ID Lien Form

What is the Id Lien

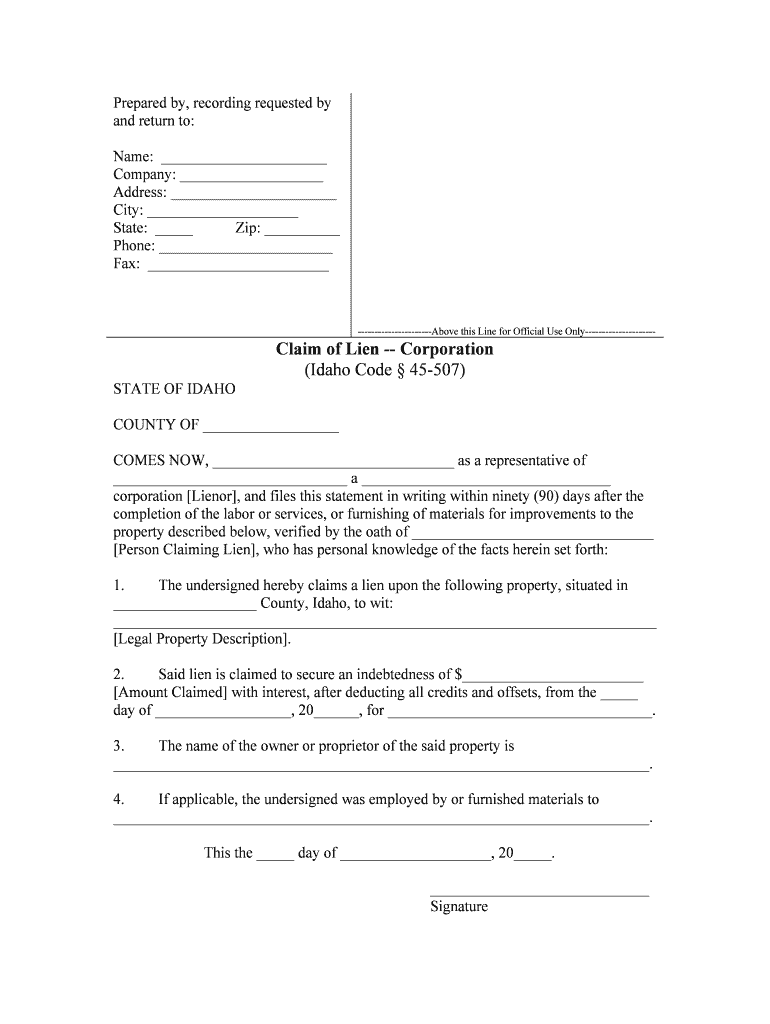

The Id Lien is a legal document that establishes a claim against an individual's property or assets due to unpaid debts or obligations. This form is crucial in situations where creditors seek to secure their interests in a debtor's property. By filing an Id Lien, creditors can ensure that they have a legal right to the property until the debt is resolved. This document is often used in various financial and legal contexts, including real estate transactions and debt recovery processes.

How to use the Id Lien

Using the Id Lien involves several steps to ensure proper filing and compliance with legal requirements. First, determine the specific debt that necessitates the lien. Next, gather all necessary information about the debtor and the property in question. After that, complete the Id Lien form accurately, ensuring that all details are correct. Once completed, the form must be filed with the appropriate state or local authority, typically the county clerk's office. It is important to keep a copy of the filed lien for your records and to notify the debtor of the lien's existence.

Steps to complete the Id Lien

Completing the Id Lien requires careful attention to detail. Follow these steps:

- Identify the debtor and the property subject to the lien.

- Obtain the Id Lien form from the appropriate authority.

- Fill out the form with accurate information, including the debtor's name, address, and details of the debt.

- Sign and date the form as required.

- Submit the form to the relevant office, either online or in person.

- Pay any associated filing fees.

- Keep a copy of the filed Id Lien for your records.

Legal use of the Id Lien

The Id Lien serves a legal purpose by providing creditors with a mechanism to secure their interests in a debtor's property. It is essential to ensure that the lien is filed in accordance with state laws and regulations. Failure to comply with these legal requirements may result in the lien being deemed invalid. Additionally, creditors must be aware of the timeframes associated with enforcing the lien and the rights of the debtor, which may vary by state.

Key elements of the Id Lien

Several key elements define the Id Lien. These include:

- The name and contact information of the creditor.

- The name and contact information of the debtor.

- A description of the property subject to the lien.

- The amount of the debt owed.

- The date the lien is filed.

Ensuring that all these elements are accurately represented is crucial for the enforceability of the Id Lien.

State-specific rules for the Id Lien

Each state has its own regulations governing the filing and enforcement of Id Liens. It is important for creditors to familiarize themselves with their state's specific rules, including filing fees, required documentation, and deadlines. Some states may have additional requirements, such as notifying the debtor or providing proof of the debt. Understanding these state-specific rules can help ensure that the Id Lien is valid and enforceable.

Quick guide on how to complete id lien

Prepare Id Lien effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the features you need to create, edit, and eSign your documents swiftly and without interruptions. Handle Id Lien on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to edit and eSign Id Lien easily

- Obtain Id Lien and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhaustive form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Id Lien and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a lien ID and why is it important?

A lien ID is a unique identifier assigned to a lien in public records. It is crucial because it helps you track and manage liens effectively, ensuring that you can verify ownership and obligations on properties or assets.

-

How does airSlate SignNow support the management of lien IDs?

airSlate SignNow offers features that streamline document management, including the capability to integrate lien IDs into your workflows. This allows users to efficiently send, eSign, and track documents related to liens, enhancing overall productivity.

-

Is there a cost associated with tracking lien IDs using airSlate SignNow?

Using airSlate SignNow comes with affordable pricing plans designed to fit your business needs. The cost includes features for managing important documents, such as those related to lien IDs, making it a cost-effective solution for businesses.

-

Can I customize documents related to lien IDs with airSlate SignNow?

Yes, airSlate SignNow provides customizable templates for various document types, including those related to lien IDs. This means you can tailor your documents to meet specific legal and organizational requirements.

-

Are there integrations available for lien ID management?

Absolutely! airSlate SignNow integrates with various platforms that are essential for managing lien IDs. These integrations help automate workflow processes and enhance collaboration across different departments.

-

How does airSlate SignNow ensure security for documents with lien IDs?

Security is a top priority for airSlate SignNow. All documents, including those containing lien IDs, are encrypted and stored securely, ensuring that your sensitive information remains protected and compliant with legal standards.

-

What are the benefits of using airSlate SignNow for lien ID documents?

The benefits of using airSlate SignNow for lien ID documents include streamlined preparation and signing processes, reduced turnaround times, and enhanced compliance. These features ultimately help in managing lien-related documents more effectively.

Get more for Id Lien

Find out other Id Lien

- Sign PDF for Sales Teams Myself

- Sign Word for Sales Teams Online

- Sign Word for Sales Teams Mobile

- Sign Form for Sales Teams Online

- Sign PDF for Sales Teams Safe

- Sign Form for Sales Teams Now

- Sign Word for Sales Teams Later

- Sign Form for Sales Teams Free

- Sign Word for Sales Teams Myself

- Sign Form for Sales Teams Secure

- Sign PPT for Sales Teams Online

- Sign Document for Sales Teams Safe

- Sign PPT for Sales Teams Computer

- eSign PDF for HR Online

- Sign PPT for Sales Teams Mobile

- eSign Word for HR Online

- eSign PDF for HR Mobile

- eSign Word for HR Computer

- Sign PPT for Sales Teams Now

- Sign Presentation for Sales Teams Online