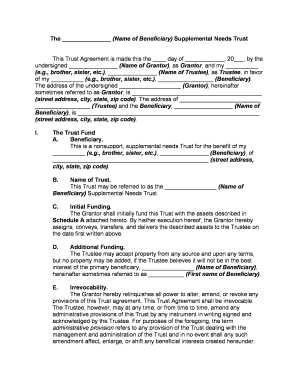

Supplemental Needs Trust Form

What is the Supplemental Needs Trust

A Supplemental Needs Trust (SNT) is a special type of trust designed to benefit individuals with disabilities while preserving their eligibility for government assistance programs, such as Medicaid and Supplemental Security Income (SSI). This trust allows assets to be set aside for the individual’s benefit without jeopardizing their access to these essential services. In New York, the creation and management of an SNT must adhere to specific state laws and regulations to ensure compliance and effectiveness.

How to use the Supplemental Needs Trust

Using a Supplemental Needs Trust involves several key steps. First, the trust must be established by a grantor, typically a parent or guardian of the individual with disabilities. Once created, the trust can receive funds or assets that are designated for the beneficiary's supplemental needs. These may include medical expenses not covered by insurance, educational costs, and other quality-of-life enhancements. The trustee, who manages the trust, must ensure that distributions do not interfere with the beneficiary's eligibility for public assistance programs.

Steps to complete the Supplemental Needs Trust

Completing a Supplemental Needs Trust involves a series of steps:

- Determine the need for a trust based on the beneficiary's circumstances.

- Consult with an attorney experienced in special needs planning to draft the trust document.

- Identify the assets to be placed in the trust.

- Designate a reliable trustee to manage the trust.

- Execute the trust document according to New York state laws.

Legal use of the Supplemental Needs Trust

The legal use of a Supplemental Needs Trust in New York is governed by specific statutes that outline how the trust must be structured and administered. It is critical that the trust be irrevocable, meaning it cannot be altered or revoked once established. This ensures that the assets within the trust are not counted as resources for government benefits. Additionally, the trust must clearly state how funds can be used to benefit the individual without affecting their eligibility for public assistance.

Key elements of the Supplemental Needs Trust

Key elements of a Supplemental Needs Trust include:

- Irrevocability: The trust must be irrevocable to protect assets from being counted against government benefit limits.

- Trustee Responsibilities: The trustee must manage the trust according to the terms set forth in the trust document and in the best interest of the beneficiary.

- Permissible Expenses: The trust can cover expenses that enhance the beneficiary's quality of life without affecting their eligibility for SSI or Medicaid.

State-specific rules for the Supplemental Needs Trust

In New York, there are specific rules that govern the establishment and operation of Supplemental Needs Trusts. These rules dictate how the trust must be funded, the qualifications for the beneficiary, and the reporting requirements. It is essential to comply with these regulations to ensure that the trust remains effective and that the beneficiary continues to receive necessary public assistance. Consulting with a legal expert familiar with New York's laws is advisable to navigate these requirements successfully.

Quick guide on how to complete supplemental needs trust

Complete Supplemental Needs Trust seamlessly on any device

Web-based document management has grown increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, adjust, and eSign your documents quickly without delays. Manage Supplemental Needs Trust on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Supplemental Needs Trust effortlessly

- Obtain Supplemental Needs Trust and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Supplemental Needs Trust and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a supplemental needs trust in New York?

A supplemental needs trust in New York is a financial tool designed to assist individuals with disabilities without jeopardizing their eligibility for government benefits. This trust allows funds to be used for additional care and services, enhancing the quality of life while maintaining essential public assistance.

-

How can a supplemental needs trust benefit my family in New York?

Establishing a supplemental needs trust in New York can provide critical financial support for your loved one with disabilities, ensuring they have access to necessary services and resources. This trust helps to cover expenses that government programs may not fully fund, creating a more comfortable living situation while protecting your family’s overall financial health.

-

What are the costs associated with setting up a supplemental needs trust in New York?

The costs to create a supplemental needs trust in New York can vary depending on factors like attorney fees and the complexity of the trust. Generally, it’s advisable to consult with a legal professional to understand the potential expenses, which can range from a few hundred to several thousand dollars, depending on your unique situation.

-

How do I establish a supplemental needs trust in New York?

To establish a supplemental needs trust in New York, you typically need to work with an attorney who specializes in estate planning and disability law. The process involves drafting the trust document, choosing a trustee, and determining how assets will be managed in accordance with New York law.

-

Can a supplemental needs trust in New York affect government benefits?

A properly established supplemental needs trust in New York is designed to provide financial support without affecting the beneficiary’s eligibility for essential government benefits. It's critical to follow regulations closely to ensure that the trust remains compliant and does not disqualify the beneficiary from receiving Medicaid or Social Security benefits.

-

What types of expenses can a supplemental needs trust cover in New York?

A supplemental needs trust in New York can cover a broad range of expenses that enhance the quality of life for the beneficiary, including recreational activities, personal care services, education, and medical expenses not covered by insurance. This allows families to ensure that their loved ones receive additional support without impacting essential government benefits.

-

How does airSlate SignNow help with managing supplemental needs trust documents?

airSlate SignNow provides a cost-effective solution for managing the documentation associated with supplemental needs trusts in New York. With easy-to-use eSigning features, families and attorneys can securely send, sign, and store crucial documents online, streamlining the process of managing legal and financial agreements.

Get more for Supplemental Needs Trust

- That i an adult resident citizen of form

- Florida advance health care directive form 1 pdf formate

- Did you know that florida law requires you to keep your driver license address current within 10 form

- Fillable online florida insurance affidavit bird road auto form

- Trust to trust form

- Individual to two individuals form

- Contractors final payment affidavit individual form

- Contractors final payment affidavit corporation or llc form

Find out other Supplemental Needs Trust

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online