Florida Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children Form

What is the Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children

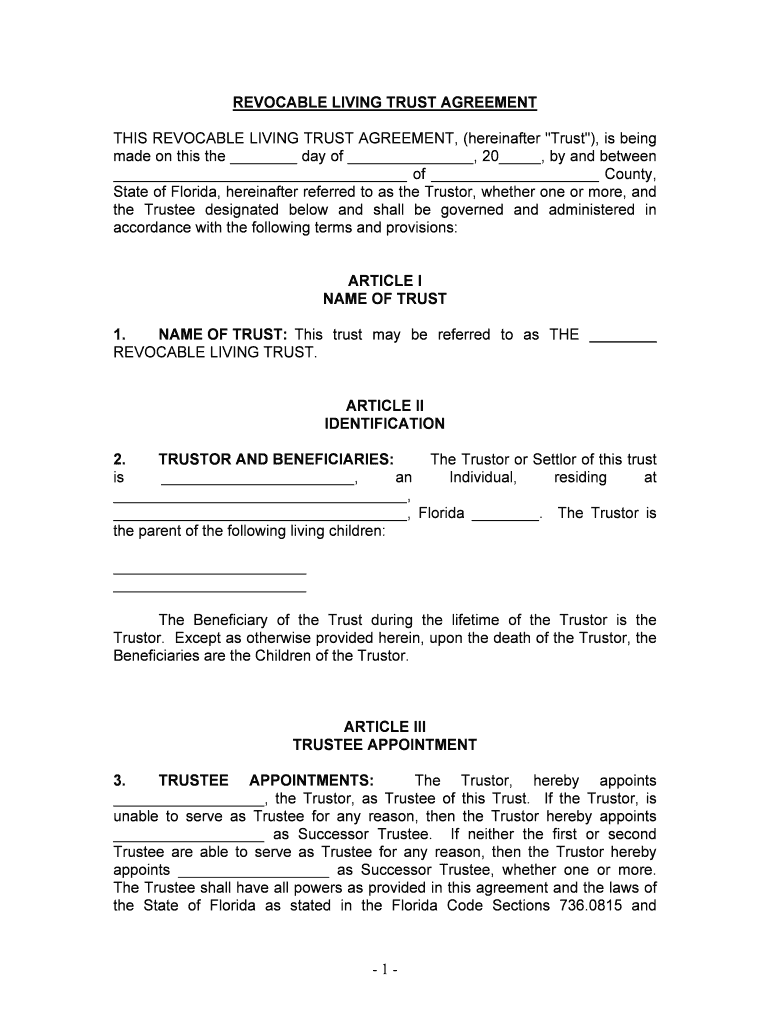

The Florida Living Trust for individuals who are single, divorced, or widowed with children is a legal document designed to manage and distribute a person's assets after their death. This type of trust allows the individual to maintain control over their assets while providing for their children. It can help avoid the probate process, ensuring that the assets are transferred directly to the beneficiaries without court intervention. Additionally, this trust can outline specific wishes regarding asset distribution, guardianship for minor children, and management of the trust until the children reach a specified age.

Key Elements of the Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children

Several key elements define the Florida Living Trust for individuals in specific circumstances. These include:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or institution responsible for managing the trust. The grantor can also serve as the trustee during their lifetime.

- Beneficiaries: The individuals, often the children, who will receive the trust assets upon the grantor's death.

- Terms of Distribution: Specific instructions on how and when the assets will be distributed to the beneficiaries.

- Guardianship Provisions: Instructions for the care of minor children, should the grantor pass away.

Steps to Complete the Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children

Completing a Florida Living Trust involves several essential steps:

- Identify Assets: List all assets to be included in the trust, such as real estate, bank accounts, and personal property.

- Select a Trustee: Choose a trustworthy individual or institution to manage the trust.

- Draft the Trust Document: Create the trust document outlining the terms, beneficiaries, and distribution methods.

- Transfer Assets: Legally transfer ownership of the identified assets into the trust.

- Review and Update: Regularly review the trust to ensure it reflects any changes in circumstances or wishes.

Legal Use of the Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children

The legal use of a Florida Living Trust is primarily to manage and distribute assets upon the grantor's death. This trust is recognized under Florida law and provides a legally binding framework for asset management. It allows for a seamless transfer of assets to beneficiaries, bypassing the probate process, which can be lengthy and costly. Additionally, the trust can provide instructions for the care of minor children, ensuring that their needs are met according to the grantor's wishes.

How to Obtain the Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children

Obtaining a Florida Living Trust typically involves consulting with an attorney who specializes in estate planning. The attorney can help draft the trust document tailored to the individual's needs. Alternatively, there are online services that provide templates and guidance for creating a living trust. It is essential to ensure that any document complies with Florida state laws to be legally valid.

State-Specific Rules for the Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children

Florida has specific laws governing living trusts, including requirements for execution and validity. The trust document must be signed by the grantor and may need to be notarized to ensure its legal standing. Additionally, Florida law allows for flexible terms regarding asset management and distribution, which can be customized to meet the grantor's unique circumstances. Understanding these state-specific rules is crucial for ensuring that the trust operates as intended.

Quick guide on how to complete florida living trust for individual who is single divorced or widow or widower with children

Complete Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children effortlessly on any device

Online document organization has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the correct form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly and without hold-ups. Manage Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children on any platform using the airSlate SignNow Android or iOS applications, and enhance any document-centric procedure today.

How to modify and electronically sign Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children with ease

- Obtain Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Select how you wish to deliver your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children to ensure effective communication at every phase of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Florida Living Trust for Individuals who are Single, Divorced, or Widowed with Children?

A Florida Living Trust for Individuals who are Single, Divorced, or Widowed with Children is a legal document that allows you to manage your assets during your lifetime and efficiently transfer them to your beneficiaries upon your death. This type of trust helps ensure that your children receive their inheritance while avoiding the lengthy probate process.

-

How does a Florida Living Trust benefit single, divorced, or widowed individuals with children?

This trust offers several benefits for single, divorced, or widowed individuals with children, such as protecting your assets from probate and providing a clear plan for asset distribution. It can help maintain privacy, as trusts are not public records, and can also safeguard your children’s inheritance in cases where they may not be of legal age to manage the assets.

-

What are the costs associated with setting up a Florida Living Trust?

The costs of setting up a Florida Living Trust can vary depending on the complexity of your assets and family situation. Typically, legal fees for drafting the trust can range from a few hundred to a few thousand dollars. However, considering the long-term benefits, including potential savings from avoiding probate, many find this an economical choice.

-

Can I customize my Florida Living Trust for my unique needs?

Yes, a Florida Living Trust allows for a signNow degree of customization to meet your specific needs. You can designate who manages the trust, specify how assets will be distributed among your children, and include special provisions for care or education. Working with a knowledgeable attorney can help you tailor the trust effectively.

-

Can I change or revoke my Florida Living Trust later?

Yes, one of the key features of a Florida Living Trust is its flexibility. As your circumstances or wishes change, you have the ability to modify or revoke the trust entirely. It's advisable to periodically review and update your trust to ensure it continues to meet your intentions.

-

What happens to my Florida Living Trust when I pass away?

Upon your passing, a Florida Living Trust generally allows for a seamless transition of assets to your beneficiaries without going through probate court. The appointed trustee will manage the distribution of assets according to your specified instructions, ensuring your children receive their inheritance as you intended.

-

How does airSlate SignNow support the creation of a Florida Living Trust?

airSlate SignNow provides an easy-to-use, cost-effective solution for managing your Florida Living Trust documents. With electronic signatures and document management features, you can collaborate with your attorney or family members efficiently. This streamlines the process, making it simpler to set up and maintain your trust.

Get more for Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children

- Form 150 petition for adoption family court of the state

- Full text of ampquotbiographical and genealogical history of the form

- Protection from abuse order attorneysnewark delaware de form

- In the interest of include form

- Praecipe form 2

- Praecipe form 3

- Divorceannulment family court delaware courts state of form

- Evictions what you should know lscd legal services form

Find out other Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document