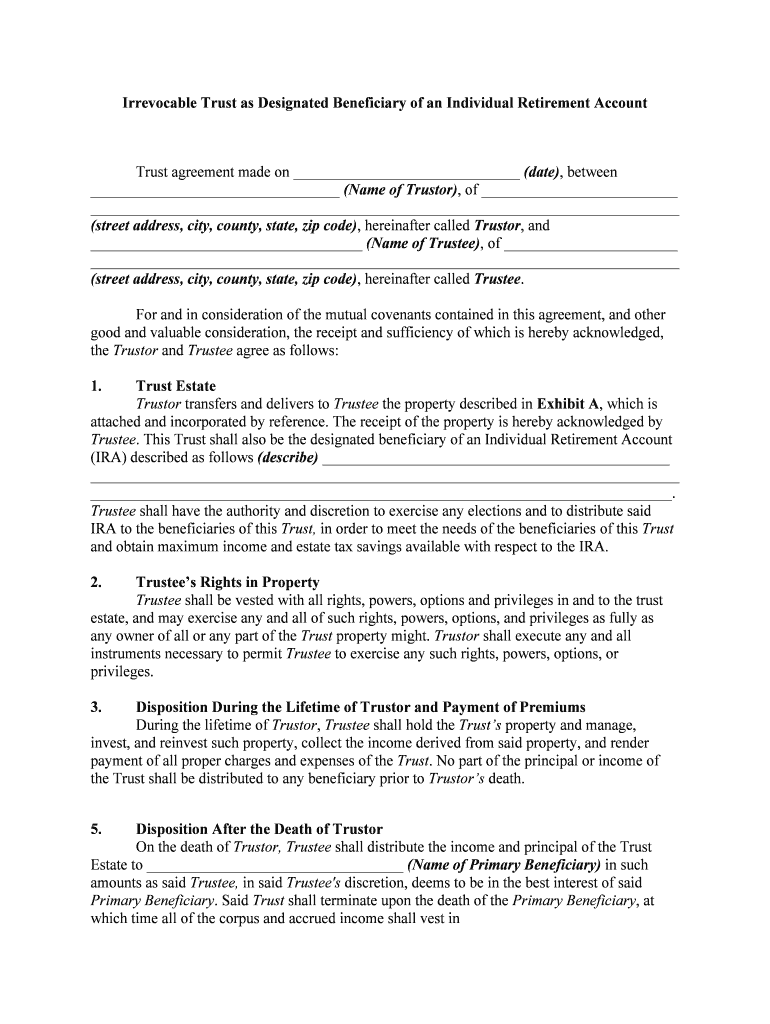

Beneficiary Account Form

What is the Beneficiary Account

A beneficiary account is a financial account established to benefit a designated individual or entity upon the account holder's death. This type of account allows for the seamless transfer of assets without the need for probate, making it a popular choice for estate planning. Beneficiary accounts can include various types of funds, such as trust beneficiary accounts, retirement accounts, and other investment accounts. The key advantage is that the beneficiary can access the funds directly, ensuring a quicker and more efficient transfer of wealth.

How to Use the Beneficiary Account

Using a beneficiary account involves a few straightforward steps. First, the account holder must designate a beneficiary by filling out the appropriate forms provided by the financial institution. This designation should be reviewed periodically to ensure it reflects the account holder's current wishes. Once the account holder passes away, the beneficiary can claim the assets by presenting the required documentation, such as a death certificate and identification, to the financial institution. This process simplifies the transfer of assets and avoids lengthy probate procedures.

Steps to Complete the Beneficiary Account

Completing a beneficiary account involves several essential steps:

- Choose the type of account: Determine whether it will be a trust beneficiary account, retirement account, or another type.

- Designate a beneficiary: Fill out the beneficiary designation form accurately, ensuring the information is up to date.

- Review regularly: Periodically check the designation to ensure it aligns with your current intentions.

- Provide necessary documentation: Ensure all required documents are submitted to the financial institution, including identification and any specific forms they may require.

Legal Use of the Beneficiary Account

The legal use of a beneficiary account is governed by state laws and federal regulations. It is crucial to ensure that the account complies with relevant legal frameworks, such as the Uniform Transfer on Death Security Registration Act (UTODRA) in many states. This act allows for the transfer of securities without probate. Additionally, understanding the tax implications, such as irrevocable trust beneficiary taxes, is vital to ensure compliance and avoid penalties. Consulting with a legal professional can provide clarity on these aspects.

Required Documents

To establish and manage a beneficiary account, several documents may be required:

- Beneficiary designation form: This form specifies who will receive the assets upon the account holder's death.

- Identification: A government-issued ID may be necessary for both the account holder and the beneficiary.

- Death certificate: This document is essential for the beneficiary to claim the assets after the account holder's passing.

- Trust documents: If the beneficiary account is part of a trust, relevant trust documents must be provided.

Eligibility Criteria

Eligibility for establishing a beneficiary account typically includes being of legal age, having the mental capacity to make financial decisions, and possessing the necessary documentation. Additionally, the account holder must ensure that the beneficiary meets any specific requirements set forth by the financial institution. This may include restrictions on who can be named as a beneficiary, such as family members or charitable organizations.

Quick guide on how to complete beneficiary account

Finalize Beneficiary Account effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Beneficiary Account on any platform using airSlate SignNow Android or iOS applications and simplify your document-centric operations today.

How to edit and eSign Beneficiary Account effortlessly

- Locate Beneficiary Account and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors requiring new document prints. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Beneficiary Account to maintain excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a trust beneficiary account?

A trust beneficiary account is a financial account established to hold assets for the benefit of a designated beneficiary. It ensures that the funds are managed according to the wishes of the trust creator. This account provides a way to securely transfer wealth while complying with legal obligations.

-

How does airSlate SignNow facilitate documents related to trust beneficiary accounts?

airSlate SignNow allows users to send and eSign documents related to trust beneficiary accounts seamlessly. This includes wills, trust agreements, and beneficiary designations, making the documentation process quick and efficient. Our platform ensures that all electronic signatures are legally binding.

-

Is there a cost associated with managing a trust beneficiary account using airSlate SignNow?

Using airSlate SignNow to manage documents related to trust beneficiary accounts is cost-effective. Our pricing plans are designed to accommodate businesses of all sizes, offering flexible options that ensure you receive value without breaking the bank. Consider our affordable subscription plans for your document management needs.

-

What features does airSlate SignNow offer for trust beneficiary accounts?

airSlate SignNow provides features such as customizable templates, secure storage, and real-time tracking for documents related to trust beneficiary accounts. These features enhance efficiency and provide peace of mind, ensuring that all your documents are easily accessible and properly managed. The platform is user-friendly, making it suitable for all users.

-

Can I integrate airSlate SignNow with my existing systems for trust beneficiary accounts?

Yes, airSlate SignNow offers integration capabilities with various systems to manage trust beneficiary accounts effectively. You can easily connect with CRMs, cloud storage solutions, and other document management systems. This flexibility helps streamline your workflow and enhances productivity.

-

How secure is airSlate SignNow for trust beneficiary accounts?

airSlate SignNow prioritizes security, especially for sensitive documents related to trust beneficiary accounts. We use industry-leading encryption and comply with regulatory standards to protect your data. Rest assured that your information is secure and only accessible to authorized users.

-

What benefits does using airSlate SignNow provide for trust beneficiary accounts?

Using airSlate SignNow for trust beneficiary accounts streamlines the eSignature process, saving time and reducing errors. With features like secure document storage and easy sharing, the platform enhances collaboration among stakeholders. Additionally, it simplifies compliance with legal requirements.

Get more for Beneficiary Account

- Restor of drivg priv 2 12final 2 form

- In the supreme court of the state of delaware appellant v form

- Pursuant to rule 110 of the rules of the court of chancery the following form

- County new castle kent sussex state of delaware form

- Justia mediation conference statement delaware form

- Page 1 of 4 united states courts form

- Motion to be relieved as bondsperson form

- Pursuant to supreme court rules 20 26 and 30 i 6 declare form

Find out other Beneficiary Account

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure