Child Inheritance Trust Form

What is the Child Inheritance Trust

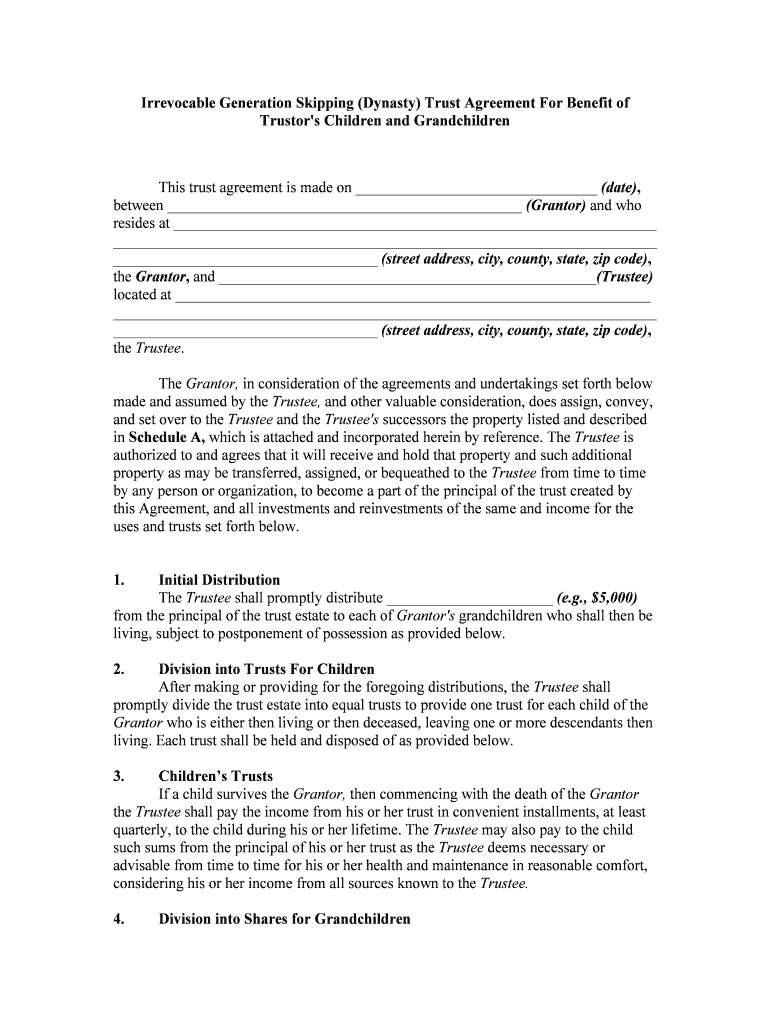

A Child Inheritance Trust, often referred to as a dynasty trust, is a legal arrangement designed to manage and protect assets for the benefit of future generations. This type of trust allows the grantor to specify how and when the assets will be distributed to their grandchildren or other beneficiaries. The primary goal is to provide financial security while minimizing tax implications and ensuring that the assets remain within the family for an extended period. By establishing a dynasty trust, individuals can create a legacy that supports their grandchildren’s education, health care, and other significant life events.

Key elements of the Child Inheritance Trust

Understanding the key elements of a Child Inheritance Trust is crucial for effective planning. Important components include:

- Trustee: The individual or institution responsible for managing the trust assets and ensuring that the terms of the trust are followed.

- Beneficiaries: Typically, the grantor's grandchildren, who will receive the benefits of the trust according to the specified terms.

- Trust terms: Detailed instructions on how the assets should be managed and distributed, including any conditions or milestones that must be met.

- Duration: Dynasty trusts can last for multiple generations, depending on state laws, allowing for long-term asset protection and management.

Steps to complete the Child Inheritance Trust

Creating a Child Inheritance Trust involves several important steps:

- Consult with a legal professional: Seek advice from an attorney specializing in estate planning to ensure compliance with state laws and regulations.

- Draft the trust document: Outline the terms, including the trustee's powers, beneficiary designations, and distribution instructions.

- Fund the trust: Transfer assets into the trust, such as cash, real estate, or investments, to ensure it can fulfill its purpose.

- Review and update: Regularly assess the trust to ensure it meets your family's changing needs and complies with any legal updates.

Legal use of the Child Inheritance Trust

The legal framework surrounding a Child Inheritance Trust is essential for its validity. It must comply with state-specific laws regarding trusts, including provisions related to the duration of the trust and the rights of beneficiaries. Additionally, the trust must be properly funded and administered according to the terms set forth in the trust document. Ensuring that the trust is legally sound helps protect the assets from creditors and potential disputes, providing peace of mind to the grantor and beneficiaries alike.

State-specific rules for the Child Inheritance Trust

Each state has its own regulations governing the establishment and operation of a Child Inheritance Trust. For example, some states have specific limitations on how long a dynasty trust can last, while others may impose different tax implications. It is crucial to understand these state-specific rules to ensure that the trust is compliant and effectively serves its intended purpose. Consulting with a local estate planning attorney can provide valuable insights into the applicable laws and help tailor the trust to meet individual needs.

Examples of using the Child Inheritance Trust

There are various scenarios in which a Child Inheritance Trust can be beneficial:

- Education funding: The trust can be structured to provide financial support for grandchildren's college expenses, ensuring they have access to higher education.

- Healthcare costs: It can cover medical expenses, safeguarding beneficiaries against unexpected health-related financial burdens.

- Business succession: If the grantor owns a business, the trust can facilitate a smooth transition of ownership to the next generation.

Quick guide on how to complete child inheritance trust

Complete Child Inheritance Trust effortlessly on any device

Digital document management has become favored among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documentation, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents swiftly without any delays. Manage Child Inheritance Trust across any platform with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to edit and eSign Child Inheritance Trust with ease

- Obtain Child Inheritance Trust and click on Get Form to begin.

- Utilize the tools we offer to submit your form.

- Highlight key sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign Child Inheritance Trust and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Illinois dynasty trust sample?

An Illinois dynasty trust sample is a legal document template that outlines how a dynasty trust can be structured and managed in Illinois. It is designed to help individuals protect their wealth across multiple generations while minimizing tax implications. By utilizing an Illinois dynasty trust sample, you can better understand the provisions and benefits of setting up such a trust.

-

How can airSlate SignNow assist with creating an Illinois dynasty trust sample?

airSlate SignNow simplifies the process of creating and signing an Illinois dynasty trust sample by providing an intuitive platform for document management. Users can easily customize templates, collect eSignatures, and securely store their trust documents. This empowers you to efficiently manage the complexity of estate planning, all while ensuring compliance with Illinois regulations.

-

What are the benefits of using an Illinois dynasty trust sample?

Using an Illinois dynasty trust sample allows individuals to preserve their assets for future generations while potentially avoiding estate taxes. These trusts can be structured to provide benefits for beneficiaries over a long period, making them a strategic choice for wealth management. Additionally, an Illinois dynasty trust sample provides clarity and structure, ensuring that your wishes are honored.

-

Is airSlate SignNow cost-effective for creating an Illinois dynasty trust sample?

Yes, airSlate SignNow offers a cost-effective solution for individuals and businesses looking to create an Illinois dynasty trust sample. With competitive pricing plans, you can choose a package that suits your needs while accessing powerful features for document eSigning and management. This affordability makes it easier to implement estate planning solutions without straining your budget.

-

What features does airSlate SignNow offer for handling Illinois dynasty trust samples?

airSlate SignNow includes features like customizable templates, secure eSigning, cloud storage, and real-time collaboration to manage Illinois dynasty trust samples effectively. The user-friendly interface ensures that even those unfamiliar with document management tools can navigate the platform effortlessly. This comprehensive suite of tools enhances your experience in creating and managing trust documents.

-

Can I integrate airSlate SignNow with other tools when working on an Illinois dynasty trust sample?

Absolutely! airSlate SignNow supports various integrations with popular applications such as Google Drive, Salesforce, and other document management systems. This allows you to streamline your workflow when working on an Illinois dynasty trust sample, ensuring all your tools communicate effectively and saving you valuable time.

-

Are there any legal considerations when using an Illinois dynasty trust sample?

Yes, when using an Illinois dynasty trust sample, it’s important to be aware of the legal requirements specific to Illinois trust law. Consulting a legal professional is advised to ensure that your trust complies with state regulations and meets your estate planning goals. airSlate SignNow can assist in documenting your needs while you work with legal experts.

Get more for Child Inheritance Trust

- 7 page of pages self insurance unit statistical report form

- Name of self insurer form

- Fraud reporting and informationdepartment of financial

- Prepared by certificate of self insurance division of form

- Applicant is a check one form

- Name of business fein number form

- Division of workers compensation self insurance section form

- If a question is not applicable please put quotnot form

Find out other Child Inheritance Trust

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast