Texas Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate Form

What is the Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate

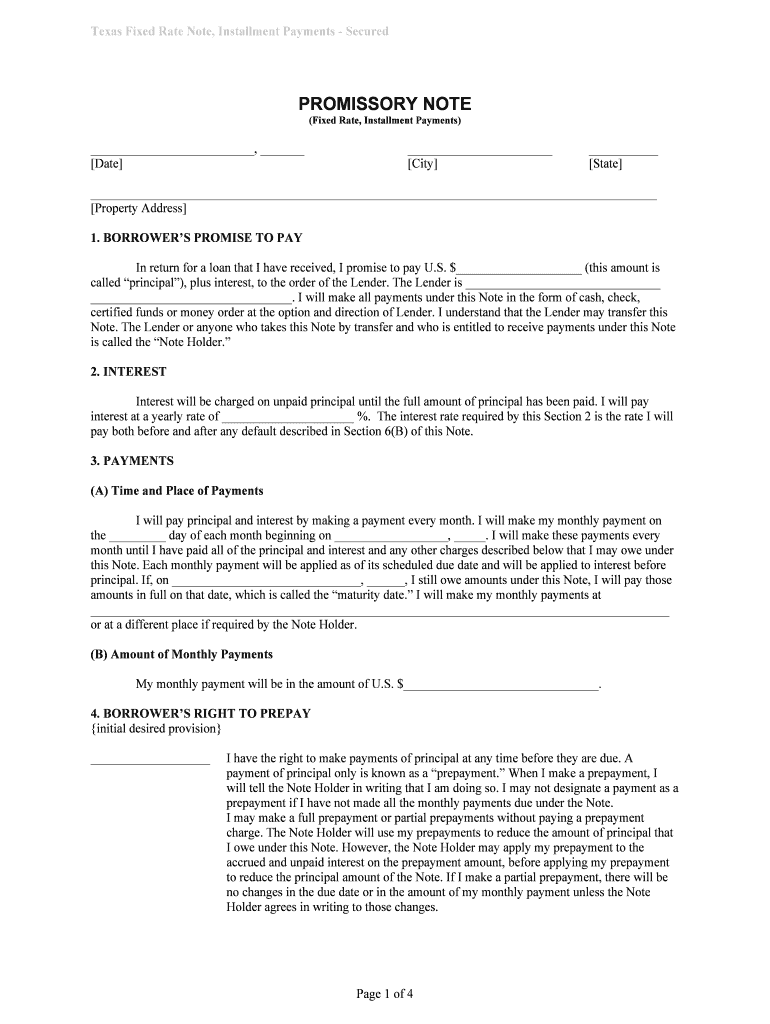

The Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines the terms of a loan secured by residential property. This type of promissory note specifies the repayment schedule, interest rate, and consequences of default. It is crucial for both lenders and borrowers to understand the obligations and rights established within this document, as it serves as a binding agreement in the state of Texas.

Key Elements of the Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Several key elements define the Texas Texas Installments Fixed Rate Promissory Note. These include:

- Principal Amount: The total amount being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the principal.

- Payment Schedule: Details about how and when payments are to be made.

- Collateral: The residential real estate that secures the loan.

- Default Clauses: Conditions under which the lender can take action if the borrower fails to meet their obligations.

Steps to Complete the Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Completing the Texas Texas Installments Fixed Rate Promissory Note involves several important steps:

- Gather Information: Collect all necessary details about the loan, including the principal amount and interest rate.

- Fill Out the Form: Accurately enter the information into the promissory note template.

- Review Terms: Ensure all terms are clear and acceptable to both parties.

- Sign the Document: Both the lender and borrower must sign the note, either physically or electronically.

- Store the Document: Keep a copy of the signed note for your records.

Legal Use of the Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate

This promissory note is legally binding when executed in accordance with Texas law. To ensure its enforceability, it must meet specific requirements such as proper signatures and adherence to state regulations. Understanding these legal aspects is essential for both parties to protect their interests and ensure compliance with applicable laws.

How to Use the Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Using the Texas Texas Installments Fixed Rate Promissory Note involves several practical applications:

- Loan Transactions: It is commonly used in transactions where a borrower needs to secure funding for purchasing or refinancing residential real estate.

- Documentation of Terms: The note serves as formal documentation of the loan terms, protecting both the lender and borrower.

- Enforcement of Rights: In case of non-payment, the lender can refer to the note to enforce their rights regarding the collateral.

State-Specific Rules for the Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Texas has specific rules governing the use of promissory notes secured by real estate. These include requirements for notarization, witness signatures, and compliance with state lending laws. Familiarity with these regulations is crucial for ensuring that the document is valid and enforceable in the event of a dispute.

Quick guide on how to complete texas texas installments fixed rate promissory note secured by residential real estate

Complete Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate effortlessly on any device

Web-based document management has gained traction with businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate without hassle

- Locate Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact confidential information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate the issues of lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate while ensuring exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

A Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines a borrower's promise to repay a fixed amount of money over a set installment period, backed by residential property. This type of note provides a clear repayment structure, ensuring both lenders and borrowers understand their obligations.

-

How does airSlate SignNow facilitate the creation of a Texas Texas Installments Fixed Rate Promissory Note?

airSlate SignNow enables users to effortlessly create a Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate through a user-friendly interface. Our platform provides templates and customizable options that help streamline the drafting process, making it accessible for everyone.

-

What are the benefits of using a Fixed Rate Promissory Note?

Utilizing a Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate ensures that borrowers have predictable monthly payments, which helps with budgeting. Additionally, it offers lenders security since the note is backed by valuable property, reducing risk.

-

What is the cost of eSigning a Texas Texas Installments Fixed Rate Promissory Note?

The cost of eSigning a Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate with airSlate SignNow is competitive and designed to provide value to users. Our pricing plans are flexible, allowing businesses to choose options that fit their needs without compromising on features.

-

Can I integrate airSlate SignNow with other tools for managing my promissory notes?

Yes, airSlate SignNow offers seamless integrations with various business applications, enhancing your experience in managing Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate. This allows users to synchronize data and automate workflows across multiple platforms.

-

Is my data secure when using airSlate SignNow for eSigning?

Absolutely! When using airSlate SignNow to eSign a Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate, your data is protected with industry-leading security measures. We utilize encryption and compliance protocols to ensure that your information remains confidential and secure.

-

How can a Texas Texas Installments Fixed Rate Promissory Note benefit real estate transactions?

In real estate transactions, a Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate offers clarity and assurance to both parties. It allows for staggered payments while providing the lender with a claim on the property, thereby facilitating smoother and more secure transactions.

Get more for Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- Be it remembered that on this date form

- Form 520a

- Title 10 courts and judicial procedure form

- Basic divorce packet 1 forms

- Prenuptial agreement attorneysnewark delaware de form

- A proceeding involving the above captioned case having been previously filed in this form

- Petition for the appointment of a guardian of the person of an alleged disabled person form

- Co guardians of the person and property form

Find out other Texas Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer