for the court to oversee the estate. Additionally, an inventory of the deceased's assets, including real estate, bank accounts, and personal property, is required. If applicable, documents related to debts or liabilities must also be submitted. Gathering these documents in advance can streamline the probate process and ensure compliance with California laws.

Legal use of intestate succession in California

The legal use of intestate succession in California is governed by state laws that dictate how an estate is to be distributed when there is no will. This process is essential for protecting the rights of heirs and ensuring that the deceased's assets are allocated fairly among surviving family members. The law provides a clear framework to resolve disputes and clarify the distribution of property, which can help prevent conflicts among heirs. Understanding the legal implications of intestate succession is vital for anyone involved in the estate administration process.

State-specific rules for intestate succession in California

California has specific rules governing intestate succession that differ from other states. One notable rule is the community property law, which states that assets acquired during marriage are jointly owned by both spouses. In the absence of a will, these assets are divided equally between the surviving spouse and the deceased's estate. Additionally, California law allows for a simplified probate process for small estates, which can expedite the distribution of assets. Familiarity with these state-specific rules is crucial for heirs and executors to navigate the intestate succession process effectively.

Quick guide on how to complete intestate succession california

Complete Intestate Succession California effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely retain it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Intestate Succession California on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Intestate Succession California with ease

- Find Intestate Succession California and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether it be via email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Intestate Succession California and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is California intestate succession?

California intestate succession refers to the legal process that determines how a deceased person's assets are distributed when they die without a valid will. Under California law, the estate is passed to the deceased's relatives based on a specific hierarchy. Understanding this process is crucial for anyone navigating estate planning in California, especially if you want to avoid accidental intestate succession.

-

How does e-signing documents relate to California intestate?

E-signing documents plays a vital role in the estate planning process in California intestate cases. By using airSlate SignNow, individuals can easily sign and send estate planning documents in a secure and legally binding manner. This ensures that your wishes are clearly communicated, potentially preventing intestate situations.

-

What are the benefits of using airSlate SignNow for California intestate documents?

Using airSlate SignNow for handling California intestate documents offers several benefits, including streamlined document management, secure e-signatures, and comprehensive compliance with California laws. The platform simplifies the signing process, allowing users to focus on more important matters, such as their loved ones and their legacies. With its cost-effective solutions, airSlate SignNow is an excellent choice for estate planning.

-

What features does airSlate SignNow provide for estate planning?

airSlate SignNow provides a range of features ideal for estate planning, such as customizable templates, automated workflows, and secure cloud storage. These features allow users to create, manage, and e-sign necessary documents related to California intestate affairs easily. The platform’s user-friendly interface ensures that even those unfamiliar with technology can navigate it seamlessly.

-

Are there any integrations available with airSlate SignNow relevant to California intestate?

Yes, airSlate SignNow integrates with various platforms such as Google Drive, Dropbox, and Microsoft, making it easier to store and manage your California intestate documents. These integrations enable users to access their documents from anywhere, facilitating smoother collaboration and ensuring that everything is organized and accessible. This feature is particularly useful when dealing with multiple stakeholders in an intestate case.

-

How does pricing work for airSlate SignNow for California intestate users?

airSlate SignNow offers flexible pricing options suitable for various users, including those dealing with California intestate matters. The platform provides a range of plans that cater to individuals, small businesses, and larger organizations. Each plan is designed to deliver value, ensuring that users can choose a solution that fits their needs while managing the complexities of intestate succession.

-

Can airSlate SignNow help avoid issues related to California intestate laws?

Yes, using airSlate SignNow can help individuals avoid potential issues related to California intestate laws. By facilitating the creation and signing of valid estate planning documents, the platform can help ensure that your wishes are clearly documented and legally recognized. This proactive approach mitigates the risk of an intestate situation arising in the future.

Get more for Intestate Succession California

Find out other Intestate Succession California

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA