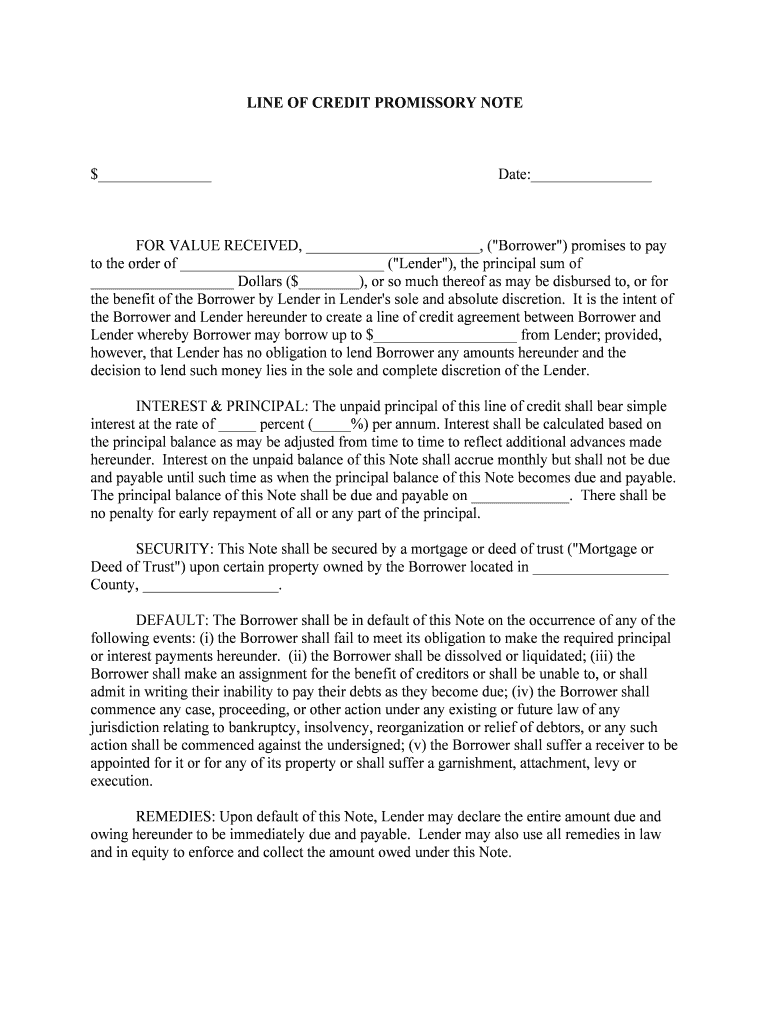

Line of Credit Form

Understanding the Line of Credit

A line of credit is a flexible loan option that allows borrowers to access funds up to a predetermined limit. Unlike a traditional loan, where you receive a lump sum, a line of credit enables you to withdraw funds as needed, making it ideal for managing cash flow or unexpected expenses. This financial tool can be secured, often backed by collateral, or unsecured, based solely on the borrower’s creditworthiness. Understanding the terms and conditions associated with your line of credit is essential for effective management and repayment.

Steps to Complete the Line of Credit Application

Completing a line of credit application involves several key steps:

- Assess your needs: Determine how much credit you require and for what purpose.

- Check your credit score: A higher score can improve your chances of approval and better interest rates.

- Gather required documents: This may include proof of income, identification, and financial statements.

- Fill out the application: Provide accurate information regarding your financial situation and needs.

- Submit the application: Follow the submission guidelines provided by the lender, whether online or in person.

- Await approval: The lender will review your application and inform you of their decision.

Key Elements of the Line of Credit

Understanding the key elements of a line of credit can help you utilize it effectively:

- Credit limit: The maximum amount you can borrow.

- Interest rates: Rates may vary based on whether the line is secured or unsecured.

- Repayment terms: Know when payments are due and the minimum payment requirements.

- Fees: Be aware of any associated fees, such as annual fees or transaction fees.

- Draw period: The time frame during which you can withdraw funds.

Legal Use of the Line of Credit

Using a line of credit legally involves adhering to the terms set forth by the lender and applicable laws. Borrowers must ensure that the funds are used for legitimate purposes, such as business expenses, personal emergencies, or debt consolidation. Misuse of the line of credit can lead to legal repercussions, including penalties or a negative impact on your credit score. Always review the lending agreement to understand your responsibilities and rights.

Examples of Using the Line of Credit

There are various scenarios where a line of credit can be beneficial:

- Home renovations: Access funds to improve property value without taking a full loan.

- Unexpected medical expenses: Cover costs that arise suddenly without straining your budget.

- Business cash flow: Manage operational costs during slow sales periods.

- Debt consolidation: Pay off high-interest debts using a lower-interest line of credit.

Eligibility Criteria for a Line of Credit

Eligibility for a line of credit typically depends on several factors:

- Credit score: Lenders often require a minimum score for approval.

- Income level: Proof of stable income is essential to demonstrate repayment ability.

- Debt-to-income ratio: A lower ratio indicates better financial health and increases approval chances.

- Employment history: Steady employment can strengthen your application.

Quick guide on how to complete line of credit

Complete Line Of Credit effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the required form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Line Of Credit on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Line Of Credit seamlessly

- Locate Line Of Credit and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Line Of Credit while ensuring clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a note form blank?

A note form blank is a customizable document template designed to capture information efficiently. With airSlate SignNow, you can create, modify, and share these templates easily, enabling seamless data collection and electronic signatures.

-

How do I create a note form blank using airSlate SignNow?

Creating a note form blank is simple with airSlate SignNow. You can start by selecting a pre-designed template or create your own from scratch. The platform provides intuitive drag-and-drop features to customize your document to fit your specific needs.

-

Is there a cost associated with using the note form blank feature?

Yes, using the note form blank feature on airSlate SignNow is part of our subscription plans. We offer flexible pricing options that cater to different business sizes, ensuring you get great value for your eSigning and document management needs.

-

What are the benefits of using note form blank for my business?

Using a note form blank streamlines your documentation process, which saves time and reduces errors. It enhances organization and increases efficiency within your team while ensuring that all necessary information is captured accurately for any transaction.

-

Can I integrate other tools with my note form blank?

Absolutely! airSlate SignNow offers various integrations with popular platforms, enabling you to connect your note form blank with CRM systems, cloud storage, and other business tools. This enhances workflow and ensures data consistency across your applications.

-

Are there any security measures in place for my note form blank?

Yes, airSlate SignNow prioritizes your data security. Each note form blank is protected with advanced encryption measures and complies with industry standards to ensure your information remains confidential and secure during the signing process.

-

Can I share my note form blank with others?

Definitely! You can easily share your note form blank with team members or clients through airSlate SignNow. The platform allows you to send documents via email or generate shareable links, making collaboration straightforward and efficient.

Get more for Line Of Credit

- Apply for yourself or someone else a blue badge will cost 10 form

- 1040 nr schedule oi form

- Cao change mind form 549358695

- International fuel tax agreement ifta tax return information and instructions

- Print or type the information in ink

- North carolina emergency services form

- Canada federal court appeal form

- Federal courts rules laws loisjusticegcca form

Find out other Line Of Credit

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document