Florida Lady Fl Form

What is the enhanced life estate deed in Florida?

The enhanced life estate deed, often referred to as a Florida Lady Bird deed, is a legal document that allows property owners in Florida to transfer their property to beneficiaries while retaining the right to live in and control the property during their lifetime. This type of deed is particularly beneficial as it avoids probate, allowing for a smoother transition of property ownership upon the owner's death. The property owner can sell or mortgage the property without needing the consent of the beneficiaries, providing flexibility and control over the asset.

Key elements of the enhanced life estate deed

Several key elements define the enhanced life estate deed in Florida:

- Retained Rights: The grantor retains the right to live in, sell, or mortgage the property during their lifetime.

- Beneficiary Designation: The deed specifies one or more beneficiaries who will inherit the property upon the grantor's death.

- Avoidance of Probate: The property automatically transfers to the beneficiaries without going through the probate process.

- Revocability: The grantor can revoke or change the deed at any time before their death.

Steps to complete the enhanced life estate deed

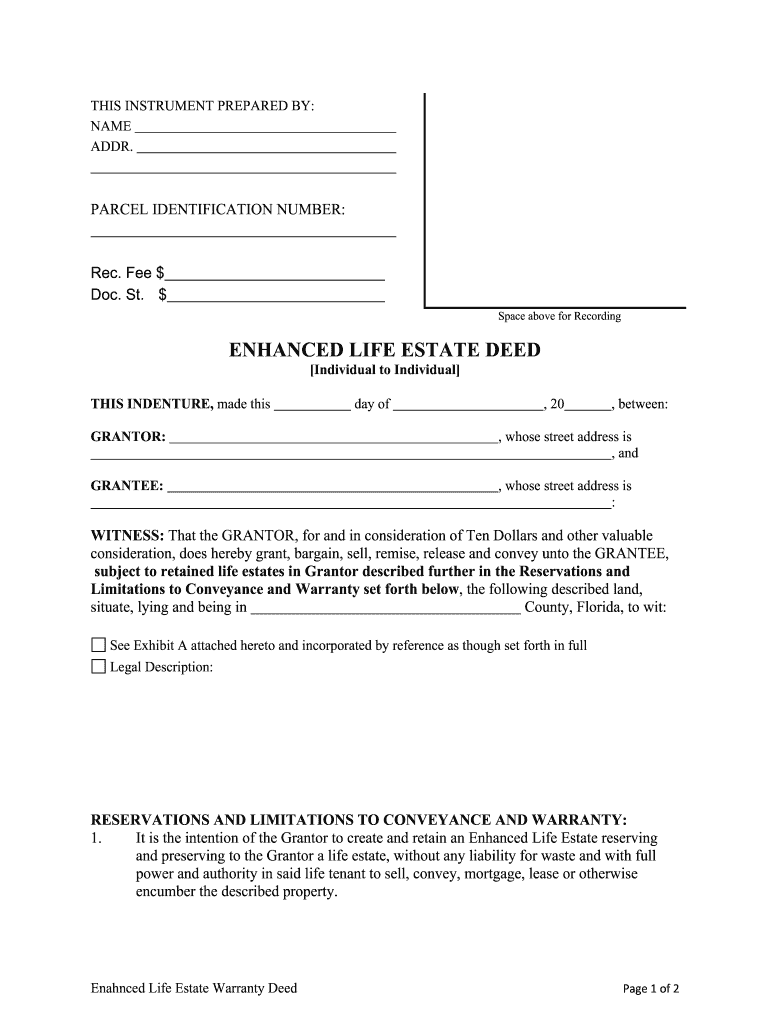

Completing an enhanced life estate deed in Florida involves several important steps:

- Consult a Legal Professional: It is advisable to consult with an attorney to ensure the deed is properly drafted and meets legal requirements.

- Draft the Deed: Prepare the deed, including the legal description of the property, the names of the grantor and beneficiaries, and the retained rights.

- Sign the Deed: The grantor must sign the deed in the presence of a notary public.

- Record the Deed: File the signed and notarized deed with the local county clerk’s office to make it a matter of public record.

Legal use of the enhanced life estate deed

The enhanced life estate deed is legally recognized in Florida and provides several advantages for property owners. It allows individuals to maintain control over their property while simplifying the transfer process to their heirs. This deed is particularly useful for those looking to avoid the complexities and costs associated with probate. However, it is essential to ensure that the deed complies with Florida laws and regulations to uphold its validity.

State-specific rules for the enhanced life estate deed

In Florida, specific rules govern the use of enhanced life estate deeds:

- Property Eligibility: The property must be real estate, and the grantor must own the property outright.

- Beneficiary Requirements: Beneficiaries must be individuals or entities capable of holding title to property.

- Execution Requirements: The deed must be signed by the grantor and notarized, with no witnesses required.

Examples of using the enhanced life estate deed

Common scenarios for utilizing an enhanced life estate deed include:

- A homeowner wishing to pass their property to their children while retaining the right to live there.

- An individual looking to simplify the estate planning process and avoid probate for their real estate assets.

- A property owner wanting to ensure that their spouse inherits the home without the complications of probate.

Quick guide on how to complete florida lady fl

Effortlessly prepare Florida Lady Fl on any device

Managing documents online has become increasingly preferred among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your files swiftly without delays. Handle Florida Lady Fl on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Florida Lady Fl without hassle

- Locate Florida Lady Fl and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Florida Lady Fl while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an enhanced life estate deed in Florida?

An enhanced life estate deed in Florida allows the property owner to retain full use of their property during their lifetime, while also designating beneficiaries to receive the property automatically upon their passing. This type of deed avoids probate, ensuring a smoother transition for heirs. It's an effective tool for estate planning in Florida.

-

How does an enhanced life estate deed differ from a standard life estate deed?

Unlike a standard life estate deed, an enhanced life estate deed in Florida allows the property owner more flexibility, such as the ability to sell or mortgage the property without the beneficiaries' consent. This added benefit makes it a popular choice for individuals looking to maintain control over their real estate while planning for the future. It provides both security and autonomy.

-

What are the benefits of using an enhanced life estate deed in Florida?

The primary benefits of an enhanced life estate deed in Florida include avoiding probate and reducing estate taxes. Property owners can manage their asset during their lifetime and ensure a seamless transfer to beneficiaries after death. This approach promotes efficient estate planning and provides peace of mind to property owners.

-

What is the process for creating an enhanced life estate deed in Florida?

To create an enhanced life estate deed in Florida, the property owner must draft and sign the deed, listing the beneficiaries. It's important to ensure that the deed complies with Florida's legal requirements. Consulting with a legal professional can help streamline the process, making it easier to implement an effective estate plan.

-

Is there a cost associated with establishing an enhanced life estate deed in Florida?

Yes, there can be costs associated with establishing an enhanced life estate deed in Florida, including legal fees for drafting the document and potential recording fees. It’s advisable to compare different service providers to get a clear understanding of the costs involved. Investing in a well-drafted deed can save your heirs time and money in the long run.

-

Can I change beneficiaries on my enhanced life estate deed in Florida?

Yes, you can change beneficiaries on your enhanced life estate deed in Florida, but the process requires creating a new deed that revokes the previous one. This ensures the updated beneficiary information is legally recognized. Always ensure to follow proper legal procedures when making such changes to avoid complications.

-

Does using an enhanced life estate deed affect my property taxes in Florida?

Using an enhanced life estate deed in Florida does not inherently affect your property taxes. You will continue to pay taxes as the property owner until your death. However, it can influence tax implications for beneficiaries, so consulting a tax professional during estate planning is advisable.

Get more for Florida Lady Fl

- Ls 246 chapter 11 final flashcardsquizlet form

- Plumbing contract template independent contractor agreement form

- Lepizzera masonry contractriread reviews get a bid form

- This drywall contract contract effective as of the date of the last party form

- To cure the default you must do the form

- Default notice prior to expiration of the period provided for in the notice form

- Fillable online florida buyers request for accounting form

- Through forfeiture termination of the contract or form

Find out other Florida Lady Fl

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF