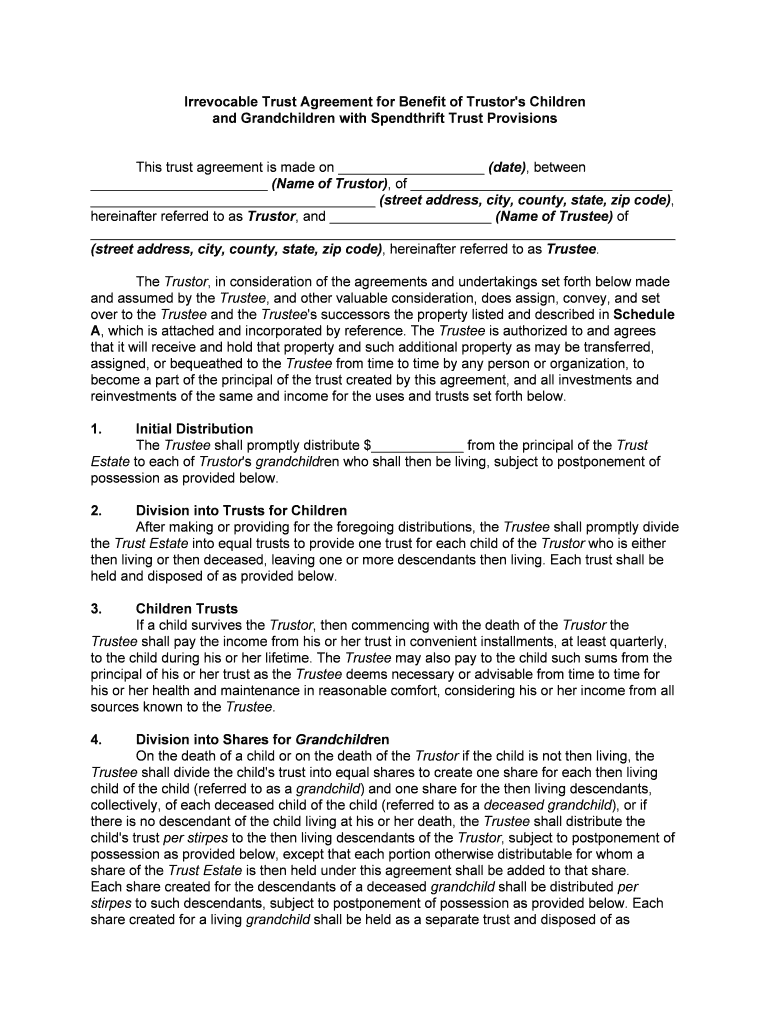

Irrevocable Form

What is the irrevocable trust?

An irrevocable trust is a type of trust that cannot be modified, amended, or revoked after its creation without the consent of the beneficiaries. Once assets are transferred into this trust, the grantor relinquishes control over them. This legal structure is often used for estate planning, allowing for the protection of assets from creditors and ensuring that they are distributed according to the grantor's wishes. Additionally, irrevocable trusts can provide tax benefits and help avoid probate, making them a valuable tool in financial planning.

Key elements of the irrevocable trust

Understanding the key elements of an irrevocable trust is essential for effective estate planning. Some of the most significant components include:

- Trustee: The individual or institution responsible for managing the trust and its assets.

- Beneficiaries: The individuals or entities that will receive the benefits from the trust.

- Trust document: A legal document that outlines the terms of the trust, including the powers of the trustee and the rights of the beneficiaries.

- Assets: Property or funds transferred into the trust, which are managed according to the trust's terms.

These elements work together to ensure that the trust operates according to the grantor's intentions and provides for the beneficiaries as intended.

Steps to complete the irrevocable trust

Completing an irrevocable trust involves several important steps. These steps ensure that the trust is legally valid and meets the grantor's objectives:

- Determine the purpose: Identify the reason for creating the trust, such as asset protection or tax planning.

- Select a trustee: Choose a reliable individual or institution to manage the trust.

- Draft the trust document: Work with an attorney to create a comprehensive trust document that outlines all terms and conditions.

- Transfer assets: Move the chosen assets into the trust, ensuring proper legal procedures are followed.

- Sign and notarize: Execute the trust document in accordance with state laws, often requiring notarization.

- Notify beneficiaries: Inform all beneficiaries about the trust and its terms.

Following these steps carefully helps ensure that the irrevocable trust is established correctly and serves its intended purpose.

Legal use of the irrevocable trust

The legal use of an irrevocable trust is governed by state laws, which can vary significantly. Generally, these trusts are used for:

- Estate planning: To manage and distribute assets after death while minimizing estate taxes.

- Asset protection: To shield assets from creditors and legal claims.

- Medicaid planning: To help individuals qualify for Medicaid benefits by removing assets from their personal ownership.

- Charitable giving: To facilitate donations to charities while retaining some benefits during the grantor's lifetime.

Understanding the legal framework surrounding irrevocable trusts ensures that they are used effectively and in compliance with applicable laws.

Examples of using the irrevocable trust

Irrevocable trusts can be tailored to meet various needs. Here are some common examples:

- Spendthrift trust: Protects beneficiaries from creditors and prevents them from squandering their inheritance.

- Irrevocable life insurance trust (ILIT): Holds life insurance policies outside of the grantor's estate to avoid estate taxes.

- Special needs trust: Provides for a disabled beneficiary without jeopardizing their eligibility for government benefits.

- Charitable remainder trust: Allows the grantor to receive income from the trust during their lifetime while benefiting a charity after their death.

These examples illustrate the versatility of irrevocable trusts in addressing specific financial and personal goals.

Required documents for establishing an irrevocable trust

Establishing an irrevocable trust requires specific documentation to ensure legal compliance and clarity. Key documents include:

- Trust agreement: The primary document outlining the terms of the trust, including the roles of the trustee and beneficiaries.

- Asset transfer documents: Legal paperwork necessary to transfer ownership of assets into the trust.

- Identification documents: Proof of identity for the grantor, trustee, and beneficiaries, such as driver's licenses or Social Security cards.

- Tax identification number: An Employer Identification Number (EIN) may be required for the trust, especially if it generates income.

Gathering these documents in advance can streamline the process of creating an irrevocable trust and ensure all legal requirements are met.

Quick guide on how to complete irrevocable

Complete Irrevocable effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly and without delays. Manage Irrevocable on any device with airSlate SignNow's Android or iOS applications and streamline any document-based task today.

How to modify and eSign Irrevocable with ease

- Locate Irrevocable and then click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Highlight necessary sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional pen-and-ink signature.

- Review the information thoroughly and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your desired device. Edit and eSign Irrevocable and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an irrevocable trust template?

An irrevocable trust template is a pre-designed document that allows users to establish an irrevocable trust efficiently. This template includes all necessary clauses and legal language needed to create a legally binding trust, ensuring that your assets are securely managed and protected according to your wishes.

-

How much does the irrevocable trust template cost?

The cost of an irrevocable trust template can vary based on the provider and any additional services included. With airSlate SignNow, you can access competitively priced legal document templates, offering great value for users looking to set up trusts without incurring high legal fees.

-

What are the benefits of using an irrevocable trust template?

Using an irrevocable trust template simplifies the process of creating a trust by providing clear, structured guidance. This helps ensure that all legal requirements are met while saving time and reducing the risk of errors, allowing you to focus on your financial planning.

-

Is the irrevocable trust template customizable?

Yes, the irrevocable trust template can be customized to fit your specific needs and circumstances. Users can easily modify sections of the document to reflect their unique wishes, ensuring that the trust aligns perfectly with their estate planning goals.

-

Can I eSign the irrevocable trust template with airSlate SignNow?

Absolutely! airSlate SignNow provides an easy-to-use platform for eSigning your irrevocable trust template. This feature not only streamlines the signing process but also ensures your documents are securely stored and accessible anytime, anywhere.

-

Are there any integrations available with the irrevocable trust template?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your productivity. Whether you are using CRM systems or cloud storage services, these integrations make it simple to manage your irrevocable trust template alongside other important documents.

-

How do I ensure my irrevocable trust template complies with state laws?

To ensure compliance, it’s advisable to consult with a legal professional familiar with your state’s trust laws before finalizing your irrevocable trust template. While our templates are designed with common legal standards in mind, state-specific requirements may vary.

Get more for Irrevocable

Find out other Irrevocable

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple