Irrevocable Trust Form

What is the Irrevocable Trust

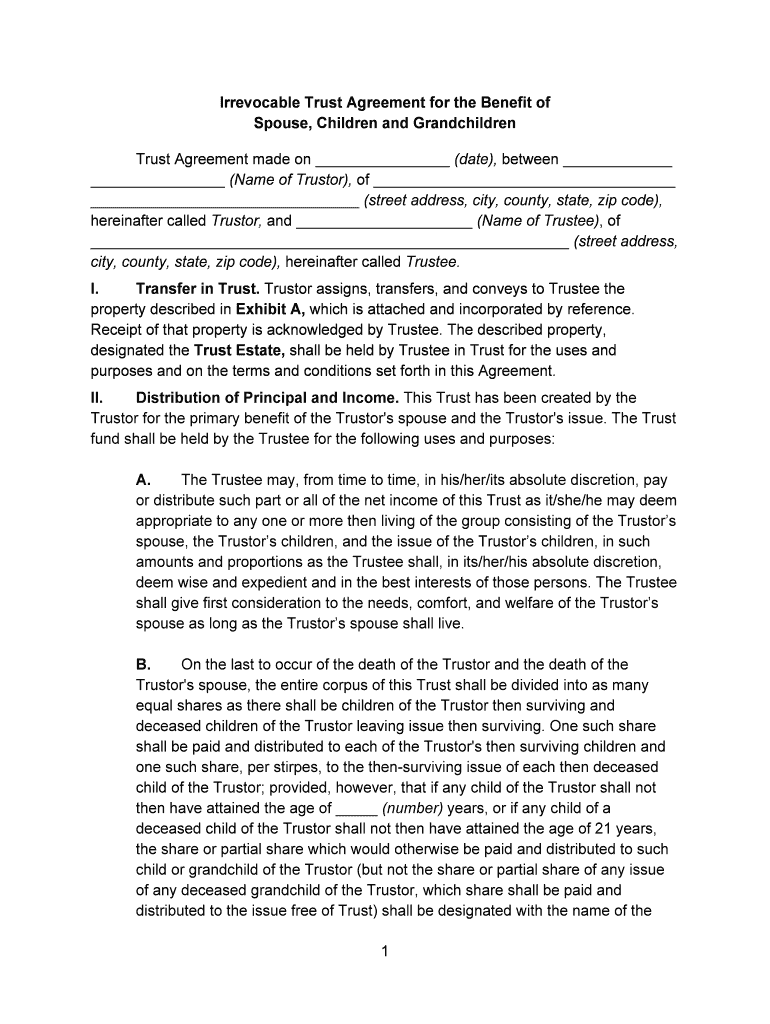

An irrevocable trust is a type of trust that cannot be modified or revoked after its creation. Once assets are transferred into this trust, the grantor relinquishes control over them. This arrangement is often used for estate planning, allowing individuals to protect their assets from creditors, reduce estate taxes, and ensure that beneficiaries receive their inheritance as intended. The trust is managed by a trustee, who has a fiduciary duty to act in the best interests of the beneficiaries.

Key elements of the Irrevocable Trust

Understanding the key elements of an irrevocable trust is crucial for effective estate planning. Some of the main components include:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust and ensuring that the terms are followed.

- Beneficiaries: Individuals or entities designated to receive the benefits from the trust.

- Trust Document: The legal document that outlines the terms, conditions, and instructions for the trust's operation.

Steps to complete the Irrevocable Trust

Completing an irrevocable trust involves several important steps:

- Define your objectives: Determine the purpose of the trust and the assets to be included.

- Select a trustee: Choose a reliable individual or institution to manage the trust.

- Draft the trust document: Work with a legal professional to create a comprehensive trust agreement.

- Transfer assets: Move the chosen assets into the trust, ensuring proper documentation is completed.

- Review regularly: Although irrevocable, it’s important to periodically review the trust to ensure it aligns with your goals.

How to use the Irrevocable Trust

Using an irrevocable trust effectively requires understanding its benefits and limitations. This type of trust can be utilized to:

- Protect assets from creditors and lawsuits.

- Minimize estate taxes by removing assets from the grantor's taxable estate.

- Provide for beneficiaries, such as children or grandchildren, ensuring their financial security.

- Facilitate charitable giving by establishing a charitable trust.

Legal use of the Irrevocable Trust

The legal use of an irrevocable trust is governed by state laws and the terms set forth in the trust document. It is essential to comply with all legal requirements to ensure the trust's validity. This includes adhering to state-specific regulations regarding trust administration, tax implications, and the rights of beneficiaries. Consulting with a legal expert can help navigate these complexities and ensure compliance with applicable laws.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding irrevocable trusts, particularly concerning taxation. Generally, the trust itself may be subject to income taxes, and the grantor may not be able to claim deductions for contributions made to the trust. Understanding these guidelines is essential for effective tax planning and compliance. It is advisable to consult a tax professional to navigate the tax implications associated with irrevocable trusts.

Quick guide on how to complete irrevocable trust 481368255

Complete Irrevocable Trust effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Irrevocable Trust on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric processes today.

The easiest method to modify and eSign Irrevocable Trust without any hassle

- Acquire Irrevocable Trust and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or cover sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Alter and eSign Irrevocable Trust and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a trust grandchildren sample, and how can it help my family?

A trust grandchildren sample is a template that allows you to set up a trust specifically for your grandchildren. This can help manage and distribute your assets according to your wishes, ensuring financial support for their education or future needs. Using this sample can streamline the process of creating a trust, making it easier for families to secure their legacy.

-

How much does it cost to create a trust grandchildren sample using airSlate SignNow?

Creating a trust grandchildren sample with airSlate SignNow is highly cost-effective compared to traditional legal services. Our pricing plans are competitive, making it accessible for families to ensure their children's future. You can select from various subscription options that fit your budget and needs.

-

What features does the trust grandchildren sample include?

The trust grandchildren sample includes customizable fields, allowing you to specify terms related to asset distribution and management. Additionally, it offers easy document sharing and eSignature capabilities, making the setup process quick and efficient. You can ensure that your trust meets legal requirements without complicated legal jargon.

-

Can I customize the trust grandchildren sample to fit my family's needs?

Absolutely! The airSlate SignNow platform allows you to customize the trust grandchildren sample according to your specific requirements. You can adjust terms, add beneficiaries, and tailor the language to better reflect your family’s values and intentions. This flexibility ensures that the trust serves your family's unique circumstances.

-

Is it easy to eSign the trust grandchildren sample with airSlate SignNow?

Yes, eSigning the trust grandchildren sample with airSlate SignNow is designed to be user-friendly and efficient. Both you and your designated trustees can sign electronically from anywhere, eliminating the need for in-person meetings. This convenience speeds up the process and helps you finalize your trust without hassle.

-

Does airSlate SignNow offer support for creating a trust grandchildren sample?

Yes, airSlate SignNow provides comprehensive support to assist you in creating a trust grandchildren sample. Our knowledgeable customer service team is available to help with any queries you may have during the process. Additionally, we offer resource guides and tutorials to ensure you get the most out of your experience.

-

Are there any integrations available for the trust grandchildren sample?

Absolutely! airSlate SignNow integrates with various applications to enhance your experience while handling the trust grandchildren sample. This includes popular cloud storage services and productivity tools, enabling seamless document management and collaboration. You can easily manage your paperwork without switching between different platforms.

Get more for Irrevocable Trust

- Poa 0831 replacement of missing offence notice form 3

- Certificate of election to wind up and form

- Motion general form this form replaces ccmd 39 120120

- Health practitioner regulation agency form

- V twin dealer application form

- Excelsior college form 560825941

- Form declaration importation

- Pdf complaint referral form internet crime complaint center

Find out other Irrevocable Trust

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy