Illinois Widow Form

What is the Illinois Widow

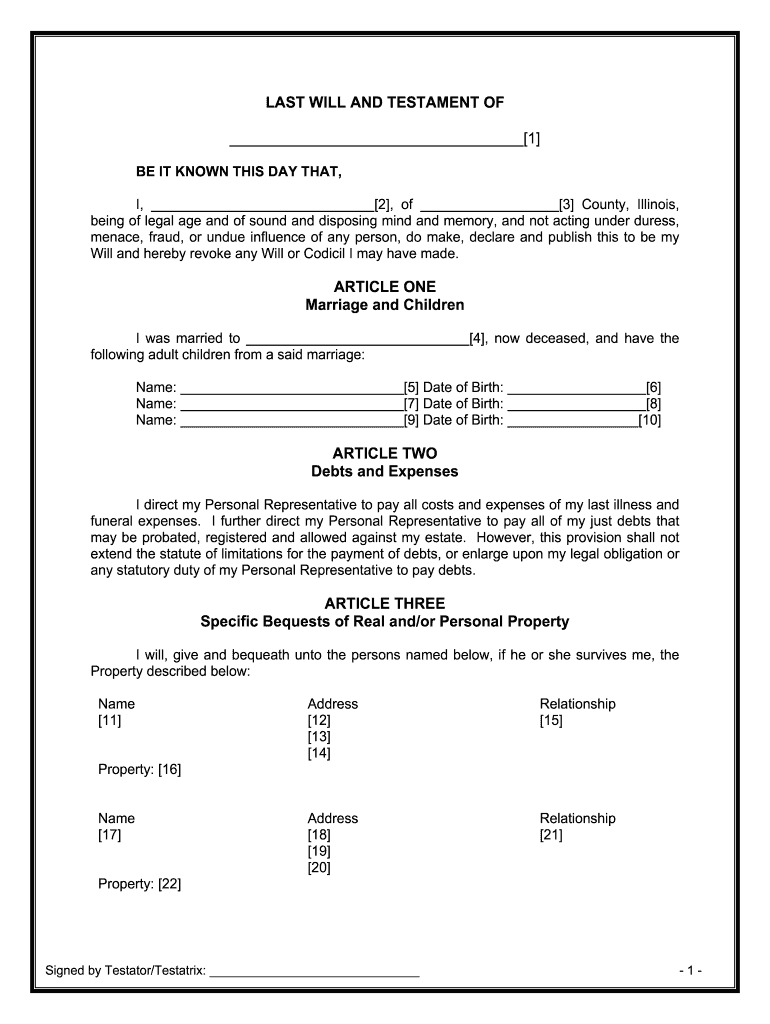

The Illinois Widow form is a legal document designed for individuals who have lost their spouse and need to manage various financial and legal affairs. This form is often associated with estate planning, tax filings, and other administrative tasks that may arise after the death of a partner. It allows the surviving spouse to address issues related to inheritance, benefits, and tax obligations effectively.

How to use the Illinois Widow

To use the Illinois Widow form, the individual must first gather all necessary documentation related to their spouse's estate and any relevant financial information. This may include death certificates, marriage certificates, and previous tax returns. Once the required documents are collected, the form can be completed either digitally or on paper, ensuring all information is accurate and up-to-date. After filling out the form, it should be submitted to the appropriate authorities, such as the state tax department or probate court, depending on the specific requirements.

Steps to complete the Illinois Widow

Completing the Illinois Widow form involves several key steps:

- Collect necessary documents, including identification and financial records.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Sign the form electronically or in person, depending on the submission method.

- Submit the completed form to the relevant agency or authority.

Legal use of the Illinois Widow

The Illinois Widow form is legally binding when completed in accordance with state laws and regulations. It is essential to ensure that the form adheres to the guidelines set forth by the Illinois government, including proper signatures and notarization if required. Compliance with these legal standards ensures that the form will be accepted by courts and other institutions, protecting the rights of the surviving spouse.

Key elements of the Illinois Widow

Several key elements must be included in the Illinois Widow form to ensure its validity:

- Full name and contact information of the surviving spouse.

- Details regarding the deceased spouse, including name and date of death.

- Information about any assets, liabilities, and beneficiaries.

- Signatures of the surviving spouse and any required witnesses.

State-specific rules for the Illinois Widow

Illinois has specific rules governing the use of the Widow form. These rules dictate how the form must be filled out, submitted, and processed. It is important for individuals to familiarize themselves with these regulations, as they can vary significantly from other states. For example, certain deadlines may apply for filing the form, and additional documentation may be required based on the circumstances surrounding the deceased spouse's estate.

Required Documents

When completing the Illinois Widow form, several documents are typically required to support the submission:

- Death certificate of the deceased spouse.

- Marriage certificate to verify the relationship.

- Financial documents, such as bank statements and tax returns.

- Any legal documents related to the deceased's estate, such as wills or trusts.

Quick guide on how to complete illinois widow

Complete Illinois Widow seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without delays. Handle Illinois Widow on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Illinois Widow effortlessly

- Find Illinois Widow and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Illinois Widow while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it assist an Illinois widow?

airSlate SignNow is a secure eSignature platform that helps an Illinois widow manage important documents easily. By utilizing this solution, you can ensure that wills, trusts, and other legal documents are signed and stored digitally, providing peace of mind and accessibility.

-

What features does airSlate SignNow offer for an Illinois widow?

airSlate SignNow offers features such as document signing, templates, and workflow automation tailored for an Illinois widow's legal needs. With intuitive tools, you can easily prepare, send, and track documents, ensuring a smooth experience during challenging times.

-

Is airSlate SignNow affordable for an Illinois widow?

Yes, airSlate SignNow offers competitive pricing plans that cater specifically to an Illinois widow's budget. These plans provide flexibility and cost-effectiveness without compromising on essential features, making document management accessible.

-

How does airSlate SignNow protect sensitive information for an Illinois widow?

airSlate SignNow prioritizes security with advanced encryption and compliance with eSignature laws, ensuring that an Illinois widow's personal information remains protected. You can confidently sign and store legally binding documents without worrying about data bsignNowes.

-

Can an Illinois widow integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers integrations with various popular applications, enhancing functionality for an Illinois widow. Whether you need to connect with cloud storage, CRM systems, or document management tools, seamless integration is available.

-

What benefits does airSlate SignNow provide for an Illinois widow dealing with legal documents?

For an Illinois widow, airSlate SignNow simplifies the process of managing legal documents, saving time and reducing stress. The platform streamlines signing processes and provides notifications, ensuring that important tasks are not overlooked during difficult times.

-

Is it easy to use airSlate SignNow for an Illinois widow unfamiliar with technology?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for an Illinois widow who may not be tech-savvy. Its straightforward interface and clear instructions allow anyone to navigate the platform with ease.

Get more for Illinois Widow

- Individual to individual with reserved life estate in form

- Control number fl 029 78 form

- Sold horse disclaimer studylib form

- Control number fl 03 82 form

- This form should be used when a husband and wife are filing for a simplified dissolution of marriage

- This will acknowledge your request for the forms and instructions to form a florida limited liability company

- Control number fl 031 77 form

- Eight 8 individuals to one 1 individual form

Find out other Illinois Widow

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT